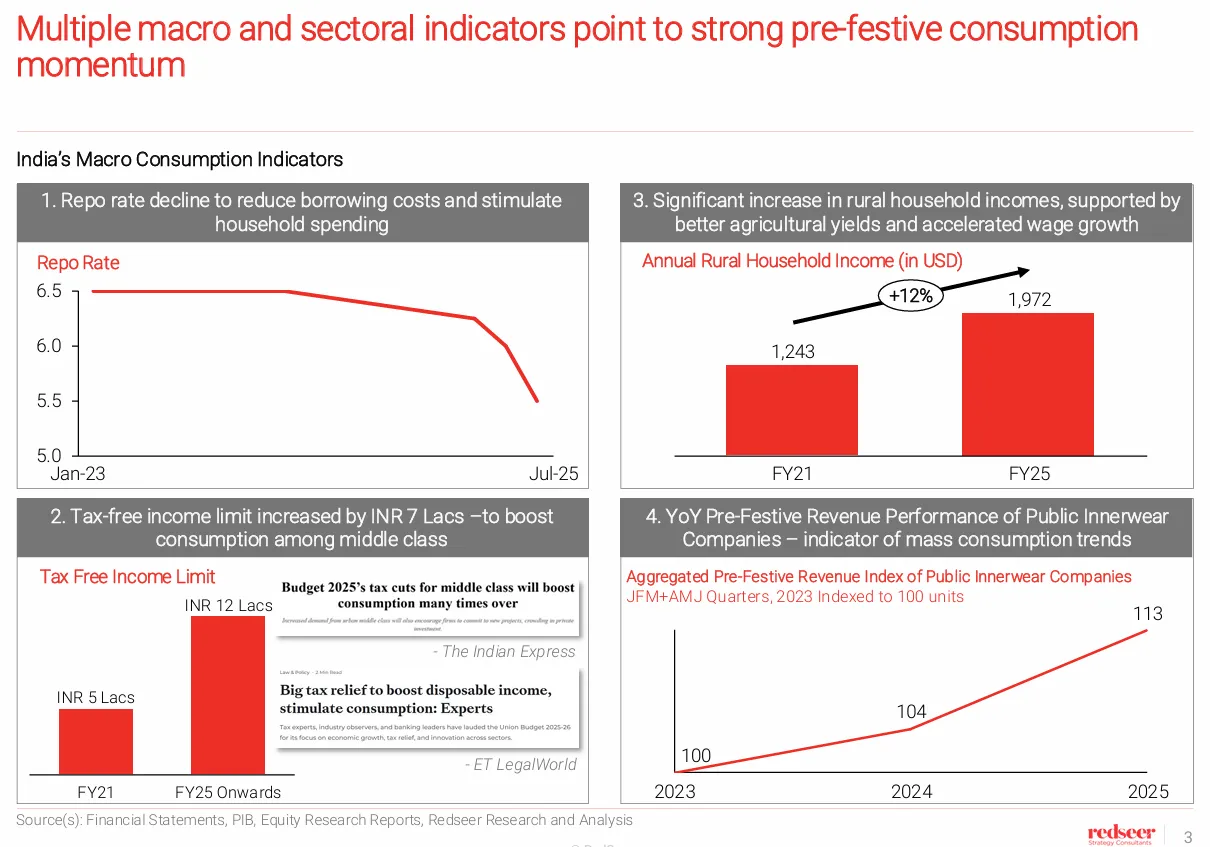

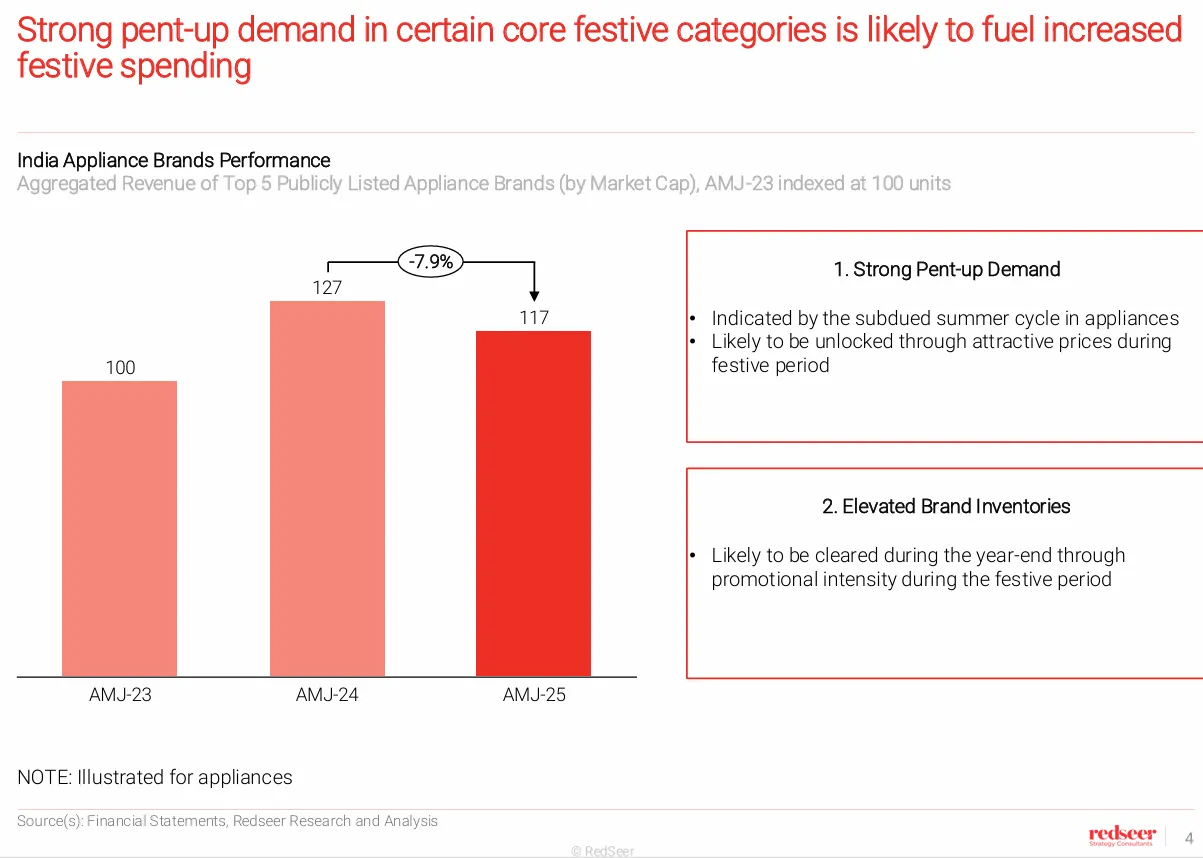

After 2 years of choppy consumption and cautious households, India is heading into what many analysts expect to be the strongest festive season in three years—with the action led online and amplified by policy tailwinds. A recent overview highlights how macro factors, tax changes, and new shopping rails (quick commerce and value commerce) are converging to create a rare “double-peak” demand year.

India’s 2025 festive season hasn’t just “felt” strong—it’s shown up in hard numbers across retail counters, checkout apps, forecourts, and registries. With Navratri (September 22–October 1) kicking off the peak window and Dussehra behind us, a clearer, more quantified picture is emerging of what’s hot, what’s lagging, and what the next four to six weeks could look like as Diwali approaches and the wedding season extends demand into November–December.

Let’s look at a data rich read on the festive season so far, and what to expect as we enter Diwali, Wedding season and the New year.

Watch our detailed video here:

Sales during Navratri 2025 appear to be India’s best in a decade, tied to the GST 2.0 rate rationalisation that took effect just before the sale cycle. The cut simplified slabs and lowered effective incidence on hundreds of mass and discretionary items, and the impact has been visible in store traffic and ticket sizes. Government sources cited by national dailies called it the “highest Navratri sales in 10+ years,” attributing the step-up to reductions across 375 items that made prices feel immediately lower to shoppers, especially in general trade and autos.

A simplified 5%/18% rate grid (with a high rate reserved for sin/luxury via cess) cuts through complexity that has historically muddied price communication. Over dozens of SKUs, a few percentage points either way might sound academic, but in cart terms it’s the difference between a “maybe later” and “add to basket.” Government documents outline reductions across common services and several goods.

Another interesting point to note is that Shraadh ended earlier, giving retailers a longer, cleaner runway into Navratri and Dussehra. This matters for autos (delivery clusters) and housing (auspicious-date registrations), where timing effects are as important as ticket price.

When the central bank signals benign inflation (and markets price it in), shoppers tend to step up from “safe value” to “value-premium.” That shows up in bigger TVs, multi-door refrigerators, higher-trim cars, and premium ethnicwear—categories where festive emotions meet financing comfort. The RBI’s hold at 5.5% with softer inflation prints underlines that backdrop.

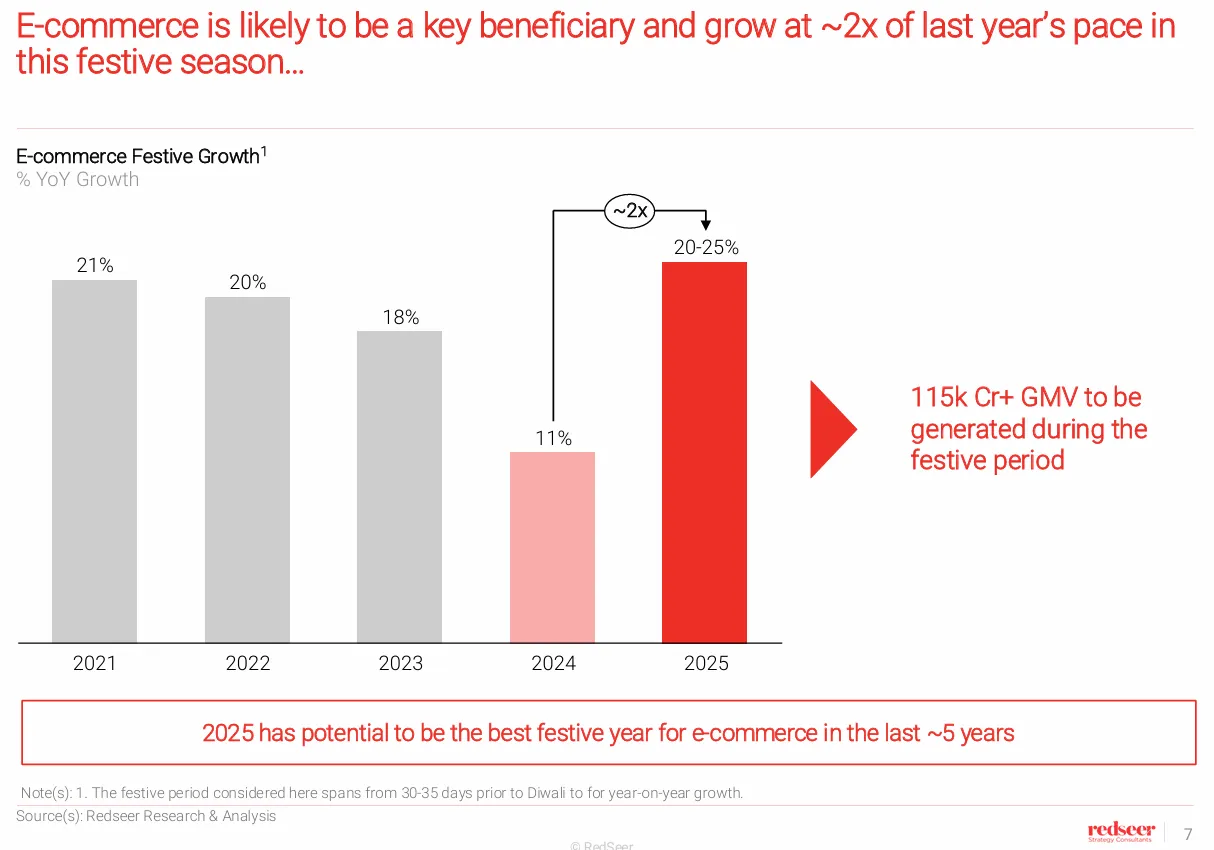

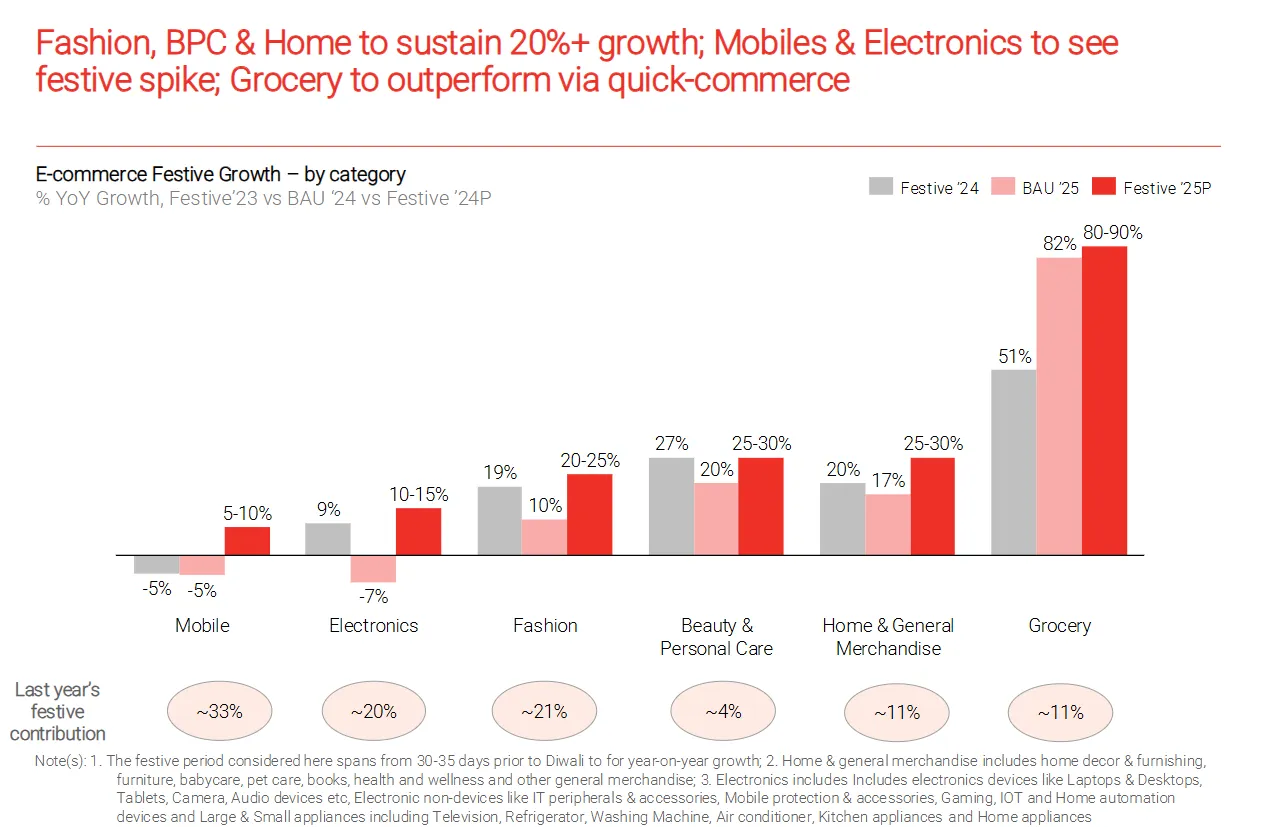

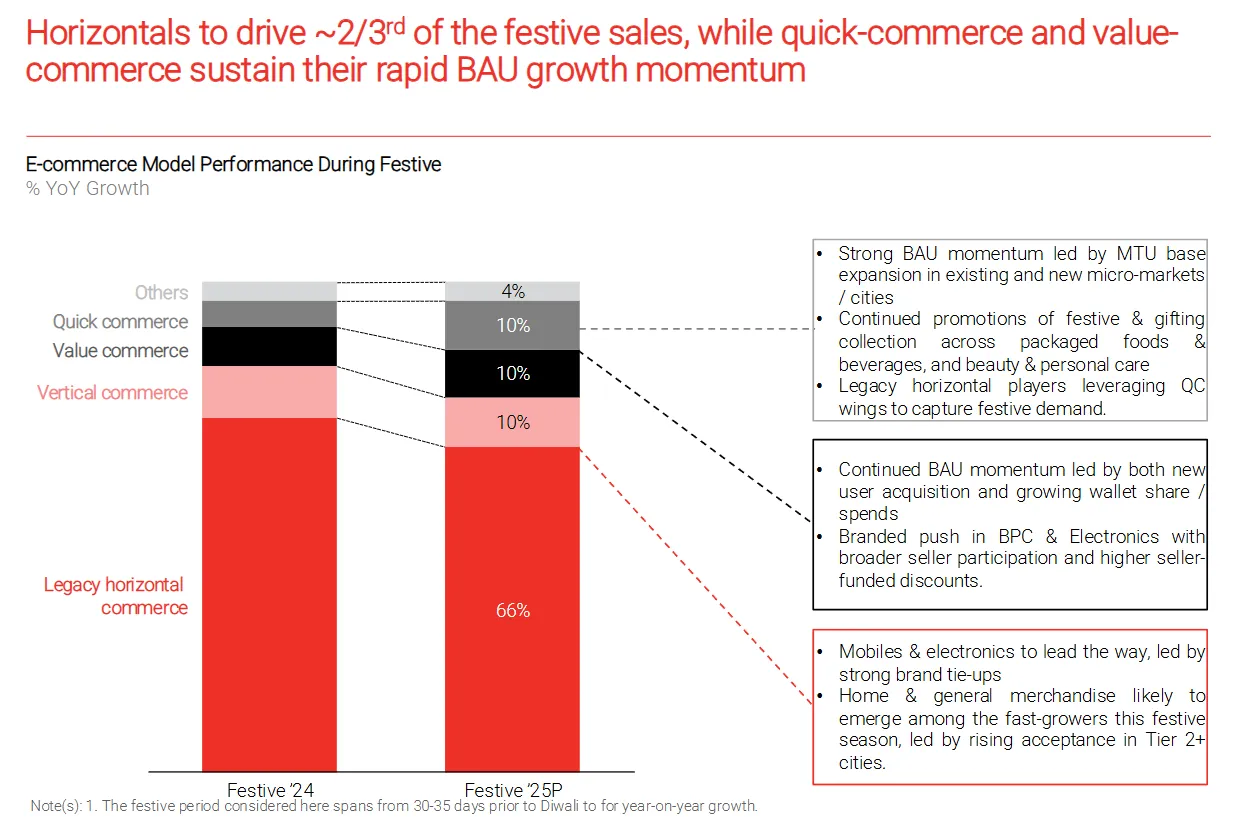

On the digital side, 2025 is pacing to be the best festive e-commerce season since 2021. Expected ₹1.15 lakh crore+ of GMV for the festive window (roughly late-September through Diwali), a +20–25% y/y step-up, nearly double last year’s expansion rate. September 22 showed +23–26% y/y GMV growth, 5–6× faster than last year’s opening-day, led by smartphones and TVs but with large appliances and grocery doing more of the incremental lifting than in previous years. Two structurally new engines matter in 2025: quick commerce, projected at ~150% y/y growth, and value commerce, projected at ~40–50% y/y, together widening the festive funnel beyond classic big-ticket categories.

Quick-commerce surges: It’s expanding beyond grocery into beauty, gifting and small accessories, and platforms are staffing up for the spike (40–60% more gig workers). Industry commentary also pegs Q-commerce at ~two-thirds of e-grocery orders and ~10% of all e-retail GMV. Expect this to power the 80–90% grocery lift.

Legacy horizontals still dominate: Despite the rise of vertical, value and quick-commerce players, legacy horizontal marketplaces are still projected to drive roughly two-thirds of festive sales.

Value commerce keeps humming: A price-sensitive cohort is pushing value formats, which Redseer sees growing 40–50% YoY this season. That supports steady 20%+ growth in categories like fashion and home.

Payments rails are absorbing the surge. UPI handled 19.63 billion transactions in September 2025 (down from August’s 20.01 billion due to calendar effects), while value ticked up to ₹24.90 lakh crore from ₹24.85 lakh crore in August—a sign that larger-ticket and higher-value transactions rose even as count dipped marginally. UPI’s daily trendline through mid-September had already shown higher daily averages as sale events ramped.

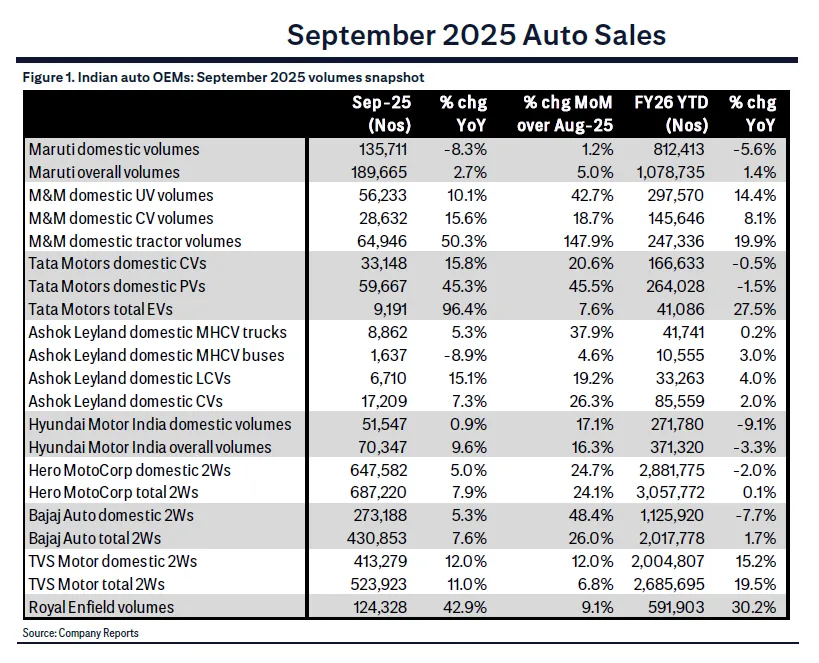

Passenger vehicles had been looking for a spark mid-year; September provided it. Wholesales (factory dispatches) were ~3,80,000 units in September 2025 (+5% y/y vs 3,60,494), while retail sales to customers hit ~4,00,000 units, a striking +25% y/y jump from ~3,20,000 in September 2024. OEM commentary makes the mechanism clear: GST 2.0 lowered tax burden in the small-car band (sub-4m) to an 18% slab with no compensation cess (previously 28% + 1–3% cess), and trimmed the burden on larger/luxury models to an effective 40% vs 43–50% earlier. Companies translated that into visible price cuts—illustratively, up to about ₹1.30 lakh on select Marutis, ₹1.55 lakh on Tatas, ₹1.56 lakh on Mahindras, ₹2.40 lakh on Hyundais, and ₹3.49 lakh on Toyotas—layered with festive finance schemes.

Beneath the aggregates, the brand leaderboard shows just how pointed the festive momentum has been:

Tata Motors: 59,667 PV wholesales in September, +45.3% y/y, its highest-ever monthly tally; over 22,500 Nexons sold (a monthly record) and 17,800 CNG units (also a record).

Mahindra & Mahindra: 56,233 wholesales, +10.1% y/y, with SUV-led strength and dealer-reported retails in the first nine days of Navratri >60% higher than last year’s comparable period.

Hyundai: 51,547 wholesales, +0.9% y/y; Creta at 18,861 (highest ever), Venue at 11,484 (20-month high); SUVs made up 72.4% of domestic sales.

Toyota: 27,089 wholesales, +13.8% y/y, with the company stating it passed on the full GST benefit, helping lift enquiries and conversions.

Maruti: Wholesales 1,32,820 (–8.4% y/y), but retails +27.5% y/y to 1,73,500; notably, 1,65,000 customer deliveries in the first 8 days of Navratri, 7,00,530 enquiries and ~1,50,000 bookings during that span—an all-time high for the company’s Navratri period, beating FY20. Pending bookings still around 2,50,000 at the month-end.

The forward read is constructive: auspicious-date deliveries around Dussehra–Diwali, a better on-road price narrative from GST 2.0, and OEM-bank programs should keep October retail tallies elevated—with the caveat that entry hatchbacks and commuter two-wheelers remain more sensitive to rural cashflows and EMI optics than mid-premium SUVs.

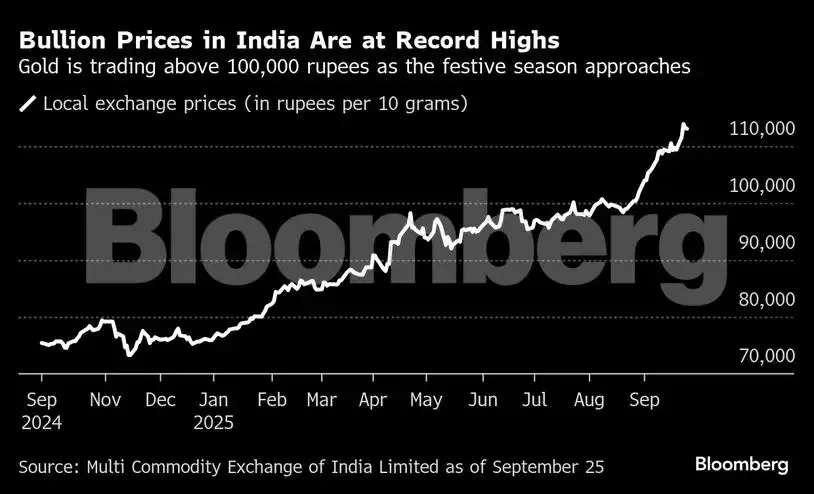

The outlier in an otherwise buoyant basket is gold jewellery, where record bullion prices are re-wiring festive buying. Trade bodies and Bloomberg-sourced reporting indicate festive-period jewellery demand could fall as much as 27% y/y in volume terms, and that 2025 may print a five-year low for India’s total gold purchases—despite high rupee-value sales on account of price. Local gold prices have hovered above ₹1,00,000 per 10g, while global spot gold printed an all-time high near $3,791/oz in late September. All of this is coaxing a visible down-trading to lighter/studded designs or deflection to silver, even as investment purchases of coins/bars hold up relatively better.

Around Dussehra itself, preliminary trade reads suggest ~18 tonnes of gold were sold—~25% lower than last year’s Dussehra run-rate—underscoring how price can overwhelm auspicious-day psychology. The shift doesn’t eliminate revenue; it changes composition and margins, favoring investment SKUs and design-led, lower-grammage ornaments over traditional, heavier sets.

Festive mobility is a useful proxy for discretionary confidence. In Maharashtra, bus bookings rose ~31% during the Dussehra period, with 84% of seats booked on AC buses and 87% of passengers opting for sleepers, signalling a willingness to pay for comfort as families undertook longer domestic trips. Routes such as Mumbai–Kolhapur, Mumbai–Pune and Pune–Hyderabad dominated, and platforms reported rising participation from smaller towns.

In the East, Kolkata airport handled ~3.6 lakh passengers between Panchami and Dashami, its third-highest Puja count on record (versus ~4 lakh in 2024 and ~3.9 lakh in 2019), despite some rain-related advisories during the approach. That’s consistent with a travel market that has normalised from pandemic disruptions and is now riding festival calendars rather than fighting them.

India’s 2025 festive season is expected to generate around two lakh new jobs, with roughly 70% of them likely to be gig or temporary roles concentrated in Tier-II and Tier-III cities. Hiring demand is strongest in e-commerce, logistics, retail and consumer services, as platforms race to scale last-mile delivery, warehousing, packaging and storefront ops ahead of Dussehra–Diwali. Several trackers peg seasonal hiring growth at ~20–25% year-on-year, and note that cities like Bhubaneswar, Surat, Indore and Nagpur are leading the upswing as consumption spreads beyond metros.

What does that mean on the ground? Expect a wave of delivery partners, pickers/packers, merchandisers and customer-support associates on short stints from now through December, with large employers announcing big seasonal intakes to meet peak demand. Staffing firms also highlight the growing influence of quick commerce on hiring curves and a continued “gig-first” tilt in blue- and grey-collar work, even as a subset of workers view festive gigs as pathways to full-time employment. Pay incentives typically rise around peak sale days, but conversion to permanent roles remains selective.

Taken together, the 2025 festive cycle marks a clean break from the stop-start consumption of the past two years. Tax rationalisation landed exactly when shoppers were primed, inflation signals eased just enough to nudge upgrades, and digital rails—from horizontals to quick commerce—have widened and sped up the funnel. The result is a rare “double-peak” season: an early surge seeded by GST 2.0 and opening-day e-commerce spikes, followed by a second crest into Diwali and the wedding months. Autos, large appliances and value-plus fashion are riding this wave; jewellery is the notable outlier, with record bullion prices pushing buyers toward lighter designs and investment SKUs. Mobility and hiring data reinforce the same story—confidence is traveling, and the multiplier is real.

What matters now is execution. Brands that make the tax benefit tangible, keep finance frictionless, and stage inventory and campaigns in two waves are best placed to convert intent into durable market share. Watch the usual tripwires—hero-SKU stockouts, uneven rural cash flows, and late-season price volatility in bullion—but the base case is constructive: a broader, earlier, more digital festive season that carries into November–December. If 2025 is the template, India’s peak consumption moments are no longer a one-week sprint—they’re a programmable quarter.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart