The Indian wedding season running from late 2025 into early 2026 is unfolding as a paradox: ceremonies are larger, more cinematic and more expensive than ever, even as record-high gold prices force families and jewellers to rethink how much metal actually goes into the jewellery box. Weddings have always been one of the biggest drivers of the gold and jewellery business in India, but in 2025 that relationship has become more complex, with volume growth under pressure and value growth surging.

At the heart of this story are three interlocking realities: the booming wedding economy, the extraordinary rally in gold prices, and the way jewellers and families are adapting to keep the wedding sparkle alive.

In India, weddings are macroeconomic events. The Confederation of All India Traders (CAIT) estimated that about 46 lakh weddings are scheduled between 1 November and 14 December 2025 alone which would generate business worth roughly ₹6.5 lakh crore, spanning venues, catering, fashion, décor, travel and of course jewellery.

Within that enormous spend, jewellery has historically accounted for around 15% of the total wedding budget. For a mid-to-upper middle class urban wedding, that can easily translate into jewellery purchases running into many lakhs of rupees. WeddingWire India, for example, reported that the average Indian wedding cost climbed to about ₹29.6 lakh in 2024, with a significant share flowing to bridal jewellery and gifting.

This means that any shift in gold prices or jewellery preferences during the wedding season has an outsized impact on the broader consumer economy, from organised national chains to neighbourhood jewellers and even international bullion markets.

The 2025 wedding season is also being shaped by a generational shift. Millennial and Gen-Z couples are leaning into highly personalised, Instagram-ready celebrations: multiple functions, destination venues, pre-wedding shoots and curated guest experiences. But while they might cut the guest list a little or choose more intimate events, they tend not to compromise on “hero” fashion and jewellery pieces that will be photographed and remembered.

This is where the tension with gold prices becomes obvious. On the one hand, social expectations and family traditions still demand that a bride enters her new home with a visible store of gold and fine jewellery. On the other hand, the per-gram cost of fulfilling that expectation has never been higher. The result is a pivot away from sheer weight of gold toward design, craftsmanship, gemstones and storytelling – while still preserving the idea of gold as wealth.

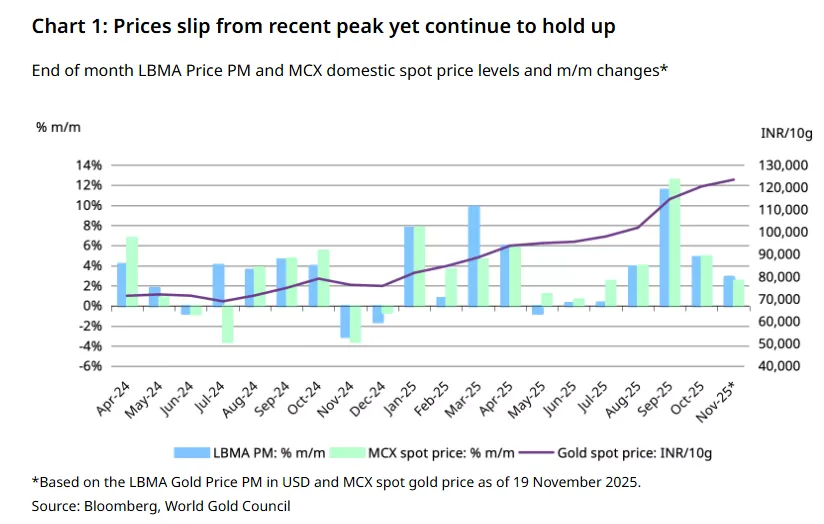

The 2025 wedding season is taking place against the backdrop of an extraordinary multi-year rally in gold. World Gold Council notes that the average domestic Indian gold price jumped by about 46% year-on-year, from roughly ₹66,600 per 10 grams in the third quarter of 2024 to around ₹97,000 per 10 grams in the third quarter of 2025.

By late November 2025 – right in the thick of the shaadi calendar – gold was trading around ₹1,25,000–₹1,26,000 per 10 grams of 24-carat purity on the Multi Commodity Exchange and in the Indian Bullion and Jewellers Association rate sheet - the latest uptick directly to wedding-season jewellery demand layered on top of global factors.

Put simply, in barely more than a year, brides and their families have seen the rupee cost of a 200-gram bridal trousseau jump from something like ₹13–14 lakh to well over ₹20 lakh if they tried to match the same weight in pure gold jewellery.

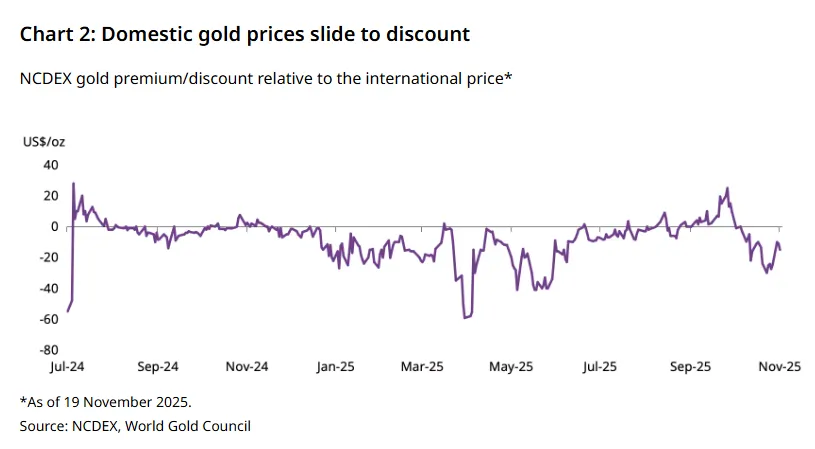

High prices are only part of the story; volatility has also unsettled buyers. A Reuters survey of physical markets across Asia in November 2025 reported that price swings had sapped bullion demand in top hubs, including India. Dealers here were quoting discounts to official domestic prices – down from even steeper discounts a week earlier – as many jewellers chose not to build large inventories and some consumers held off purchases in the hope of a correction.

Local stories reinforce this mood. In Kolkata, Times of India reported in early November that the price of 22-karat gold had fallen by about ₹10,200 per 10 grams from an all-time high hit on 17 October, just before Dhanteras. Despite this dip, demand around the start of the marriage season was described as “healthy”, with buyers planning purchases earlier and paying in smaller instalments to manage the strain of high prices.

What emerges is a market where weddings are still happening, jewellery is still being bought, but timing, ticket size and product mix are being carefully managed to navigate volatility.

India’s relationship with gold is inseparable from weddings and festivals. The World Gold Council estimates that around half of India’s annual consumer gold demand is tied to weddings alone – in the form of bridal jewellery, gifts to the couple, and ornaments purchased for close family members and guests.

Overall gold demand in India rose about 5% in 2024 to roughly 803 tonnes, compared with around 761 tonnes in 2023, even though global jewellery demand dropped by about 11% that year as high prices cooled buying in many markets. Within this, India’s jewellery demand slipped only about 2% by volume to around 563 tonnes, but its rupee value surged to about ₹3.6 trillion (₹3.6 lakh crore), with roughly 70% of that value generated in the second half of 2024, when festival and wedding buying is concentrated.

This pattern – flat to slightly lower volumes, but sharply higher value – has carried through into 2025. Weddings are effectively propping up the jewellery business in tonnage terms and turbo-charging it in value terms.

WGC’s India Gold Market Update for the third quarter of 2025 shows just how distorted the numbers have become. Total gold demand in India during the quarter fell to about 209.4 tonnes, down 16% from around 248.3 tonnes a year earlier. Jewellery demand suffered an even steeper 31% year-on-year drop, as some consumers balked at record prices. Investment demand, however – coins, bars and similar products – rose about 20% compared to the same quarter in 2024.

Yet in rupee terms, the market is booming. Because of the price increase, the total value of India’s gold demand in Q3 2025 jumped to roughly ₹2,03,000 crore, up 23% from the previous year, even as tonnage fell.

For jewellers, this means fewer grams per customer but larger bills. For households, it means that gold remains central to wedding rituals, but the amount of metal embedded in each necklace, bangle set or mangalsutra is being carefully engineered.

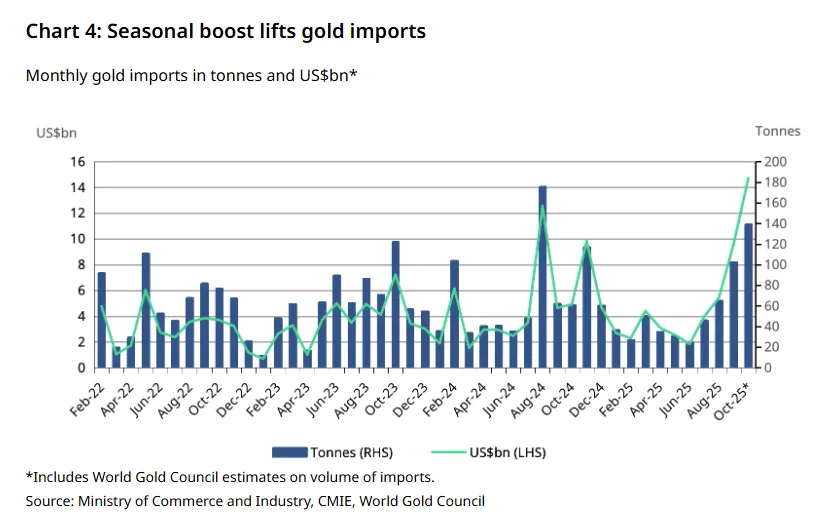

The supply side tells a similar story. Times of India reports that India’s gold imports soared to 165 tonnes in October 2025, valued at about $14.7 billion, compared with just 60.63 tonnes worth $4.92 billion in October 2024. From April to October 2025, imports totalled around 472.5 tonnes, only about 2.3% higher than the 461.9 tonnes imported in the same period the previous year – but at prices that were less than half today’s levels.

In other words, India is importing roughly the same physical quantity of gold as before, but paying vastly more for it because of global price appreciation. Much of this inflow is being stockpiled or transformed into jewellery in anticipation of wedding-season demand, even as exports of gold jewellery have slowed. October 2025 saw gross gems and jewellery exports fall by around 30% year-on-year, with exports of plain gold jewellery down nearly 40%, underscoring a pivot toward serving robust domestic consumption rather than external markets.

Indian families have not abandoned gold; they have adapted to it. A widely cited personal finance feature in October 2025 quotes financial planners and jewellers noting a boom in lightweight designs: necklaces under 10 grams and earrings using as little as 2 grams of gold, designed to look substantial thanks to smart craftsmanship, filigree work and the use of gemstones.

Analysts covering listed jewellery retailers have made similar observations in their quarterly notes: customers remain keen to buy, but they are trading down in caratage – for example, choosing 18-karat or 14-karat diamond jewellery over heavier 22-karat plain gold sets – and prioritising one or two standout bridal pieces instead of several heavy sets.

This shift is visible across metros and tier-2 cities alike. The visual impact of a bridal look is now being built as much through design, layering and styling as through sheer metal weight.

Another major behavioural change is the way families are funding these purchases. The WGC and industry experts report a marked increase in the practice of exchanging old jewellery for new designs, helping households offset part of the cost at current high prices. Kolkata jewellers told Times of India that they had expected more swapping of old jewellery, and while new-gold orders remain strong, consumers are clearly planning purchases months in advance and making payments in smaller instalments to cope with the price shock.

This trend dovetails with the rise of organised, EMI-based purchase schemes, digital gold savings plans and store-linked gold accumulation products. By the time a wedding date arrives, a considerable portion of the gold may already have been paid for through systematic purchases made at different price points, smoothing the impact of volatility.

Perhaps the most visible aesthetic trend of the 2025 season is the mania for personalised bridal jewellery. A Times of India feature from November 2025 describes how brides are commissioning bespoke maang tikkas etched with a couple’s initials, chokers engraved with wedding dates, and rings or necklaces that weave in motifs from family heritage or shared memories.

Designers explain that every piece is now treated as a narrative: gemstones linked to family history, patterns inspired by ancestral homes, motifs drawn from the couple’s journey. Digital tools allow CAD renders, mood boards and 3D previews before production, so brides can perfect details while still working within strict gram budgets. What is being sacrificed in raw metal weight is being reclaimed in emotional weight and design value.

In parallel, there is renewed interest in repurposing mothers’ and grandmothers’ jewellery – melting or redesigning heritage pieces into contemporary silhouettes that retain sentimental value while updating aesthetics for a modern bride.

As the high-auspicious dates of December 2025 and the spring 2026 wedding clusters approach, several patterns are clear. First, gold has become more of a “quality over quantity” purchase. Couples and families are willing to spend eye-watering sums in rupee terms, but they want that spend to translate into distinctive design, emotional storytelling and long-term investment value rather than just heavier chains.

Second, the gold and jewellery market is experiencing a structural shift from pure ornament to a blend of adornment and financial asset. The 20% rise in investment demand in Q3 2025 despite high prices suggests that many households view any wedding-season gold purchase as an opportunity to shore up balance sheets in an uncertain macro environment.

Third, the industry itself is becoming more sophisticated. From lightweight engineered designs and caratage optimisation to digital gold, EMI schemes and CAD-driven personalisation, jewellers are using every lever available to reconcile tradition with affordability. Articles across Indian media note that organised jewellery retailers have managed to grow revenue even in quarters when volumes fell, thanks to higher realisations per gram and an expanding mix of value-added products.

For the rest of the 2025–26 wedding calendar, the most likely scenario is one of continued strong value growth in the jewellery sector, modest to flat volume growth, and sustained importance of weddings and festivals in anchoring India’s gold demand. If prices remain at or near current record levels, the pressure to innovate – in design, financing and product format – will only intensify.

What will not change is the central cultural insight: for Indian families, a wedding without gold is almost unimaginable. The 2025 wedding season proves that even when the metal becomes breathtakingly expensive, the country will find new ways to wear, gift and invest in it – less by the kilo, perhaps, but still very much by the heart.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart