For decades, India’s economic commentary has been framed by shortages - of jobs, of infrastructure, of purchasing power. That frame is cracking. The most important development in the world’s most populous country is not just that output is growing fast, it is that the composition of demand is tilting towards aspiration and affluence. The centre of gravity in consumption is moving from necessities to the things people actively choose: a better home instead of merely a roof, a sports-utility vehicle rather than a hatchback, a skin-care regime as well as soap, a holiday flight instead of a train berth. This pivot to discretionary spending is not a fashion cycle. It is structural, durable and, provided policy does not stumble, self-reinforcing.

OECD projections place India at or near the top of global growth tables for 2024–2026 among large economies. India’s macro backdrop makes the turn plausible. Growth forecasts still put it among the fastest-expanding large economies in 2025–26. More important is what that growth buys by the end of the decade: a higher rung on the income ladder.

Watch the video here:

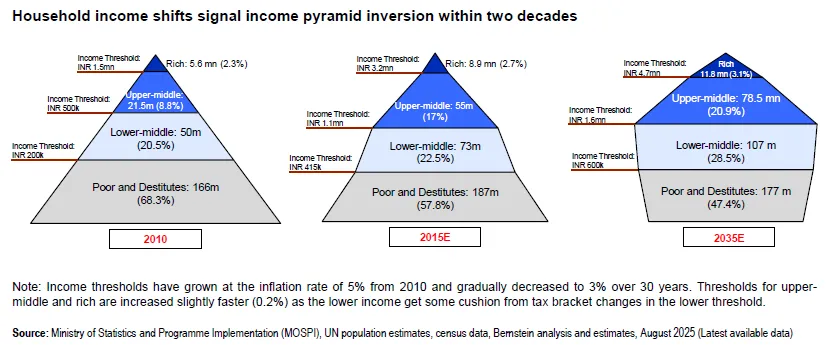

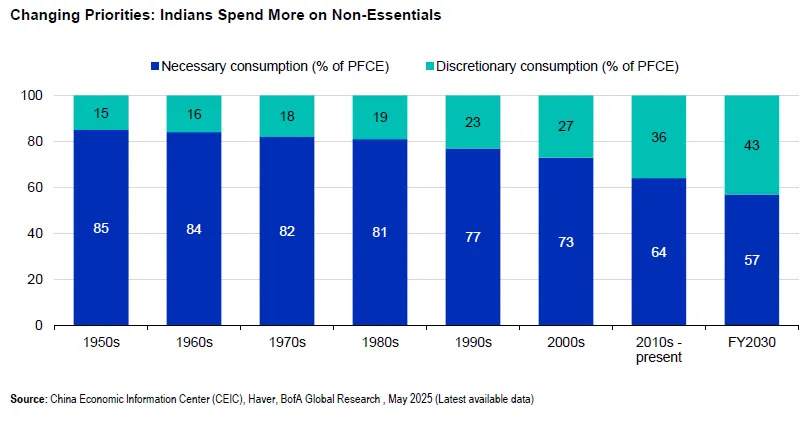

Economies do not flip from necessity to indulgence at a precise rupee level, but they do cross thresholds after which new products suddenly become mass-market. Refrigerators, air conditioners, mid-range cars and foreign holidays are all products that, in most countries, take off when per-capita incomes move from the lower-middle to upper-middle bracket. India is approaching that range. Today the average Indian consumer already spends twice as much, in nominal terms, as in 2013; by 2030 the pool of households capable of choosing premium variants could be the dominant slice of the market. The macro math is straightforward: if nominal GDP grows at a double-digit pace and consumption retains roughly a 60% weight in GDP, even modest shifts within that consumption basket create large absolute markets for “wants”.

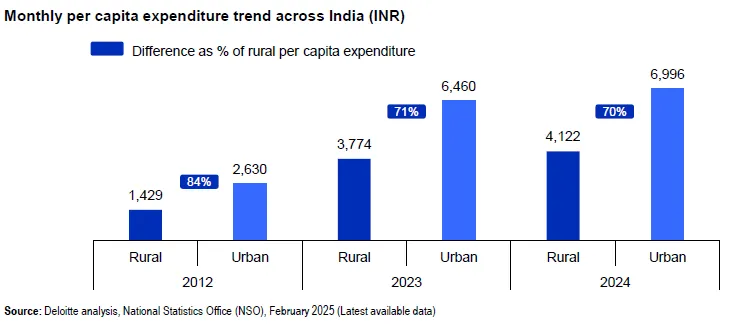

This is not just an urban phenomenon. The narrowing gap between rural and urban spending still large, but shrinking adds breadth to the story. Rural households once devoted the bulk of their budgets to food - that share has been falling, replaced by outlays on mobility, communication and small durables. When the basic calorie is secure, status goods arrive quickly.

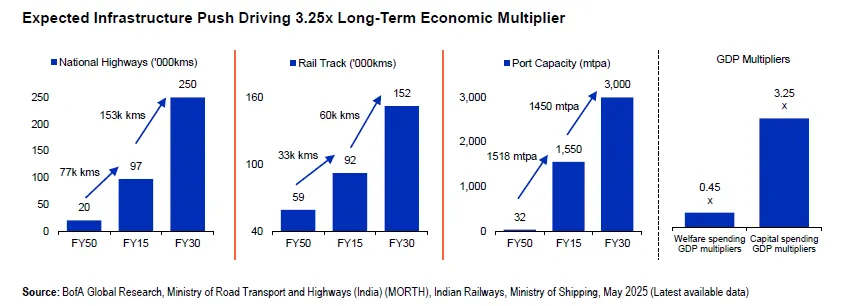

Policy-led capex is expected to keep the flywheel turning. National highways, rail track, and port capacity show steep step-ups by FY2030 versus FY2015 levels. Capital spending carries an estimated GDP multiplier ~3.25x significantly higher than the ~0.45x multiplier historically associated with pure welfare spending suggesting infrastructure will keep catalyzing jobs, logistics efficiency, and regional market access in the years ahead.

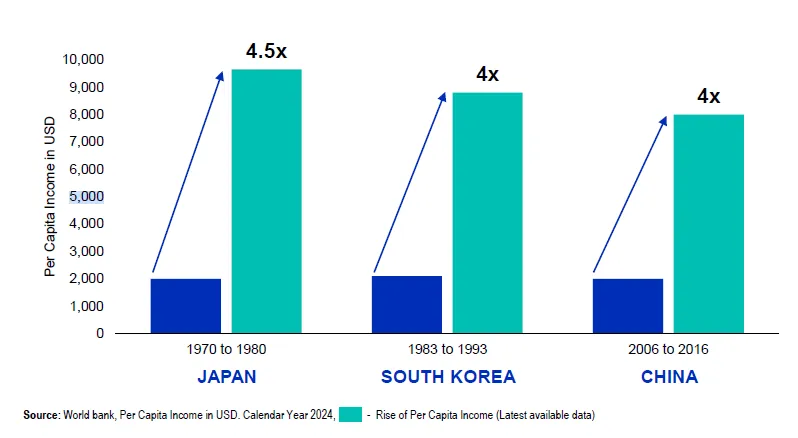

As per-capita income heads towards roughly $5,000 by 2030, the share of non-essentials in private consumption is set to rise and stay higher, an inflection familiar from the S-curves of Japan in the 1970s, South Korea in the 1980s and China in the 2000s. The difference this time is the digital infrastructure already in place and a far wider dispersion of aspiration across smaller cities and rural districts. That is why the trend looks like a regime shift, not a spurt.

Private consumption already contributes close to 60% of India’s GDP, and the mix is tilting decisively toward discretionary categories. Notably, private consumption has already doubled, from about US$1 trillion in 2013 to ~US$2.1 trillion in 2024, outpacing the consumption gains of many peers. The share of non-essentials in household spending is expected to rise from ~36% today to ~43% by FY2030 - an inflection powered by premiumization and the expansion of the middle and affluent classes.

A telling way to watch an economy mature is to track what people stop buying. And as India crosses income thresholds that historically correlate with premium adoption, more households are stepping into “choice-first” markets: premium detergents, bodywash, specialty teas, higher-ticket appliances, premium two-wheelers and SUVs, and luxe-adjacent experiences from spas to destination travel.

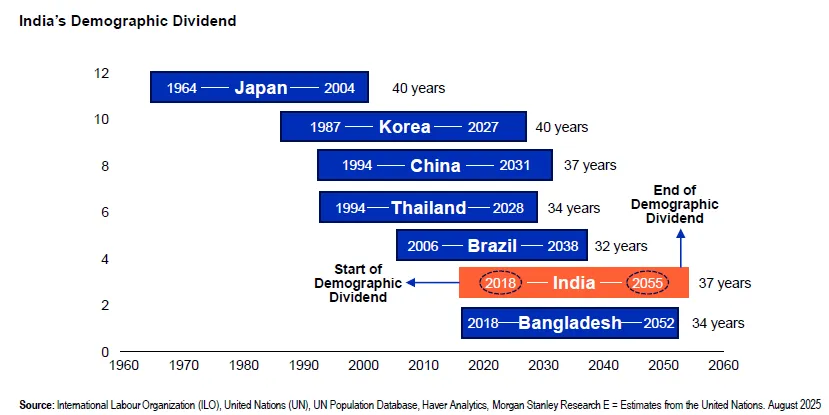

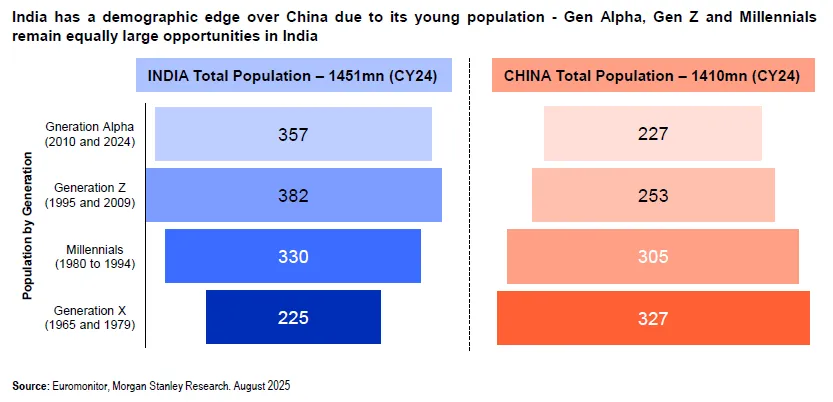

India sits in a rare demographic sweet spot: its age-dependency ratio is projected to stay below the global average through the next decade, meaning relatively fewer non-working dependents per working adult. That translates into a larger, more productive labor pool, rising from ~980 million people of working age (15–64) in 2024 to ~1.07 billion by 2033, or roughly 70% of the population so long as job creation, skills, and inclusive policy keep pace.

Demography is also reshaping demand. About 712 million Gen Z and Millennials , the world’s largest cohort, are digitally fluent, globally exposed, and increasingly confident about their finances; social media shapes tastes while e-commerce puts brands within one-tap reach from metros to smaller towns, lifting discretionary spending. Investment behavior is moving in tandem: between FY2013 and FY2023, the share of mutual-fund investors aged 18–24 inched up to 4%, but the 25–35 bracket (Millennials plus younger Gen Z) saw the sharpest gains, signaling a durable broadening of equity participation. Together, these forces position India’s demography not just as a labor advantage, but as a consumption and capital-formation engine for long-term growth.

One of the lazy clichés about Indian consumption is that it is a metropolitan story. It is not. Rural monthly per-capita expenditure has risen ~2.6x since 2012, and the urban–rural spend gap is narrowing. As roads, connectivity, and digital access deepen, a larger rural base participates in aspirational categories. When “premium” arrives in rural areas, it often arrives first as a feature rather than a brand.

The rural–urban gap in spending is narrowing. Rural and urban expenditures grew at ~9.23% and ~8.49% CAGR, respectively, from 2012 to 2024. The difference between urban and rural monthly per-capita expenditure (MPCE) fell from 84% to 70% over that period. Food’s share of the wallet dropped from ~60% to ~47% in rural households and from ~48% to ~40% in urban, freeing wallet share for aspirational goods. Rural MPCE itself jumped ~2.6× from ₹1,429 (2012) to ₹3,774 (2023), signaling a move beyond basics.

The rural upgrade is also social. Family sizes are shrinking, nuclear households are rising and migration into work-rich districts increases cash incomes. As remittances pool into small towns, the purchase of a two-wheeler or a mid-range phone becomes a rite of return. Over time, the same towns develop a taste for chain restaurants, branded apparel and organised retail..

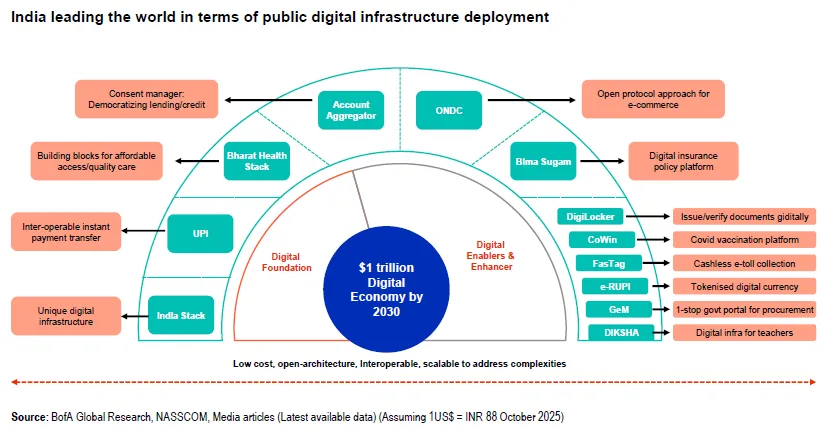

India’s “Digital Public Infrastructure” has lowered friction in identity, payments, data sharing, and commerce making it easier to discover products, pay instantly, access credit, and formalize economic activity.

A quick snapshot of the rails in 2025:

Aadhaar: Over 1.4 billion individuals enrolled; >153 billion authentications since rollout.

UPI: Processes upward of 20 billion transactions monthly, accounting for nearly 85% of India’s digital payment volume.

ONDC: >269 million cumulative orders; >775,000 sellers and service providers onboarded (as of late July).

Ayushman Bharat Digital Mission: >700 million linked health records; >400,000 healthcare facilities registered.

These feed a real, rapidly growing online user base: ~810–840 million internet users; ~680–690 million smartphone users; ~430–450 million digital transactors; ~230–250 million online commerce users as of 2024. The e-commerce user base rose from 135 million in 2019 to ~250 million in 2024 and is projected to reach ~427 million by 2027. Discovery is going digital too about 68% of users in emerging markets find products via social media.

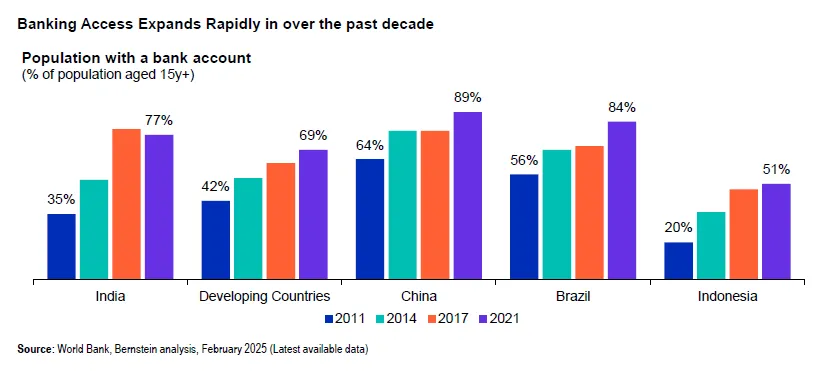

Financial inclusion has expanded dramatically. Bank account penetration more than doubled over a decade from ~35% in 2011, lifting formal savings and enabling credit access for millions newly onboarded to the system. Digital payments have become more routine and account aggregators now allow borrowers to share verified data. The impact on consumption comes through two channels. First, it smooths lifetime spending: a young household can bring forward the purchase of an air conditioner or a two-wheeler. Second, it raises the ceiling of feasible upgrades: a salaried couple can stretch from a peripheral flat to a better-located one, from a compact car to a crossover. As mortgage debt inches up from a very low base, barely a fraction of GDP compared with developed markets, the knock-on effects ripple through furniture, electronics, paint and services.

The real runway sits in mortgages. India’s mortgage penetration stands at roughly ~12% of GDP, far below global comparables leaving years of structural headroom. As consumers move from small-ticket credit to larger, secured loans, mortgage growth is expected to outpace overall consumer credit by 4–5 percentage points in the coming decade, historically correlating with durable consumption upcycles in appliances, furniture, and home improvement.

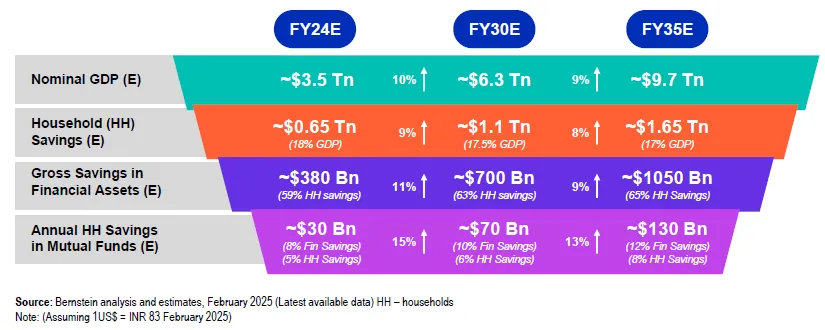

Household savings are large and greasing the consumption wheel. India currently saves ~US$650 billion annually (~18% of GDP). Projections suggest annual household savings could exceed US$1 trillion by 2030 and approach US$1.6 trillion by 2035, with financial savings (mutual funds, etc.) rising as a share of the pie. Monthly SIP inflows stood at ₹29,361 crore in September 2025 a window into the mainstreaming of equity investing through disciplined retail flows.

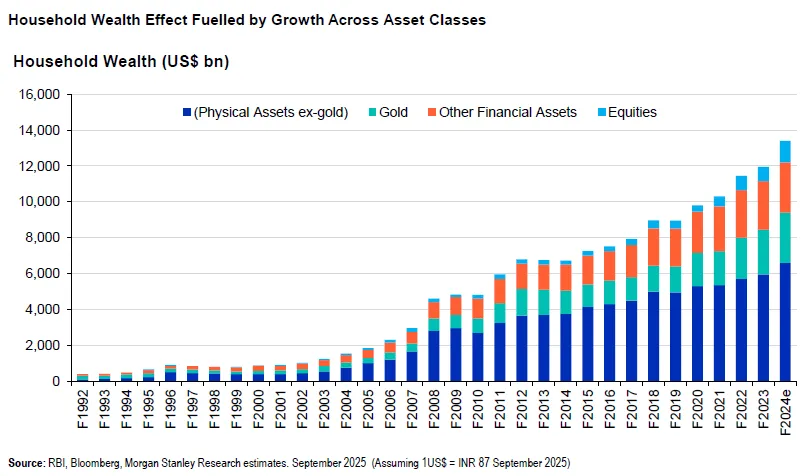

Households now pour record sums into systematic plans every month; the investor mix is skewing younger; and financial savings are rising as a share of total savings. When asset prices march upward, people spend more freely; when they wobble, confidence retreats. This wealth effect is especially potent at the top quintile of households, which already accounts for the bulk of savings and the lion’s share of spend on luxuries.

The distribution of savings is also evolving: while the top quintile still dominates, the lower-middle segment is expected to triple its savings to about US$310 billion by 2035. Financial savings in mutual funds alone are forecast to grow from US$30 billion to US$140 billion, creating a deeper wealth channel for the consumption multiplier.

As the equity and mutual-fund base broadens, more people see wealth on their phones. That immediacy translates into quicker and more volatile spending responses. Another reason why discretionary categories could accelerate faster than headline GDP in bull phases, and why they will be the first to feel a chill if markets correct.

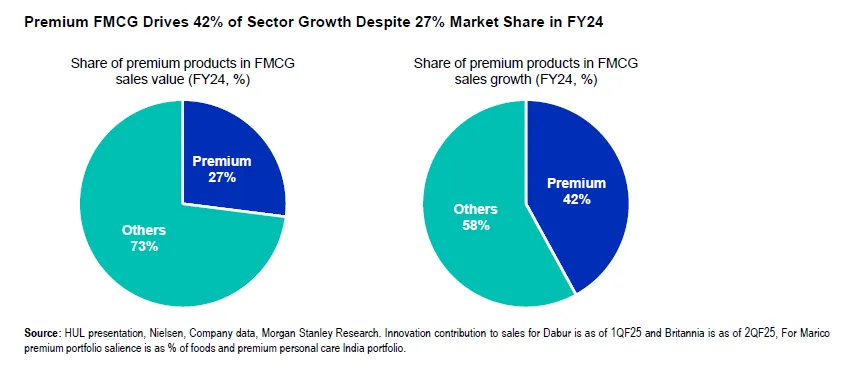

What distinguishes India’s present phase from earlier spurts is that the premium shift spans both durable and non-durable categories. In fast-moving consumer goods, the premium tier accounts for a minority of sales but a disproportionate share of growth. In durables, the “aspirational” and “premium” tiers together are already close to half the market by value and will dominate by the decade’s end.

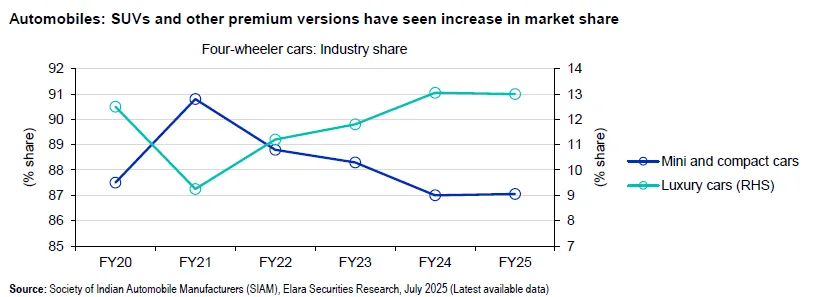

The car market mix is moving up the curve: SUVs and premium variants have been taking share, while mini/compact car shares edge down; luxury sales, while a small base, have been climbing. In two-wheelers, the premium 125–200cc segment has gained share against 75–125cc commuter bikes.

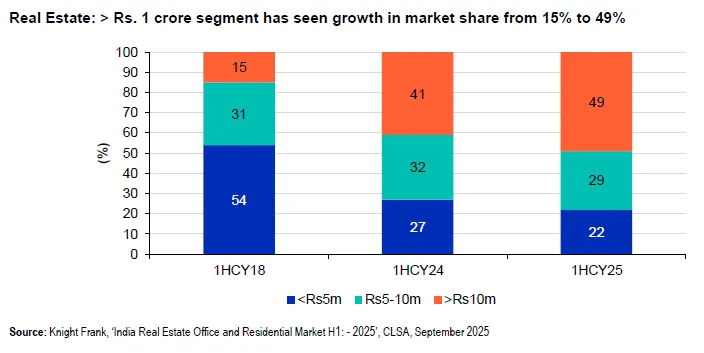

In residential real estate, homes priced above ₹1 crore have expanded their share markedly from ~15% to ~49% (1H CY2018 vs 1H CY2025), underscoring how wealth and credit are concentrating at higher price bands in major markets.

Premium FMCG contributes ~42% of sector growth while accounting for just ~27% of sales value (FY24). Over the last decade, premium sub-categories have consistently outgrown mass peers for example, premium detergent (~26% 10-yr CAGR) vs standard detergent (~7%), green tea (~25%) vs regular tea (~10%), mayonnaise (~26%) vs ketchup (~13%), and bodywash (~15%) vs bar soap (~6%).

India’s domestic air travel is tracking the early rapid-growth phase China experienced around 2009. With rising disposable incomes, regional connectivity, and tourism infrastructure, India’s passenger traffic trajectory is increasingly comparable to China’s ~11.2% CAGR in 2009–2019, suggesting sustained double-digit growth potential for aviation-linked ecosystems.

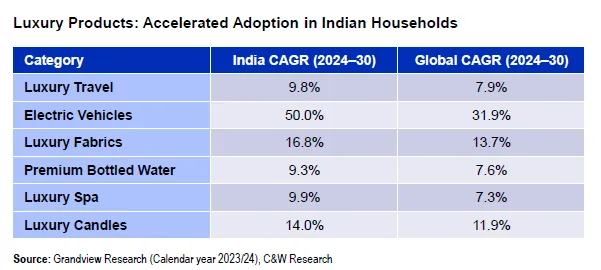

In 2024–2030 projections, several premium/luxury categories in India show faster expected CAGRs than global averages: luxury travel (~9.8% vs 7.9%), luxury spa (~9.9% vs 7.3%), premium bottled water (~9.3% vs 7.6%), luxury candles (~14.0% vs 11.9%), luxury fabrics (~16.8% vs 13.7%), and EVs (~50% vs 31.9%).

A practical test of whether a premiumisation trend is real is to ask: is the mid-tier getting hollowed out? In some sub-categories the answer is already yes. Consumers who once bought the cheapest or the median option are now choosing the second-best, not because they are flush but because financing, digital discovery and social signalling make the stretch small and the payoff visible. Firms are re-architecting product ladders to offer visible step-ups at tight price increments, often financed through easy monthly instalments. That changes the elasticity of demand: small boosts in income or confidence trigger step-ups, not just more units of the old choice.

The bullish case is that the transmission from income to aspiration to purchase is now more efficient. In earlier cycles, desire built faster than supply chains. Today, logistics networks, payment rails and content distribution are ahead of demand. A start-up with a good product can find customers and collect cash in towns it has never visited, a multinational can localise a premium portfolio and find an audience on day one, an incumbent can climb its own value curve without abandoning volume.

India’s discretionary penetration is still low in many categories versus peers. Car ownership per thousand people is a fraction of rich-world levels, air-conditioner penetration is minuscule and international air travel is only beginning to democratise. That low base gives the cycle room. Each percentage point of penetration gained now creates more units of demand than it would have a decade ago, because the total market is much bigger and because upgrades pull through accessory categories such as insurance, after-sales, financing, travel services, furnishings.

Two macro sensitivities could test India’s next 10 years. First, job creation: the IT services complex has long been a generator of high-quality employment. It now faces a massive business model shift in an AI-first world, potentially altering near-term hiring intensity. Second, asset prices: a sharp reversal in equities or gold would cool the wealth effect that’s been buoying sentiment. Policy continuity on infrastructure and manufacturing, alongside measured credit dispersion, will be critical shock absorbers. Digital rails make credit safer - credit makes upgrades possible - upgrades expand formal retail - formal retail boosts taxes - taxes pay for infrastructure - infrastructure lowers time costs - lower time costs raise real disposable incomes and higher real incomes fund the next upgrade. When one cog slows for example, when asset prices correct the others keep turning. That is what resilience looks like in a consumption-led cycle.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart