by Naman Agarwal

Published On Sept. 25, 2025

When discussing long-term wealth creation in India, two asset classes consistently dominate the conversation: equities (stocks) and real estate. Both have created significant wealth for investors, yet they differ radically in returns, accessibility, risks, and suitability for different financial profiles. Despite some recent capital shifts from equities to real estate, historical and contemporary data clearly tilt the balance in favor of equities for most investors seeking consistent compounding and flexible investment options. Both equity (stocks) and real estate are foundational pillars for long-term wealth creation in India, but their characteristics, risks, and returns diverge sharply. Incorporating rigorous data and references from academic sources, this analysis presents a detailed comparison of each asset class.

Indian equity markets have demonstrated remarkable resilience and growth over the past two decades, consistently outperforming most other asset classes including real estate. Academic research indicates that Indian equities have delivered average annual returns between 12-15% over long-term periods, with some studies showing actual market returns often exceeding expected returns. The Nifty 50 Total Return Index, which includes dividend reinvestment, has been particularly impressive in its wealth creation capabilities.

The most compelling evidence comes from comprehensive 20-year performance data showing that ₹1 lakh invested in Indian equities through the Nifty 50 TRI would have grown to ₹15.2 lakh, representing a compound annual growth rate of 14.6%. Midcap equities have performed even better, multiplying capital by more than 25 times over the same period. This performance has been achieved despite periodic market corrections and volatility, highlighting the power of long-term compounding in equity investments.

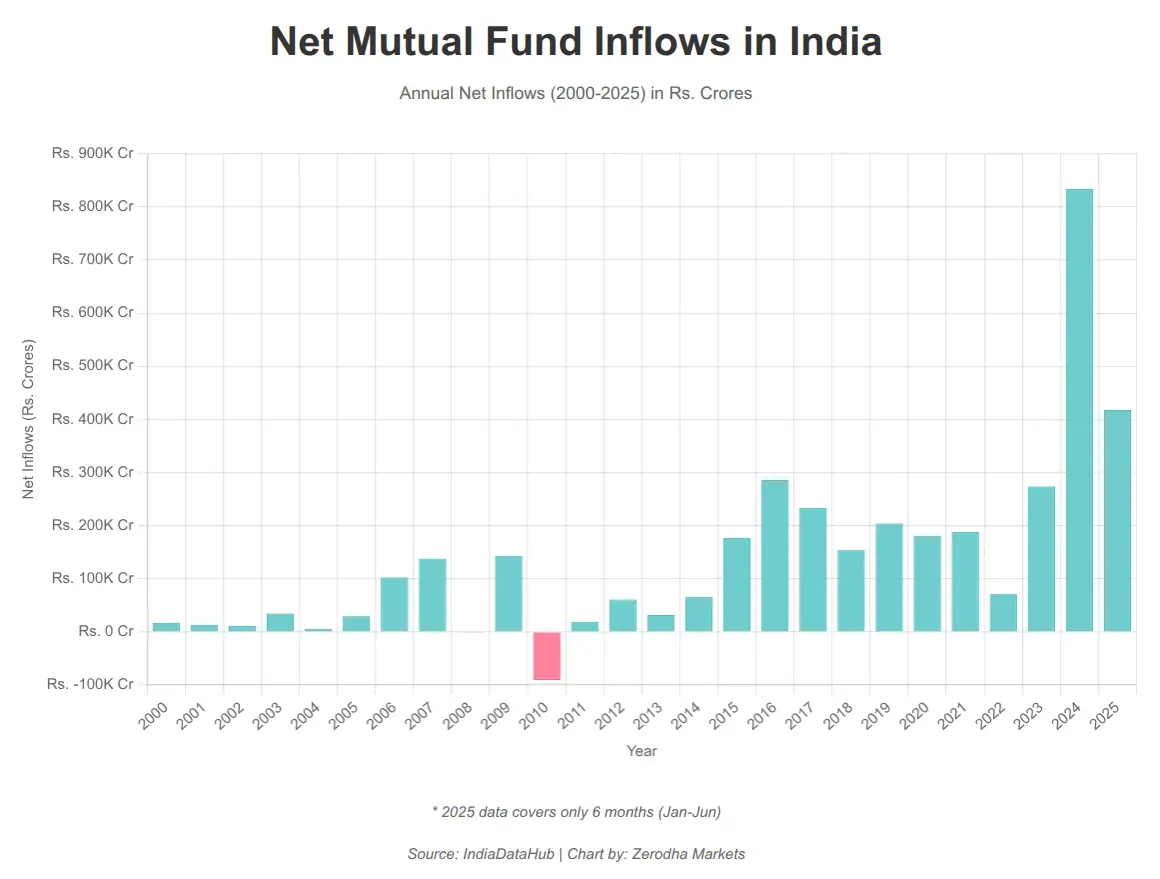

Interestingly, compared to annual inflows recorded since 2000, 2025 already stands out. Excluding 2024, the inflows seen in just the first six months this year exceed the full-year totals of most previous years.

(Source : The Daily Brief by Zerodha )

Of those ₹4.18 lakh crore worth of inflows this year, ₹1.6 lakh crore has been towards equity mutual funds. This has seen a steady stream of funds coming in since 2021; in fact, despite multiple periods of economic uncertainties post-COVID, flows into equity funds have remained positive ever since.

The democratization of equity investing in India has been remarkable, with minimum investment amounts as low as ₹100 through systematic investment plans and mutual funds. This accessibility has enabled millions of Indians to participate in equity markets, contributing to the sector's growth and stability. Investors can now even invest Rs.50 in mutual funds thanks to the Indian government and its ONDC platform.

Digital platforms and fintech innovations have further enhanced accessibility, with online trading accounts, robo-advisors, and mobile applications making equity investing more user-friendly than ever before. The introduction of fractional investing and zero-commission trading platforms has eliminated many traditional barriers to market participation.

Regulatory improvements under SEBI have enhanced investor protection, market transparency, and operational efficiency. Real-time price discovery, mandatory disclosures, and robust settlement systems provide institutional-quality infrastructure for retail investors

India's real estate sector is undergoing significant transformation, with expectations of reaching $5.8 trillion by 2047 and contributing 15.5% to GDP. However, this growth will likely be concentrated in specific segments and geographies rather than providing broad-based investment opportunities.Real estate in India has delivered more modest returns compared to equities, with academic studies and market research consistently showing average annual returns in the range of 6-8% over extended periods. The National Housing Bank Residex, which tracks residential real estate performance across major Indian cities, indicates that ₹1 lakh invested in real estate 20 years ago would have grown to ₹4.4 lakh, representing a compound annual growth rate of 7.7%.

Rental yields in residential real estate typically range between 2-4% annually, which when combined with property appreciation of 3-7% in major cities, results in total returns that consistently lag behind equity performance. Recent data from Knight Frank shows that while residential sales volumes have reached 12-year highs in certain markets, the underlying return dynamics remain challenging for investors seeking superior wealth creation.

The real estate sector's financial performance has shown signs of strain in recent years, with research indicating declining profitability margins, falling returns on capital employed, and reduced asset utilization efficiency. These operational challenges translate into lower investor returns and highlight structural issues within the sector that may persist in the medium term.

Real estate markets in India remain largely fragmented and opaque compared to equity markets. Property valuations often lack standardization, and price discovery mechanisms are inefficient, particularly in secondary markets.

( Research Paper on Indian Real Estate Market : Real Estate Market Research )

One of the most compelling arguments for equities is historical returns, supported by robust 20-year datasets.

Timeframe | Indian Equities (Nifty 50 TRI) | Real Estate (NHB Residex) |

1 Year | 11.1% (1.1x) | 7.4% (1.1x) |

3 Years | 15.6% (1.5x) | 6.9% (1.2x) |

5 Years | 22.3% (2.7x) | 5.7% (1.3x) |

10 Years | 12.7% (3.3x) | 5.2% (1.7x) |

15 Years | 12.5% (5.8x) | 6.4% (2.5x) |

20 Years | 14.6% (15.2x) | 7.7% (4.4x) |

Over 20 years, equities turned ₹1 lakh into ₹15.2 lakh, while the same amount in real estate grew to only ₹4.4 lakh.

Midcap equities performed even better, multiplying capital by more than 25x over 20 years.

Rental yields in residential real estate typically linger between 2% and 4%, rarely enough to outperform inflation when combined with modest price appreciation.

Equities, even accounting for occasional volatility, have shown a clear upward trajectory.

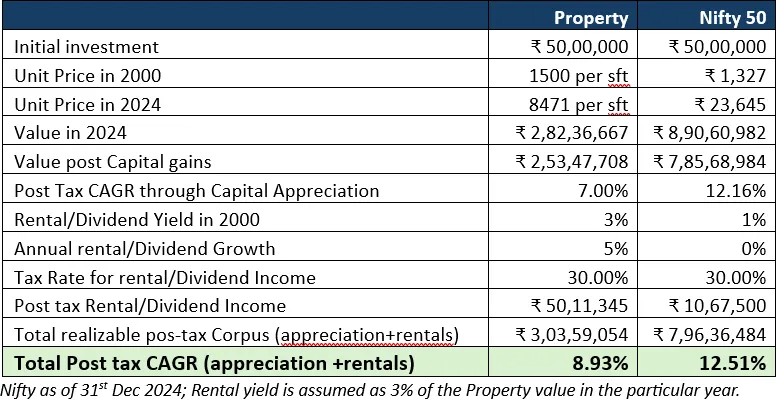

A simple illustration comparing an investment of Rs.50 Lakh in 2000 in both real estate and Nifty 50 index can help in bringing better understanding.

(Source : Wealthfirst )

Equities: Investment amounts can be as low as ₹100, thanks to SIPs and mutual funds. Anyone can build an equity portfolio quickly convenient for both beginners and seasoned investors.

Real Estate: Entry typically needs lakhs (or crores) due to high property prices, stamp duty, registration, and maintenance costs.

Equities can be converted to cash within minutes during trading hours, allowing for fast rebalancing or exit during unforeseen events.

Real estate sales can drag on for weeks or months. Paperwork, legal hurdles, and lack of buyers in weak markets can trap capital for extended periods.

Equities

Are volatile as market prices fluctuate daily.

Company-specific hazards such as governance failures or business model weaknesses can erode investment value.

Macroeconomic shocks (like the 2008 crisis) can lead to steep but temporary declines.

These are mitigated by diversification and long-term holding, which averages out such volatility.

Real Estate

Illiquidity: Dumping a property in distress is rarely possible at a fair value.

Concentration risk: Most retail investors can't afford more than one or two properties, resulting in poor diversification.

Hidden costs: Maintenance, municipal taxes, and costs of vacancies can significantly erode net returns.

Legal/title risk: Especially in under-construction or disputed properties, leading at times to total investment loss.

Market cyclicality: Returns depend heavily on local demand-supply, subject to unpredictable changes.

Real estate provides rental income, but net yields (after all costs) are low and erratic, especially during vacancies or economic slowdowns.

Equities offer dividends, and with the right portfolio can yield steady income streams. Dividend yields from blue-chip stocks average 1–3% annually comparable to or better than rental yields.

Stocks: Long-term capital gains tax at 12.5% (on gains over ₹1.25 lakh after 1 year) makes equity investing relatively tax-efficient.

Real estate: Long-term capital gains taxed at 20% (with indexation), plus stamp duty and registration charges at purchase, and rental income taxed as regular income.

Stocks fluctuate more in the short term that can cause anxiety for many. But over long durations, the volatility smooths out and consistent upward momentum dominates.

Real estate, while appearing stable day-to-day, is subject to large cyclical swings. PE-backed funds, developers, and ordinary folks have all faced multi-year periods of losses or near-zero growth when markets turn.

Feature | Equities | Real Estate |

Historical Returns | 12–15% p.a. over 20 yrs | 6–8% p.a. over 20 yrs |

Liquidity | Instant during market hours | Weeks to months |

Diversification | Easy, low entry barrier | Difficult, high ticket size |

Taxation | 12.5% LTCG (after ₹1.25L) | 20% LTCG (indexed) |

Volatility | High short-term, low long-term | Low visible, but can be severe |

Passive Income | 1–3% dividends | 2–4% net rental yield |

Hidden Costs | Low | High (maintenance, fees) |

Management Effort | Minimal (professionalized PMS/MF) | High (tenant, upkeep) |

Transparency: Stock prices, data, and company fundamentals are updated instantly and audited frequently. Real estate market rates, deal flows, and quality are opaque and local.

Scalability: Equities can be scaled up or down in small increments; real estate needs major capital and commitment for every step up.

Regulatory clarity: Capital markets have strong investor protections; although real estate regulation is improving (RERA, etc.), challenges remain.

Market recoveries: The Nifty 50 has rebounded from every major downturn with new highs, rewarding disciplined, long-term investors with exponential wealth growth.

There are certain special situations where investing in land can be particularly attractive and worth considering, even for those who generally prefer equities. One of the most notable examples is when land becomes available at a significantly discounted price, such as through bank or government auctions.

During recent volatility or profit booking in equities, some investors have shifted capital into real estate, viewing it as 'safer'. This perception, however, is often not backed by data especially if the investment horizon is long-term and liquidity is a priority.

Real estate's risk is front-loaded (title, legal, builder default) and often hidden (liquidity event, ill-timed sale).

Equity ownership allows for course correction like bad stocks can be sold, portfolios can be rebalanced, and exposure adjusted in real time.

Despite lower returns and higher risks, real estate remains popular for certain reasons:

Tangible asset appeal: People feel more secure owning something physical.

Emotional component: Owning a home is a key aspiration in India, and is distinct from investing for returns.

Utility value: Self-use properties or homes offer non-financial returns like stability and social status.

Non-Depreciable Nature: Unlike buildings or other physical assets, land itself does not depreciate over time. Its value is usually preserved or can appreciate, thanks to its finite nature and steady demand.

Potential for Windfall Gains: If the location witnesses infrastructure growth or urban expansion, land prices can increase substantially, producing outsized returns especially when acquired at below-market rates.

No Regular Maintenance: Undeveloped land typically involves minimal to zero ongoing maintenance costs compared to constructed real estate.

Land or property that is auctioned by banks typically when a borrower defaults on a loan is often sold below prevailing market rates. Government departments also conduct auctions of surplus or seized land. These auctions can be appealing because:

Discounted Entry Price: Properties may be available at prices 15–20% (or even more) below normal market value, offering an opportunity to purchase at a rare discount.

Transparent Process: Auctions usually follow a strict and clear legal process, with announced reserve prices and publicly disclosed terms, ensuring qualified buyers a fair shot.

Variety and Locations: It’s possible to find residential, commercial, and agricultural land across diverse geographies, sometimes in prime locations that rarely come to private sale.

Legal Documentation: Banks and government bodies typically provide essential legal documents, helping reduce the risk of title fraud or encumbrances.

India's equity markets are positioned for continued growth, supported by favorable demographics, increasing financialization, and structural economic reforms. The country's emergence as a global manufacturing hub and technology center provides multiple growth drivers for listed companies.

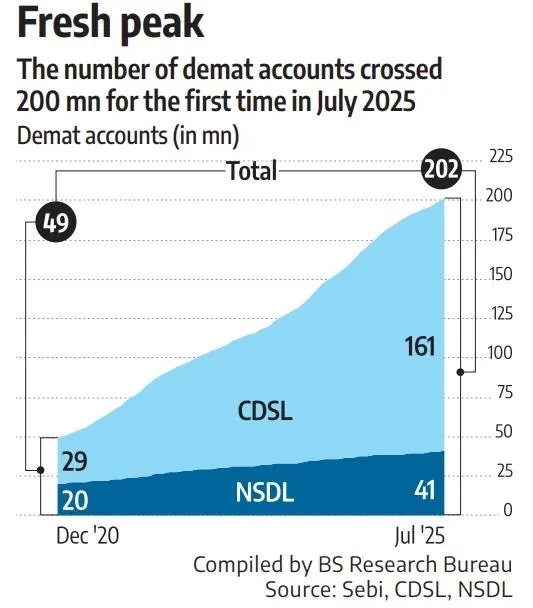

Rising domestic institutional participation, including increased mutual fund penetration and pension fund investments, provides a stable foundation for market growth. The growing number of retail investors and improving financial literacy suggest sustained domestic capital flows into equity markets.

(Source : Sebi , CDSL , NSDL , Business Standard )

Indicators suggest that India's equity markets could continue delivering strong returns as the economy modernizes and companies benefit from operating leverage in a growing market. Despite market fluctuations and economic noise, Indian retail investors have shown remarkable resilience through Systematic Investment Plans (SIPs) in the first half of 2025. SIPs have remained a strong pillar of disciplined investing, as reflected in the consistent monthly flows and robust growth in SIP assets under management (AUM).Retail investors aren't panicking during market dips. They are using SIPs as a long-term wealth-building tool.

The emergence of REITs and fractional ownership platforms may improve liquidity and accessibility over time. However, these innovations are still in early stages and may not significantly alter the fundamental characteristics of direct real estate investment in the near term.

(Source : Economic Times)

Premium housing segments have shown resilience, with luxury home sales growing significantly in major metropolitan areas. However, this trend primarily benefits developers rather than individual property investors, as increased supply may moderate price appreciation in many segments.

Key finding of recent research on real estate found out that :

Real estate remains the most preferred asset class for investment, with 59% of respondents favouring it.

67% of buyers seek property for end use, while 33% invest.

Demand for ready homes has declined significantly. The ratio of ready homes to new launches is now 20:25, compared to 46:18 in H1 2020.

57% of investors are buying property to earn rental income, driven by surging rental rates in cities.

Over 53% of homebuyers are dissatisfied with current affordable housing options, citing issues with location, construction quality, and unit sizes.

Home loan interest rates below 8.5% would have minimal impact on buying decisions for 71% of respondents. However, rates exceeding 9% would significantly impact 87% of buyers.

Though real estate retains its allure, the numbers, flexibility, and transparency favor equities for wealth creation particularly for those who value liquidity, efficient compounding, and low management hassle. It's essential to understand that perceived safety is a mirage when seen across full cycles . Investing in equities with discipline and diversification, are the true growth engine.

Special situations like discounted land in government or bank auctions deserve attention and can offer exceptional value, especially given land’s status as a non-depreciable asset. For a robust portfolio, a modest allocation to real estate may help diversification, but the core for most financial plans should remain equities especially in India's dynamic and fast-growing economy.

The evidence overwhelmingly supports equity markets as the primary vehicle for long-term wealth creation in India, while real estate serves a complementary role in portfolio construction. Investors should carefully consider their liquidity needs, risk tolerance, and investment horizon when determining optimal asset allocation between these classes.

This analysis demonstrates that while both asset classes have their place in Indian investment portfolios, equities offer superior prospects for wealth creation, better liquidity, and more favorable risk-adjusted returns for most investors seeking long-term financial goals.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart