by Naman Agarwal

Published On Nov. 24, 2025

India has achieved a remarkable milestone in its renewable energy journey, with total installed renewable energy capacity reaching 251 GW as of October 2025, marking a transformative shift in the nation's power landscape. This achievement represents more than a 228% growth from 76.37 GW in 2014, positioning India as the fourth-largest renewable energy market globally and demonstrating the country's unwavering commitment to its ambitious target of 500 GW of non-fossil fuel capacity by 2030.

Year | Total RE (GW) | Solar (GW) | Wind (GW) | Hydro & Biomass (GW) | YoY Growth (GW) | YoY Growth % | Key Milestones |

2015 | 85 | 5 | 23 | 57 | 8.63 | 11.3 | Solar policy beginning |

2016 | 95 | 8 | 27 | 60 | 10 | 11.8 | 95 GW achieved |

2017 | 105 | 12.5 | 32 | 60.5 | 10 | 10.5 | Solar rising (12.5GW) |

2018 | 120 | 21 | 35 | 64 | 15 | 14.3 | Solar surge begins (21GW) |

2019 | 135 | 28 | 37 | 70 | 15 | 12.5 | 135 GW milestone |

2020 | 148 | 37 | 38.6 | 72.4 | 13 | 9.6 | COVID impact, steady growth |

2021 | 163 | 48 | 40 | 75 | 15 | 10.1 | 163 GW, rooftop solar growing |

2022 | 175 | 60 | 42 | 73 | 12 | 7.4 | 175 GW achieved |

2023 | 198.75 | 75 | 44 | 79.75 | 23.75 | 13.6 | Solar crosses 75GW |

2024 | 220.1 | 90 | 47 | 83.1 | 21.35 | 10.7 | 220 GW, strong momentum |

2025 | 251 | 129.92 | 53.6 | 67.48 | 30.9 | 14 | 251 GW, record additions 34.4GW |

The year 2025 has been extraordinary for India's clean energy sector, with the country adding a record 34.4 GW of new solar and wind capacity in just the first nine months, representing a 71% year-over-year increase compared to the same period in 2024. This unprecedented growth has been driven by favorable government policies, declining technology costs, improved manufacturing capabilities, and strong investor confidence in India's renewable energy potential.

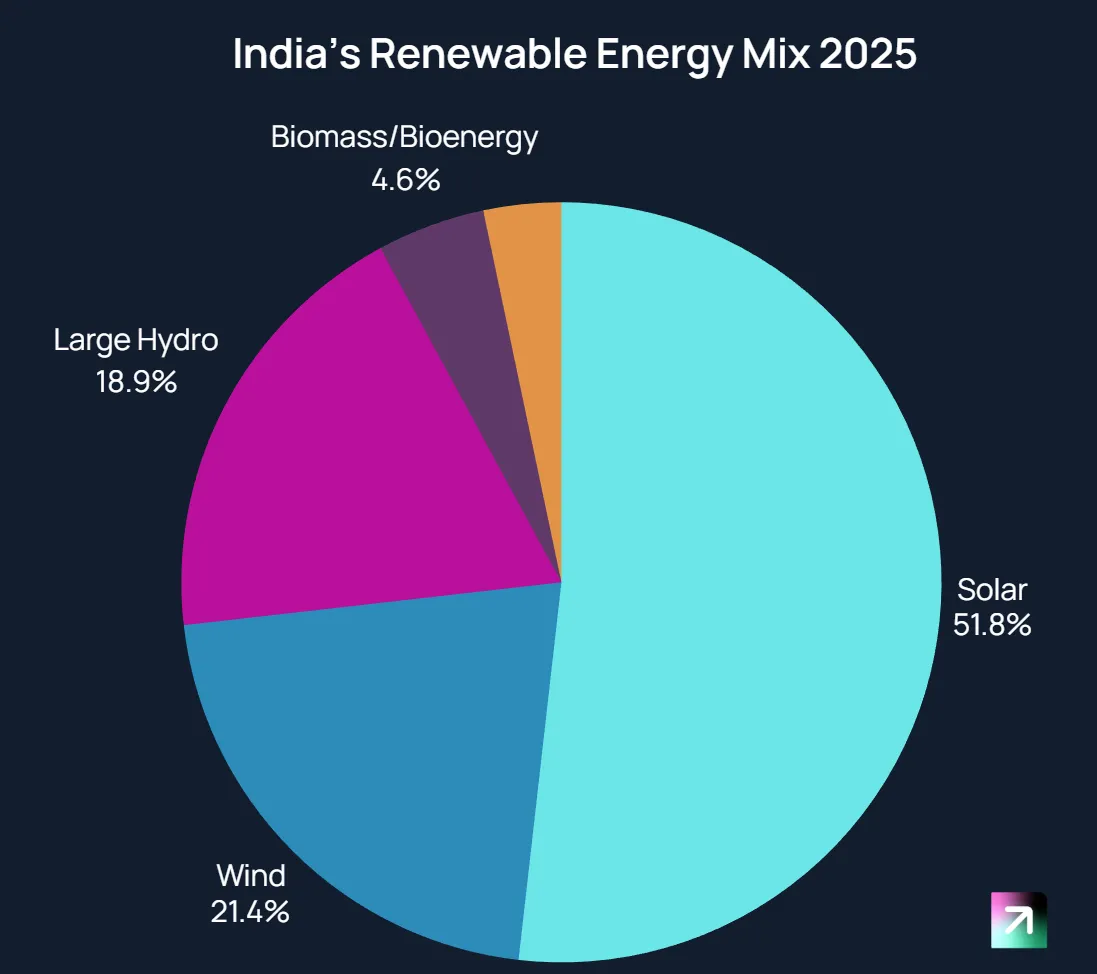

As of October 2025, India's renewable energy capacity (excluding large hydro) stands at approximately 200.29 GW, with the total renewable capacity including large hydropower reaching 251 GW. Solar energy has emerged as the dominant force in this transformation, accounting for 129.92 GW or approximately 51.7% of the total renewable capacity, excluding large hydropower projects. This solar capacity includes 98.72 GW from ground-mounted installations, 22.42 GW from rooftop solar systems, 3.33 GW from solar-wind hybrid projects, and 5.45 GW from off-grid systems.

Wind energy maintains its position as the second-largest renewable source with 53.60 GW of installed capacity, contributing approximately 21.3% to the renewable energy mix. The wind sector has witnessed steady growth, adding 4.96 GW in the first nine months of 2025, representing an 88.8% year-over-year increase. This growth trajectory demonstrates the increasing maturity and competitiveness of India's wind energy sector.

The renewable energy portfolio is further complemented by 11.58 GW of bioenergy capacity (including bagasse cogeneration and waste-to-energy projects), 5.10 GW of small hydropower, and 47.50 GW of large hydropower projects. These diverse sources collectively ensure a balanced and resilient renewable energy ecosystem capable of meeting India's growing electricity demands.

The momentum of renewable energy deployment in 2025 has been unprecedented. In the first half of the year alone, India added 22 GW of renewable capacity, comprising 18.4 GW of solar, 3.5 GW of wind, and 250 MW of bioenergy. This marked the country's highest-ever capacity addition in any six-month period, driven largely by developers rushing to capitalize on the government's Interstate Transmission System (ISTS) charge waiver, which begins at 25% and increases annually until full implementation by June 2028.

By September 2025, the cumulative additions had reached 34.4 GW, with solar capacity increasing by 68.9% and wind installations experiencing an even stronger surge of 88.8% compared to the same period in 2024. The total capacity added in the first nine months of 2025 has already surpassed the total additions recorded in the entire calendar year 2024, indicating robust growth momentum across the sector. Industry analysts project that India will add another 11-12 GW of capacity in the final quarter of 2025, bringing total solar and wind installations to a record 45-46 GW by year-end.

The rooftop solar segment has also witnessed remarkable growth, with 5.8 GW added in the first nine months of 2025, representing an 81% year-over-year increase. Public Sector Banks have approved over 5.79 lakh loan applications totaling ₹10,907 crore to support rooftop solar installations, demonstrating strong financial backing for distributed generation. This growth has been significantly aided by the PM Surya Ghar: Muft Bijli Yojana, which targets installing rooftop solar systems in one crore (10 million) households with an outlay of ₹75,021 crore.

India's renewable energy capacity is strategically distributed across multiple states, with western and southern states leading the charge. Rajasthan has emerged as the undisputed leader with 37.4 GW of installed renewable capacity, driven by 32 GW of solar and 5.2 GW of onshore wind. The state's leadership is attributed to high solar irradiance levels and vast desert terrain that provides ideal conditions for large-scale solar parks. Rajasthan topped the list in electricity generation with 57.35 BU, nearly 14% of India's renewable output.

State | Total RE Capacity (GW) | Solar (GW) | Wind (GW) | Hydro & Biomass (GW) |

Rajasthan | 37.4 | 32 | 5.2 | 0.2 |

Gujarat | 35.5 | 21.5 | 13.8 | 0.2 |

Tamil Nadu | 25.24 | 10.6 | 11.8 | 2.84 |

Karnataka | 24 | 15 | 7.7 | 1.3 |

Maharashtra | 22 | 12 | 5.3 | 4.7 |

Andhra Pradesh | 20 | 10 | 4.4 | 5.6 |

Madhya Pradesh | 18 | 12 | 3.2 | 2.8 |

Telangana | 12 | 8 | 2 | 2 |

Uttar Pradesh | 10 | 6 | 1 | 3 |

Punjab | 8 | 5 | 0.5 | 2.5 |

Haryana | 6.5 | 5 | 1 | 0.5 |

Himachal Pradesh | 5.8 | 2.5 | 0.8 | 2.5 |

Uttarakhand | 5.5 | 3.5 | 0.5 | 1.5 |

Chhattisgarh | 5.2 | 4 | 0.5 | 0.7 |

Odisha | 4.8 | 2.5 | 1.5 | 0.8 |

Goa | 3.5 | 2.5 | 0.5 | 0.5 |

Kerala | 3.2 | 1.8 | 0.5 | 0.9 |

West Bengal | 3.1 | 2 | 0.5 | 0.6 |

Jharkhand | 2.8 | 1.5 | 0.5 | 0.8 |

Assam | 2.5 | 1.2 | 0.3 | 1 |

Other States | 17.86 | 9.12 | 4.69 | 4.05 |

Gujarat follows closely with 35.5 GW of renewable capacity, including 21.5 GW of solar and 13.8 GW of wind, bolstered by strong policy support and favorable geographical conditions. The state is home to the ambitious Khavda Renewable Energy Park, which is set to become the world's largest hybrid renewable energy installation with a planned capacity of 30 GW spread over 72,600 hectares in the Rann of Kutch desert.

Tamil Nadu ranks third with 25.24 GW, maintaining its position as a wind energy hub with 11.8 GW of wind and 10.6 GW of solar capacity. The state is also a top performer in bioenergy, contributing 1 GW of the national total of 11.6 GW. Karnataka and Maharashtra round out the top five contributors with 24 GW and 22 GW respectively, driving consistent growth in both capacity and generation. Together, these top five states Rajasthan, Gujarat, Tamil Nadu, Karnataka, and Maharashtra collectively account for more than 63% of India's total renewable capacity.

Other states making significant contributions include Andhra Pradesh (20 GW), Madhya Pradesh (18 GW), Telangana (12 GW), Uttar Pradesh (10 GW), and Punjab (8 GW). The diversified geographical distribution ensures that renewable energy development is not concentrated in a few regions but spread across the country, enhancing energy security and grid stability. States with high industrial activity and growing power demand, such as Telangana (driven by its IT hub) and Uttar Pradesh (emerging solar market), are witnessing accelerated renewable energy deployment to meet their energy needs sustainably.

Despite impressive growth, India's renewable energy sector faces several challenges that need to be addressed to sustain the momentum toward the 500 GW target by 2030. Land acquisition for large solar parks is becoming increasingly difficult in many regions, as competition for land intensifies from agriculture, urban development, and other uses. While India has established nearly 70 solar parks, identifying suitable land parcels with good solar irradiation, flat terrain, and proximity to transmission infrastructure remains challenging.

Grid integration of variable solar and wind power requires significant improvements in transmission infrastructure and balancing technologies. The intermittent nature of renewable energy sources necessitates substantial investment in grid infrastructure, energy storage systems, and advanced forecasting and scheduling tools. While the government has taken steps to promote battery storage and mandate flexible operation of thermal plants, the scale of required investment remains substantial.

Right of Way (ROW) challenges for transmission lines and the movement of heavy equipment for wind projects have caused delays in project commissioning. The physical logistics of transporting large wind turbine components through rural areas with limited road infrastructure has proven particularly challenging. Companies like Tata Power and NTPC have acknowledged that wind projects face ROW issues that may cause slight slippage in capacity addition targets.

The renewable energy sector is evolving beyond traditional solar and wind installations toward more complex and integrated solutions. Hybrid projects combining solar and wind with complementary generation profiles are gaining traction, offering more stable power output and better capacity utilization. As of 2025, hybrid projects account for 2.87 GW of solar components and are increasingly being combined with battery storage.

Firm and Dispatchable Renewable Energy (FDRE) projects, which combine renewable generation with storage to provide round-the-clock power supply, are emerging as the next phase of renewable energy evolution. Companies like ACME Solar are leading this transition with substantial FDRE portfolios that achieve plant load factors of 50%, comparable to thermal power plants. The declining costs of battery storage are making FDRE projects increasingly economically viable and attractive to distribution companies seeking reliable renewable power.

Offshore wind energy represents a significant untapped opportunity for India, with the government approving a VGF scheme of ₹7,453 crore for the first 1 GW of projects targeting 30 GW by 2030. The coastal areas of Gujarat and Tamil Nadu have substantial offshore wind potential with higher capacity factors than onshore installations. However, offshore wind requires different skill sets, marine construction capabilities, and specialized turbines, necessitating technology transfer and capacity building.

Green hydrogen production is emerging as a critical component of India's decarbonization strategy, particularly for hard-to-abate sectors. The National Green Hydrogen Mission targets 5 MMT of green hydrogen production by 2030, which will require 125 GW of renewable energy capacity. Major companies including ACME, ReNew Energy, Adani, and Hero Future Energies are investing in green hydrogen projects, positioning India to become a global hub for green hydrogen production and export.

Company Name | Operational Capacity (GW) | Solar (GW) | Wind (GW) | Hydro (GW) | Hybrid (GW) | BESS Capacity (MWh) | Under Construction (GW) | |

Adani Green Energy Limited | 16.68 | 11.01 | 1.98 | 0 | 2.56 | 50( Target ) | ||

Tata Power Renewable Energy | 5.7 | 4.6 | 1 | 0 | 0 | 5.7 | ||

ReNew Energy Global PLC | 10.7 | 5.5 | 4.7 | 0.1 | 0 | 7.8 | ||

JSW Energy Limited | 13.3 | 2.29 | 3.72 | 1.63 | 0 | 29400 | 12.5 | |

NTPC Green Energy Ltd | 7.56 | 3.6 | 0 | 0 | 0 | 11 | ||

ACME Solar Holdings | 2.89 | 2.89 | 0 | 0 | 0 | 550 | 3.5 | |

Hero Future Energies | 7.2 | 4 | 2.4 | 0 | 0.8 | 2300 | ||

Azure Power | 3.04 | 3.04 | 0 | 0 | 0 | 1.09 | ||

KPI Green Energy | 0.95 | 0.95 | 0 | 0 | 0 | 2.96 | ||

KP Energy Limited | 1.07 | 0.12 | 0.04 | 0 | 0.24 | 2.22 | ||

Adani Green Energy Limited has established itself as India's largest renewable energy company with an operational capacity of 16.68 GW as of October 2025, making it the first Indian company to surpass the 15 GW milestone. The company's portfolio comprises 11.01 GW of solar energy, 1.98 GW of wind power, and 2.56 GW from hybrid wind-solar projects, all developed through greenfield projects. This achievement is particularly remarkable as AGEL added the last 5 GW in just 15 months, representing the fastest capacity addition by any Indian energy firm.

The company's flagship project is the Khavda Renewable Energy Park in Gujarat, spanning 538 square kilometers in the Rann of Kutch desert. As of 2025, the Khavda project has already commissioned 5.36 GW of capacity, with an ambitious target to reach 30 GW by 2029, which would make it the world's largest renewable energy installation.

AGEL has set an aggressive expansion target to reach 50 GW of installed renewable energy capacity by 2030. In FY25 alone, the company added 3,309 MW, marking the highest annual renewable capacity addition by a single player in India to date.

Tata Power Renewable Energy Limited, the renewable energy arm of Tata Power, has achieved significant scale with 5.7 GW of operational utility-scale renewable capacity as of September 2025, comprising 4.6 GW of solar and 1.0 GW of wind projects. The company's renewable energy portfolio now represents approximately 65% of its total generation capacity, reflecting a strategic pivot toward clean energy.

Tata Power has an aggressive expansion pipeline with 5.7 GW of renewable capacity under various stages of construction and is targeting 33 GW of green energy capacity by FY30. Despite facing delays in the first half of FY26 due to monsoon-related challenges that limited capacity additions to just 205 MW, the company expects to add 1.3 GW in the second half, more than six times the H1 additions, bringing the total FY26 addition to 1.5 GW.

ReNew Energy Global PLC, listed on NASDAQ, operates as one of India's largest renewable energy independent power producers with a total portfolio of 18.5 GW as of March 2025, including 10.7 GW of operational capacity. The company distinguishes itself with the largest wind portfolio in India at 4.7 GW, representing approximately 10.5% of India's total wind energy capacity. Its operational assets also include approximately 5.5 GW of solar capacity and 100 MW of hydropower.

ReNew crossed the significant milestone of 10 GW of gross renewable energy assets during FY 2023-24, adding 1.9 GW that year comprising 1,174 MW of solar and 768 MW of wind power. The company generated 17,385 GWh in 2023 and contributes approximately 10% of India's total solar and wind energy generation. Its portfolio spans across ten states in India, with significant presence in Andhra Pradesh (717 MW wind), Karnataka (1,291.8 MW combined), Gujarat (990 MW combined), and Rajasthan (497 MW combined).

ReNew has announced plans to invest approximately ₹22,000 crore (US$ 2.5 billion) to set up a 2.8 GW hybrid renewable energy project in Anantapur, Andhra Pradesh, which will include 1.8 GWp solar, 1.0 GW wind, and a 2 GWh battery storage system, making it one of India's largest single-location renewable energy complexes.

JSW Energy Limited has achieved a remarkable operational capacity of 13.3 GW as of November 2025, with renewables now accounting for 57% of the company's total capacity. The renewable portfolio comprises 3.72 GW of wind, 2.29 GW of solar, and 1.63 GW of hydroelectric capacity. The company has demonstrated strong growth momentum, commissioning 85 MW of new renewable energy capacity in November 2025 (74 MW solar and 11 MW wind), following earlier additions of 114 MW in September and 317 MW in August.

JSW Energy's total locked-in generation capacity stands at an impressive 30.5 GW, which includes 13.3 GW operational, 12.5 GW under construction across thermal and renewable segments, 150 MW of hydro capacity under acquisition, and a pipeline of 4.6 GW of renewable energy projects. This substantial pipeline ensures the company remains on track to achieve its ambitious target of 30 GW of generation capacity by FY 2030.

The company has also made significant strides in energy storage, with 29.4 GWh of locked-in energy storage capacity, comprising 26.4 GWh through hydro pumped storage projects and 3.0 GWh via battery energy storage systems.

NTPC Green Energy Limited, the renewable energy subsidiary of state-owned NTPC, has achieved an operational capacity of 7.56 GW as of October 2025, comprising primarily solar energy projects with approximately 3.6 GW of solar capacity. The company has demonstrated strong growth, adding 1,506 MW in the first half of FY26 and an additional 156 MW in October, taking the NTPC Group's total installed capacity to 84,849 MW.

NGEL currently has 14 GW of renewable energy capacity under construction, representing a significant expansion pipeline. The company added 956 MW in October 2025 alone, bringing total fresh capacity addition to 5,359 MW in the first seven months of FY26. This positions NTPC to potentially achieve its highest-ever annual capacity addition, surpassing the previous record of 6,984 MW set in 2019-20.

The parent company NTPC has revised its capacity addition targets significantly, aiming for 149 GW by 2032 and 244 GW by 2037, reflecting a 15% growth vision. For FY26, NTPC targets adding 2,019 MW on a standalone basis and 7,825 MW through joint ventures and subsidiaries, totaling 9,844 MW.

Company Name | Module Capacity (GW) | Cell Capacity (GW) | Wind Turbine(GW) | Other Products | Market Position | Expansion Plans |

Waaree Energies | 15 | 5.4 | BESS (20GWh planned), Electrolyser (1GW), Inverters (4GW) | No.1 module supplier, 14-17% market share | BESS 20GWh, Electrolyser 1GW, Inverters 4GW | |

Vikram Solar | 4.5 | 12 | Advanced tech (TOPCon, HJT) | Top performer PVEL, Tier 1 Bloomberg NEF | 17.5GW modules + 12GW cells by FY27 | |

Premier Energies | 5.4 | 5.4 | High-efficiency cells | Quality-focused manufacturer | Export-focused growth | |

Inox Wind | 2.5 | Blades, towers, hubs, nacelles | Leading component provider | 4Bn blade factory in Karnataka | ||

KP Energy | Wind/Solar/Hybrid BOP, Hybrid (243MW) | Gujarat wind BOP leader | 2GW wind-solar hybrid with Senvion | |||

Tata Power | 4.3 | Solar cell & modules (Tirunelveli plant) | Tier-1 IPP + integrated manufacturer | Continued solar manufacturing scale-up |

Waaree Energies Limited has established itself as India's leading solar module manufacturer, consistently capturing the top position in market share throughout 2025. The company achieved a commanding 13.9% share of total module shipments in FY2025, and maintained leadership with 14% market share in H1 FY2025 and 17.3% in Q1 2025. This market dominance underscores Waaree's crucial role in powering India's renewable energy expansion and advancing the nation's energy independence goals.

Waaree operates state-of-the-art manufacturing facilities with an installed capacity of approximately 15 GW for solar PV modules globally (including facilities in India and Texas, USA) and 5.4 GW for solar cells. In 2025, the company announced significant capacity expansions across multiple segments. The board approved increasing the capacity of its lithium-ion advanced chemistry cell and battery energy storage system manufacturing plant from 3.5 GWh to 20 GWh with an investment of around ₹80 billion. The company also approved expansion of electrolyser manufacturing capacity from 300 MW to 1,000 MW annually with an additional capex of ₹1.25 billion, and raising inverter manufacturing capacity from 3 GW to 4 GW with an investment of ₹0.5 billion.

Vikram Solar Limited has emerged as one of India's leading solar photovoltaic module manufacturers with a significant manufacturing footprint and global reach. The company successfully increased its manufacturing capacity with a 1 GW expansion at its Falta facility in West Bengal, bringing its total annual nameplate production capacity to 4.5 GW as of April 2025. Additionally, the manufacturing lines at the Oragadam facility in Chennai, Tamil Nadu, have been upgraded to manufacture more efficient technology modules, including TOPCON and HJT (Heterojunction Technology).

Vikram Solar has announced ambitious expansion plans, targeting 17.5 GW of module manufacturing capacity and entering solar cell manufacturing with a targeted capacity of 12 GW by FY27. The company's Chairman and Managing Director, Gyanesh Chaudhary, emphasized that this strategic backward integration into cell manufacturing will significantly enhance revenue and profitability in the coming years, particularly addressing India's current limited cell manufacturing capacity. The expansion is crucial for India to achieve its renewable energy targets and reduce dependence on imports.

As of June 30, 2025, Vikram Solar's order book stood at an impressive 10.96 GW with a capacity utilization rate of 89.2%. The company has been securing significant orders from major players in the Indian solar market, including a recent 148.9 MW order for high-efficiency modules rated at 595 Wp from Sunsure Energy. Vikram Solar is recognized as a 'Top Performer' in PVEL's PV Module Reliability scorecard 2025 and is listed as a Tier 1 solar PV modules manufacturer by Bloomberg NEF. With its cumulative production and international presence across 39 countries, Vikram Solar is positioned to make a significant impact on global renewable energy adoption.

Inox Wind Limited, part of the multi-billion-dollar INOXGFL Group, has established itself as a leading wind energy solutions provider in India with manufacturing capabilities and a growing order book. The company operates four state-of-the-art manufacturing plants in Gujarat, Himachal Pradesh, and Madhya Pradesh, producing essential wind turbine components including blades, tubular towers, hubs, and nacelles. With its 3 MW series wind turbine offering, the company's manufacturing capacity stands at approximately 2.5 GW per annum.

In FY26, Inox Wind has secured substantial orders, with total inflows reaching approximately 400 MW by November 2025. The company received a 160 MW order for its 3.3 MW wind turbines for projects in Rajasthan, a 69 MW repeat order for a Maharashtra-based project, and a 100 MW equipment supply order for projects in Gujarat. These orders include limited-scope engineering, procurement, and construction (EPC) services as well as multi-year operations and maintenance (O&M) support after commissioning.

To support anticipated growth, Inox Wind announced in October 2025 plans to invest ₹4 billion ($45.09 million) in establishing a wind turbine blade manufacturing unit in Kushtagi, Koppal district, Karnataka. The project includes an initial investment of ₹3 billion for the blade manufacturing plant, followed by an additional ₹1 billion for wind tower fabrication, to be developed on 70 acres of land.

Premier Energies Limited has positioned itself as a leading solar cell and module manufacturer in India with substantial manufacturing capacity. The company operates solar cell manufacturing facilities with a capacity of approximately 5.4 GW, focusing on high-efficiency solar cells that cater to both domestic and international markets. Premier Energies has been actively expanding its production capabilities to meet the growing demand for domestically manufactured solar components, aligning with India's push for self-reliance in the renewable energy sector under the Atmanirbhar Bharat initiative.

The company has benefited from government policies such as the Production-Linked Incentive (PLI) scheme and the Approved List of Models and Manufacturers (ALMM) policy, which mandate the use of certified domestically manufactured solar modules in government-supported projects. These policies have created a favorable environment for established manufacturers like Premier Energies to scale operations and compete effectively in both domestic and export markets.

India's renewable energy journey in 2025 has demonstrated that ambitious targets can be achieved through a combination of strong policy support, declining technology costs, robust private sector participation, and innovative financing mechanisms. As the country marches toward its 500 GW goal, it is not only transforming its own energy landscape but also emerging as a global leader in the clean energy transition, offering lessons and opportunities for other developing nations pursuing similar paths. The success achieved in 2025 with over 34 GW of capacity additions, early achievement of the 50% non-fossil fuel target, and a thriving domestic manufacturing ecosystem provides confidence that India's renewable energy ambitions are not just aspirational but entirely achievable.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart