by Siddharth Singh Bhaisora

Published On Feb. 5, 2026

For much of the past 10 years, India’s growth story is imbalanced.

The economy has grown exponentially, headlines have been bullish, and yet the country’s private sector has often hesitated to invest at the scale you would expect from a fast-growing nation.

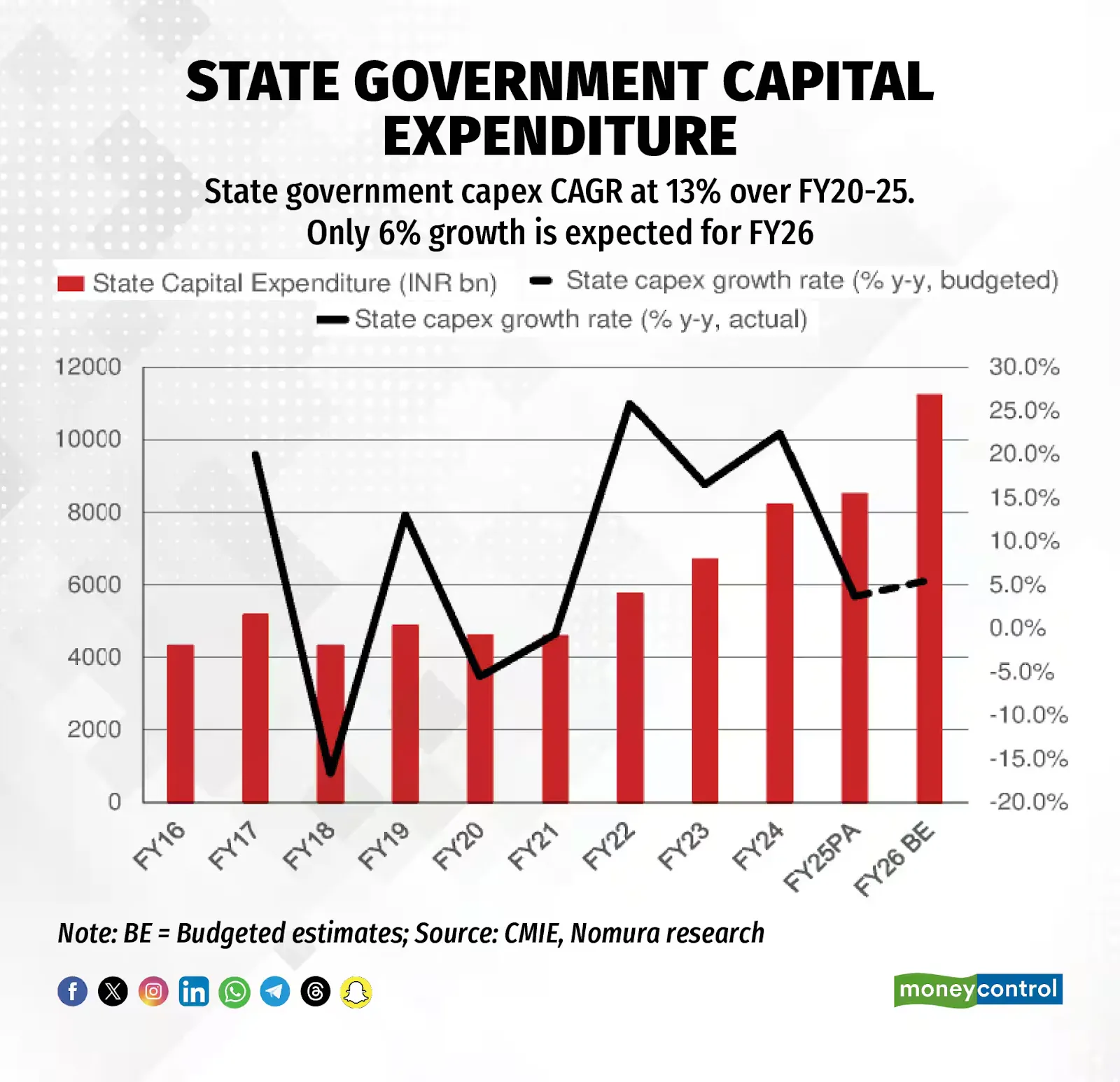

Naturally, government-led infrastructure spending had surged.

Select spaces in the private sector are investing aggressively, and several indicators suggest the downcycle in broad-based private capex could be closer to a floor than a free fall.

Private capex is the money businesses spend on long-term productive assets such as factories, plants, machinery, logistics capacity, R&D facilities, and other investments that expand the economy’s ability to produce and employ.

Unlike consumption, it builds future supply.

Unlike government capex, it is usually tied directly to commercial demand and tends to create self-reinforcing cycles of jobs, income, and repeated investment.

This is why economists obsess over it.

A growth model dominated by public infrastructure can lift demand for cement, steel, and construction services, but it may not be as durable as a model where companies continuously build capacity because they foresee stable, profitable demand.

In materials like cement and steel, executives frequently point to a long pipeline of infrastructure and real-estate activity.

UltraTech Cement management, for example, highlighted demand linked to a broad slate of public projects, explicitly tying strength to the government’s infrastructure push.

JSW Steel has also cited a broad-based “India story” across construction, infrastructure, commercial real estate, renewables, and selected consumption categories.

Strong demand for building materials can coexist with weak private capex if the primary engine is public works rather than private capacity expansion.

That’s exactly what multiple datasets and reports have been pointing to.

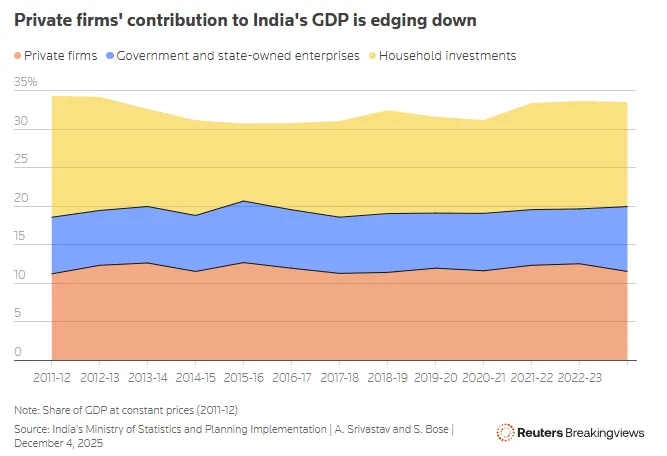

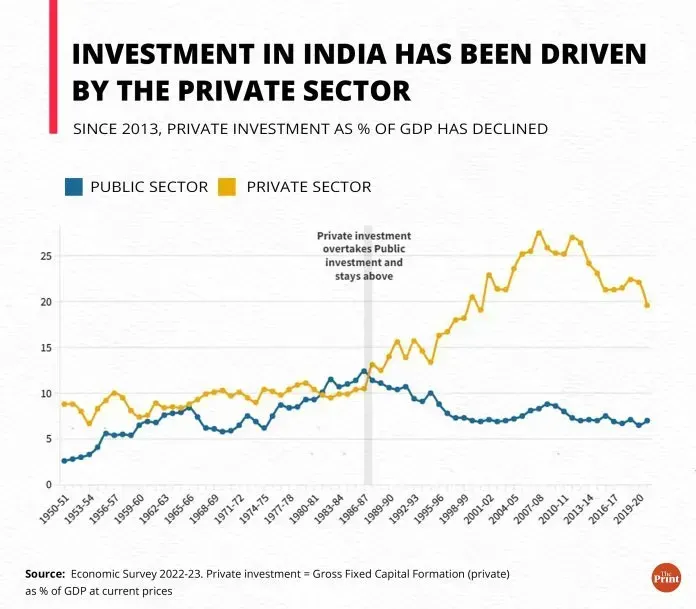

A striking long-run data point is that private investment as a share of GDP peaked around 27% in the boom years (2007–08 and again around 2011–12).

But it has slid meaningfully since then and hovered far lower since.

The private sector’s share of total fixed investment shrunk from over 40% in 2015–16 to about 33% in 2023–24.

This is a structural drift.

New private capex fell for a second straight quarter in the October–December 2025 period (Q3FY26).

Overall new investment proposals rose to ₹15.7 trillion in Q3FY26 as government projects rebounded.

New government investment projects jumped 26.5% quarter-on-quarter to ₹5.64 trillion, lifting the public sector share of proposals to nearly 36%.

Private sector plans fell 4.61% quarter-on-quarter, after an even sharper sequential contraction the prior quarter

Domestic private Indian companies’ commitments dropped 15.6% to ₹7.76 trillion.

Foreign investors partly offset the weakness, with fresh investment surging 69.3% to ₹2.3 trillion.

The aggregate can look fine because the public sector (and some foreign capital) had stepped up, while domestic private companies remained cautious.

The private sector “capex crisis” is better understood as a mix of demand uncertainty, balance-sheet psychology, and global risk.

Here are 4 primary reasons:

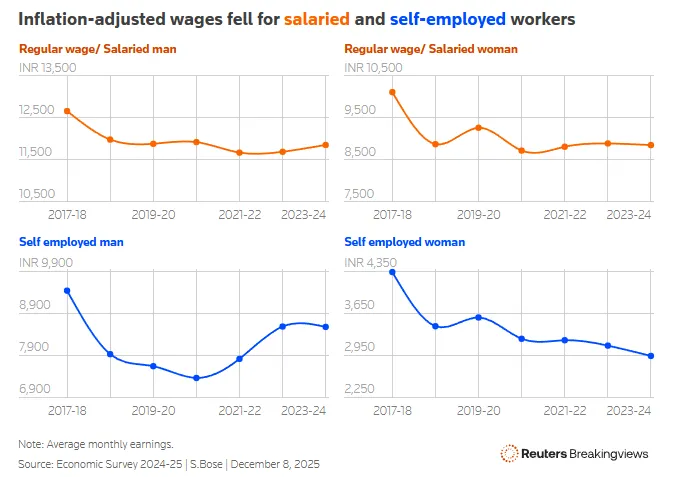

Demand confidence is still patchy.

Capacity utilisation sits below about 75%, which weakens the incentive to add new capacity: Why build another factory if existing lines aren’t running hot?

Stagnant real wages are a drag on broad consumption demand, which feeds corporate caution.

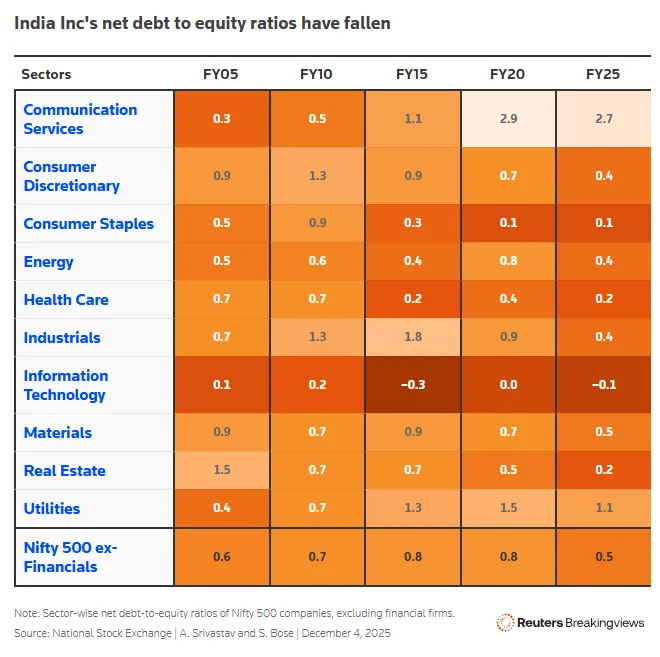

Debt aversion after past cycles.

Scars of earlier corporate/credit stress have made firms wary of leverage.

Low net debt multiples among large non-financial firms and a trend toward “zero net debt” postures.

A shift in “where returns feel safer.”

The rise of family offices and financial investing as an alternative to capital-intensive projects, especially when equity and digital-economy returns appear attractive relative to the grind of industrial execution.

Global headwinds and trade uncertainty.

There is a link explicitly between near-term caution to tariff risks, geopolitical uncertainty, and a softening export environment.

Factors that delay big-ticket commitments even when domestic conditions look great.

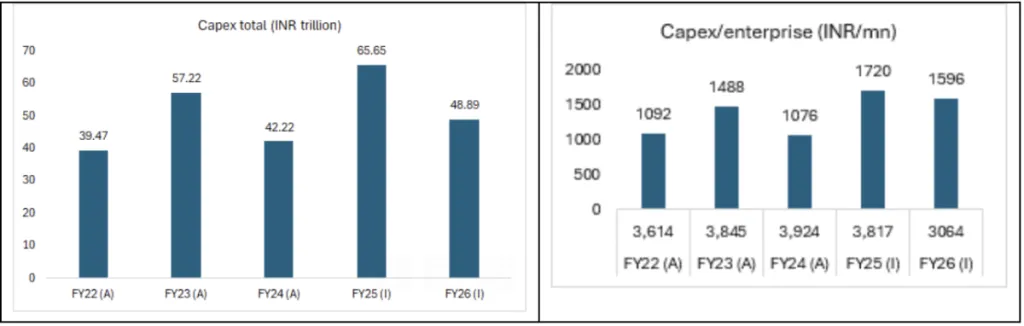

Perhaps the most direct official signal came from a forward-looking survey on private capex intentions conducted by India’s Ministry of Statistics and Programme Implementation.

The survey projected a 25% year-on-year decline in intended private capex for FY26 (intended) to ₹4.88 trillion, down from ₹6.56 trillion in FY25.

The responding enterprises fell year-on-year, and the survey itself excludes smaller firms and certain vehicles, so it may not capture the full universe.

Still, as a directional indicator, it reinforced the same message that Indian corporates were planning conservatively.

India is already seeing acceleration in certain pockets.

First, public capex is increasingly being designed to crowd in private investment.

India’s latest budget raised infrastructure spending to a record ₹12.2 trillion, while explicitly aiming to bolster growth amid global volatility.

Whether one cheers or critiques public-led growth, the transmission channel is real: more roads, ports, rail, power, and logistics lowers costs and raises the viability of private projects.

Second, the foreign-investor cushion is not trivial.

Foreign investment jumped sharply even as domestic promoters pulled back.

If global capital is willing to fund projects (selectively), it can keep the overall ecosystem moving such as when suppliers invest, skills deepen, clusters form and domestic players often follow once uncertainty fades.

Third, the “next-economy” capex themes are getting clearer.

Multinationals and major Indian groups are pouring money into renewables and AI-ready infrastructure.

Even if broad-based industrial capex remains cautious, these sectors can create demonstration effects and new supply chains that eventually spill into manufacturing, electronics, grid equipment, and specialised construction.

Finally, the cycle mechanics suggest we may be closer to a floor than a peak of fear.

When private capex drops for consecutive quarters, it often reflects delayed decisions rather than permanently cancelled ones especially when domestic conditions are described as stable and inflation manageable, but global uncertainty is the blocker.

As trade risks normalise and utilisation inches up, “wait-and-watch” can turn into “move before competitors do.”

India’s private capex story has been disappointing relative to the country’s ambition.

If the last decade was about learning that tax cuts and liquidity alone don’t force companies to invest, the next phase may be about something simpler but more powerful: rebuilding confidence that demand will persist, costs will fall, and rules will hold.

When that confidence returns, even gradually, private capex will grow fast.

And that’s why, despite the real slump, there’s a credible case that India’s private capex cycle may be bottoming out: because the ecosystem is slowly aligning to make the next wave of private investment less risky and, finally, more inevitable.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart