The Petroleum and Natural Gas Regulatory Board (PNGRB) has approved a significant tariff increase for GAIL India's natural gas pipeline network, raising rates by 12 % effective January 1, 2026. This approval comes after months of anticipation and will see the integrated pipeline tariff increase from Rs 58.61 per million British thermal units (mmBtu) to Rs 65.69 per mmBtu. While this represents a notable boost for the state-owned gas transmission company, the increase falls short of GAIL's original request of 33 %, which would have raised tariffs to Rs 79.98 per mmBtu. This comprehensive guide explains what this tariff hike means, why it happened, and what impact it will have on GAIL and the Indian energy sector.

The tariff hike represents an increase of Rs 7.08 per mm/Btu, translating to a 12 % jump from the previous rate. To understand this better, it's important to know that GAIL operates India's largest natural gas pipeline network, spanning over 16,421 kilometers across the country. The company controls approximately 65 % of India's natural gas transmission market and transports gas to power plants, fertilizer units, city gas operators, and industrial consumers nationwide. The tariff GAIL charges customers is essentially the fee they pay to transport natural gas through these pipelines, and any change directly affects the company's revenue and profitability.

According to GAIL's regulatory filing with the stock exchanges, this 12 % increase will have a positive financial impact of approximately Rs 1,200 crore annually. This amounts to a substantial boost for the company's earnings, though it falls significantly short of the Rs 3,400 crore annual benefit that GAIL's Chairman Sandeep Kumar Gupta had estimated would come from the company's original 33 % tariff request made in August 2024.

The tariff revision was necessitated by two primary factors that PNGRB specifically addressed in its decision. The first component involves System Use Gas (SUG), which increased by Rs 5.16 per mmBtu. System Use Gas is the natural gas that GAIL itself consumes to operate its pipeline network, including powering compressors and other operational equipment. The second component is an increase of Rs 1.92 per mmBtu due to lower volume divisor based on the latest capacity assessment. Together, these two factors account for the entire 12 % tariff increase that was approved.

The key driver behind the SUG increase is a significant shift in fuel pricing. When GAIL originally filed its tariff petition, it valued the system use gas at certain price points. However, the Indian government subsequently withdrew its allocation of cheaper domestic gas for system use purposes. This forced GAIL to rely entirely on market-price gas, which currently trades at approximately $10 to $10.50 per mmBtu, significantly higher than the previous subsidized domestic rate of $3.61 per mmBtu. This explains why GAIL's operational costs increased substantially.

Additionally, the exchange rate fluctuations between the Indian rupee and the US dollar played a role. When GAIL filed its petition in 2024, the exchange rate was approximately Rs 83.54 per dollar. These macroeconomic factors contributed to GAIL's higher cost structure, necessitating the tariff increase.

This is a question many investors and industry observers have asked. GAIL's original request for a 33 % tariff increase was based on comprehensive calculations that included not just SUG and capacity adjustments, but also adjustments for operational expenditure (Opex), capital expenditure (Capex), transmission loss, revenue-sharing adjustments, and other regulatory amendments. The company argued that these parameters had significantly changed since the last tariff review in 2019, justifying a substantial revision.

However, PNGRB adopted a "balanced approach" as communicated by the regulator. The board was concerned that approving the full 33 % increase would impose unexpected financial strain on GAIL's customers, including power plants, fertilizer units, and city gas distribution companies. These entities, in turn, would likely need to pass on the cost increases to end consumers, potentially creating affordability challenges across the energy sector.

To manage this transition smoothly, PNGRB decided to provide only interim relief now. This interim adjustment incorporates only the SUG and capacity determination parameters. The regulator has deferred the full review of other parameters—including Opex, Capex, transmission loss, revenue-sharing adjustments, and other regulatory amendments—to the next tariff review scheduled to take effect on April 1, 2028. This means that additional tariff increases are likely coming in 2028 when the comprehensive review occurs, but the immediate shock to the system has been minimized.

One of the disappointments for GAIL regarding this tariff approval was the timing. The company had requested that the tariff increase take effect from January 1, 2025, but the PNGRB approved implementation from January 1, 2026 instead. This one-year delay meant that GAIL will miss out on a full year of higher tariff revenues. By the time the new tariff became effective in January 2026, three quarters of the 2025-26 financial year had already passed. If the tariff had been approved for implementation in January 2025 as requested, GAIL would have captured a full year of higher revenues during the 2025-26 financial year. Instead, the company will only benefit from the tariff increase for one quarter of that fiscal year.

This timing issue was particularly frustrating for GAIL because the company had originally sought approval in April 2025, but regulatory processes took longer than anticipated. The delay reflects the careful deliberation required by PNGRB when making decisions that affect multiple stakeholders across India's energy sector.

The Rs 1,200 crore annual impact represents a meaningful boost to GAIL's profitability. Various brokerages have analyzed this impact with cautious optimism. Citi estimated that this tariff hike would increase GAIL's transmission EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) by approximately 7 to 8 % in fiscal year 2027. Motilal Oswal raised its price target for GAIL shares to Rs 220 after the tariff announcement, citing the positive impact on the company's earnings trajectory.

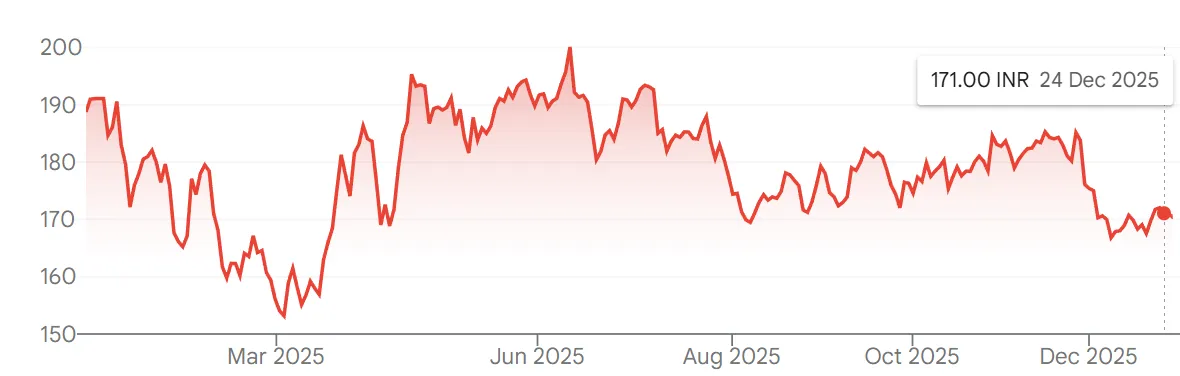

However, when the tariff increase was announced on November 27, 2025, GAIL's stock price fell by approximately 6.3 % on the day, reflecting market disappointment that the increase was lower than expected. Investors had been speculating that GAIL might receive a 15 to 20 % tariff hike, so the 12 % approval was viewed as a letdown. Over time, as the positive earnings impact becomes clearer and additional tariff increases are anticipated for 2028, sentiment has stabilized.

The next major tariff review is scheduled for April 1, 2028, when PNGRB will conduct a comprehensive true-up of all parameters. This will be a full review, not just an interim adjustment. Based on the parameters that were deferred—including Opex adjustments, Capex recognition, transmission loss calculations, and revenue-sharing adjustments—there is significant scope for additional tariff increases in 2028. Industry analysts expect this next review to grant GAIL a substantial additional tariff hike, potentially moving significantly closer to the originally requested 33 % increase or at least providing additional interim relief.

This creates a longer-term positive outlook for GAIL investors, as the company now has a pathway to substantially improved transmission margins over the coming years. The first step of 12 % increase begins the process in January 2026, and the next substantial step is expected in April 2028.

GAIL's tariff increase will have ripple effects across India's energy sector. The company transports gas to approximately two-thirds of the fertilizer sector and around 45 % of gas-based power plants. Any increase in transmission tariffs will eventually be reflected in the cost of gas to these end users. However, because PNGRB approved only an interim increase now, the impact has been moderate compared to what a full 33 % increase would have caused.

Looking at India's natural gas landscape, demand is projected to grow at a compound annual growth rate of 5.33 % from 2025 to 2030, reaching 100.35 thousand mmscm by 2030. This growth will be driven primarily by expanding city gas distribution networks for compressed natural gas (CNG) and piped natural gas (PNG) connections, increased industrial usage, and growing power generation from gas. As India works toward making natural gas 15 % of its primary energy mix by 2030 (up from 7 % in 2024), pipelines like GAIL's will become increasingly critical infrastructure.

One benefit of the tariff approval is regulatory clarity. GAIL and its stakeholders now know that the next tariff review will occur in 2028, providing a medium-term planning horizon. This allows GAIL to develop strategic plans and investments with known tariff parameters, while also giving customers visibility into when future rate changes might occur. For large industrial consumers and utility companies that depend on GAIL's transmission services, this clarity is valuable for their own financial planning.

The PNGRB's decision to implement the tariff increase only from January 2026, and to defer comprehensive review parameters until 2028, represents a cautious but forward-thinking regulatory approach. It balances GAIL's need for revenue growth to fund pipeline expansion with the concerns of customers and downstream consumers about sudden and sharp increases in energy costs.

GAIL India's tariff hike of 12 %, effective January 1, 2026, represents a significant but not complete victory for the state-owned transmission company. While the Rs 1,200 crore annual impact will meaningfully improve GAIL's earnings and provide a boost to shareholders, the tariff fell short of the company's ambitious 33 % request. However, the approval includes a clear pathway for additional tariff increases through a comprehensive review in 2028, when PNGRB will reassess all parameters that were deferred in this interim decision.

For investors, this tariff increase provides medium-term earnings support and improved visibility into GAIL's revenue growth. For India's broader energy sector, it signals PNGRB's commitment to ensuring that critical transmission infrastructure like GAIL's pipelines remain financially healthy while managing the impact on downstream consumers. As India transitions toward a more gas-dependent energy mix and expands city gas networks across the country, reliable and well-funded transmission infrastructure will be essential. This tariff increase, while smaller than hoped, represents an important step in that direction.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart