In an extraordinary turn of events that has sent shockwaves through Silicon Valley and beyond, news emerged of a "trade deal" unlike anything we've witnessed before in modern American commerce. Nvidia and AMD, two of the world's most valuable technology companies, have agreed to hand over 15% of their revenue from chip sales in China to the U.S. government in exchange for the removal of export controls. This unprecedented arrangement has corporate boardrooms across America in full panic mode and for good reason.

This isn't just another trade negotiation or tariff adjustment. This represents a fundamental shift in how the U.S. government approaches international commerce, national security, and corporate relationships. The implications of this deal extend far beyond the semiconductor industry, potentially setting a dangerous precedent that could reshape global business forever.

The roots of this controversial agreement trace back to October 2022, when the Biden administration first imposed sweeping export controls on advanced semiconductors destined for China. These restrictions were designed to prevent China from accessing cutting-edge AI and computing technology that could enhance its military capabilities or give it a strategic advantage in the global technology race.

However, these controls came with a massive cost. Nvidia alone lost $2.5 billion in quarterly revenue when the Trump administration tightened restrictions on H20 chip exports to China in April 2025. For a company that generated $17 billion from China in fiscal 2024 – representing 13% of its total revenue , this was a devastating blow.

AMD faced similar challenges, with China representing $6.2 billion in revenue in 2024, accounting for 24% of its total revenue. The combined impact on both companies was staggering, with investors and analysts questioning whether American tech companies could maintain their competitive edge while being locked out of the world's second-largest economy.

Key Events in US-China Chip Controls

Year | Event | Impact |

2018 | US bans Huawei and ZTE from telecom infrastructure | Fuels Chinese push for self-sufficiency in semiconductors |

2020 | Trump administration blacklists SMIC and more Chinese firms | Begins US clampdown on China's chip supply access |

2022 | Sweeping US export controls on advanced AI/GPU chips | Slashes US chip exports to China, revenue declines |

2024 | Nvidia, AMD revenue from China drops after H20 chip ban | Billions lost in quarterly sales |

Aug 2025 | 15% Revenue-sharing deal for Nvidia and AMD China sales | US Treasury to receive estimated $3.5B/year; export rules relaxed |

The turning point came during a pivotal meeting between President Trump and Nvidia CEO Jensen Huang at the White House. According to Trump's own account, the negotiation was remarkably direct: "I said, 'Listen, I want 20% if I'm going to approve this for you,'" Trump revealed at a White House press conference. Huang successfully negotiated that figure down to 15%, but the principle was established - access to the Chinese market would come at a price paid directly to the U.S. government.

This negotiation represents more than just a business deal; it's a fundamental redefinition of the relationship between the U.S. government and American corporations operating in global markets.

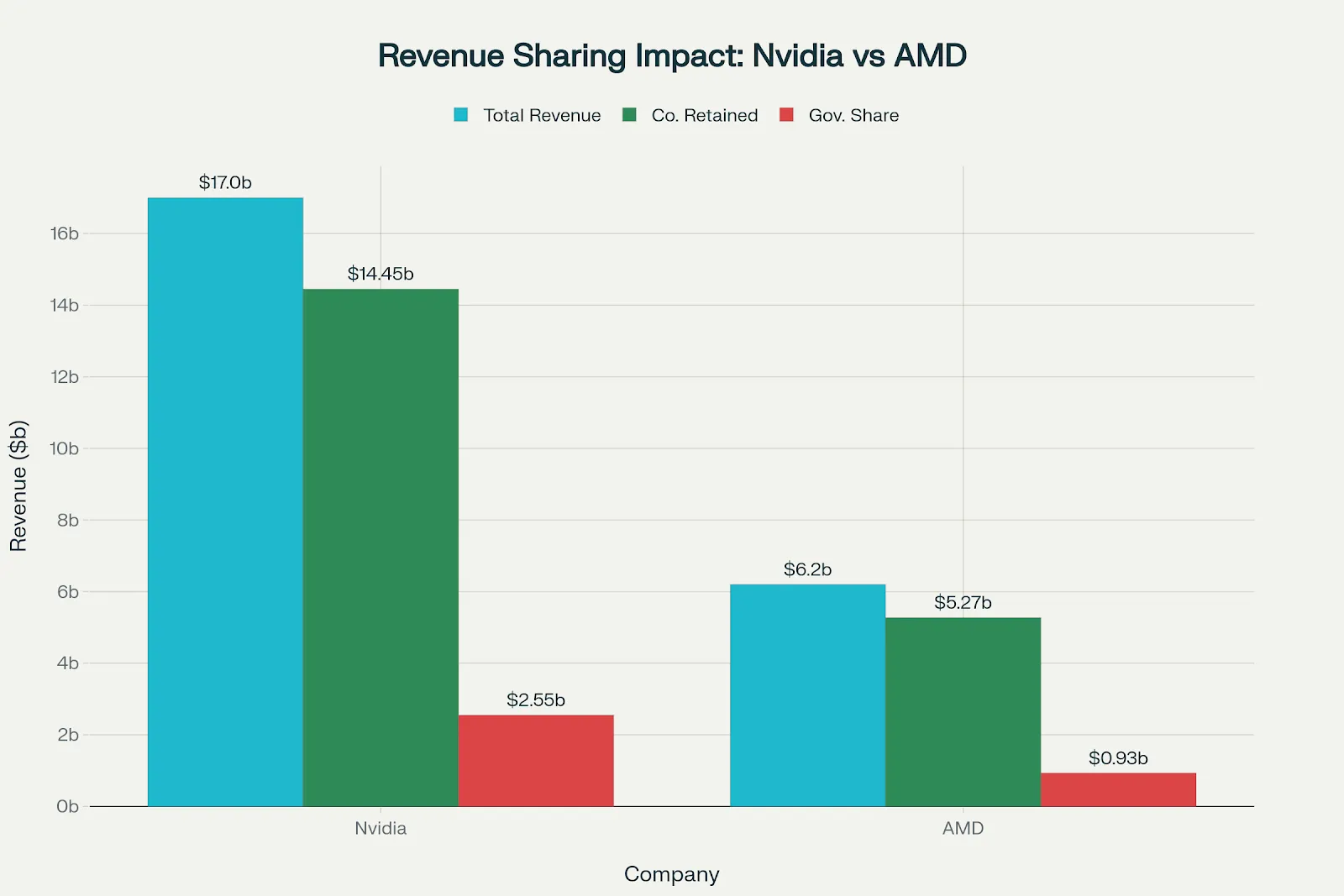

The financial implications of this arrangement are staggering when viewed in concrete terms:

Nvidia's Financial Impact:

Total China revenue (2024): $17 billion

15% government share: $2.55 billion annually

Retained revenue: $14.45 billion

AMD's Financial Impact:

Total China revenue (2024): $6.2 billion

15% government share: $930 million annually

Retained revenue: $5.27 billion

Combined, these two companies alone will funnel approximately $3.48 billion annually into U.S. government that represents a completely new revenue stream for the Treasury Department.

The Broader Market Context

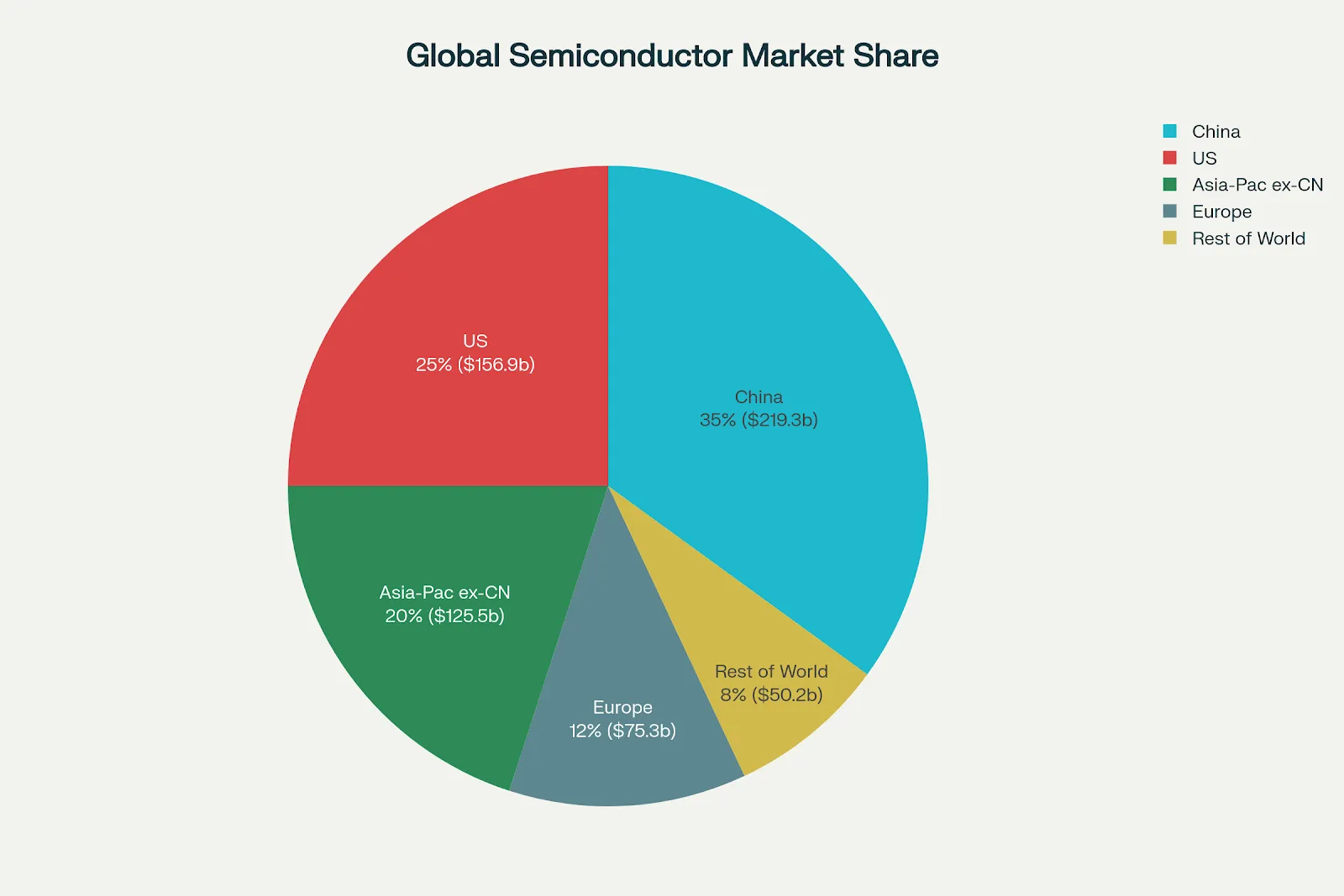

To understand the magnitude of this deal, it's crucial to recognize China's position in the global semiconductor market. China represents a massive portion of global demand, making access to this market essential for any company seeking to maintain global competitiveness.

Global Semiconductor Market Share by Region (2024)

The global semiconductor market reached $627.6 billion in 2024, representing a 19.1% increase from the previous year. With China commanding such a significant portion of this market, being locked out represents an existential threat to American semiconductor companies.

The corporate panic extends far beyond Nvidia and AMD. Industry leaders across multiple sectors are asking a terrifying question: Are we next? Treasury Secretary Scott Bessent has already suggested that this arrangement could serve as a "model, beta test" for other industries, sending chills through executive suites nationwide.

Top US Companies Most Exposed to China (by % Revenue)

Sector | US Market Leaders | China Revenue Exposure (%) |

Tech Hardware | Apple, Dell, HP | 15-20% |

EVs/Automotive | Tesla, GM | 10-25% |

Pharmaceuticals | Pfizer, J&J | 7-11% |

Cloud/Software | Microsoft, Google | 7-18% |

Aerospace | Boeing | 22% |

Consider the implications:

Apple, which generated over $100 billion from China in recent years, could face similar demands

Tesla, with significant Chinese operations, might be subjected to comparable arrangements

Boeing, Microsoft, Google – virtually any American company with substantial Chinese business could become targets

The legality of these arrangements remains murky at best. White House Press Secretary Karoline Leavitt admitted that "the legality of it, the mechanics of it, is still being ironed out by the Department of Commerce". This uncertainty creates a nightmarish scenario for corporate legal departments trying to plan for compliance and risk management.

Legal experts have raised fundamental questions about the government's authority to essentially tax private commercial transactions as a condition for export licenses. Rep. Raja Krishnamoorthi (D-Ill.) captured the concern perfectly: "By putting a price on our security concerns, we signal to China and our allies that American national security principles are negotiable for the right fee".

From an operational standpoint, this deal creates unprecedented complexities:

Financial Planning Chaos: Companies must now factor government revenue shares into their pricing strategies, margin calculations, and investor projections.

Competitive Disadvantages: The 15% revenue share effectively increases the cost of American products in Chinese markets, potentially making them less competitive against domestic Chinese alternatives.

Supply Chain Disruptions: The uncertainty surrounding these arrangements makes long-term supply chain planning nearly impossible.

China has not remained passive in the face of this arrangement. The Chinese government has already begun actively discouraging local firms from using Nvidia's H20 chips, particularly for national security-related work. This response represents a direct challenge to the effectiveness of Trump's strategy.

More concerning for American companies, China has begun asking domestic firms to justify why they purchase American chips over domestic alternatives from companies like Huawei. This pressure campaign could significantly reduce demand for American products, potentially making Trump's revenue-sharing arrangement less valuable than anticipated.

This deal represents a significant escalation in the ongoing U.S.-China technology competition. Rather than maintaining a clear separation between commercial interests and national security concerns, the arrangement explicitly monetizes security restrictions.

The DeepSeek Factor: The controversy intensified when it was revealed that Nvidia's H20 chips were used in developing Chinese company DeepSeek's advanced AI model, which surprised U.S. officials with its sophistication. This development raised questions about whether the restrictions were effective and whether allowing chip sales for a fee undermines their security purpose.

The deal specifically covers Nvidia's H20 chip and AMD's MI308 processor both designed as "compliance versions" of more advanced chips to meet U.S. export restrictions while still serving the Chinese market.

Nvidia H20 Specifications:

Deliberately slowed-down version of advanced AI chips

Designed specifically for Chinese market compliance

Used in cloud computing and AI model development

Annual sales potential: $15+ billion

AMD MI308 Details:

AI processor tailored for Chinese compliance requirements

Reduced capabilities compared to advanced Western versions

Annual sales potential: $800 million

Trump characterized these chips as "essentially old" and "obsolete," yet acknowledged they "still have a market". This contradiction highlights the complex nature of technology restrictions in a rapidly evolving industry.

Industry analysts like Bernstein's Stacy Rasgon have characterized this arrangement as a "very slippery slope". The fundamental question is whether the U.S. government is now in the business of selling export control licenses to the highest bidder.

Owen Tedford, a senior research analyst at Beacon Policy Advisors, summarized the broader concern: "It raises questions about how policy feels like it's for sale in some ways, like policy outcomes. If companies are big enough or strong enough, they can basically buy the policy that they want from the Trump Administration".

The revenue-sharing requirement fundamentally alters the economics of innovation in the semiconductor industry. Companies depend on profits from current-generation products to fund research and development for next-generation technologies. When 15% of revenue from a major market is redirected to government coffers, it directly impacts companies' ability to invest in future innovation.

This could have particularly severe consequences for smaller companies that lack the financial reserves of giants like Nvidia and AMD. The arrangement essentially creates a two-tiered system where only the largest corporations can afford to pay for market access.

Companies worldwide are now reassessing their supply chain strategies in light of this precedent. The possibility that any major market could suddenly become subject to government revenue-sharing requirements creates massive uncertainty for international business planning.

European companies are particularly concerned about potential similar arrangements being imposed on their access to American markets. Asian companies are questioning whether they should reduce dependence on American suppliers who might face unpredictable government taxation of their international sales.

Based on current market analysis, the financial impact of this deal extends beyond just the immediate 15% revenue share:

Nvidia's Projected Impact:

Expected H20 sales to China (2025): $15 billion

Government share: $2.25 billion

Potential margin reduction: 5-15 percentage points

Stock price volatility: Significant uncertainty

AMD's Projected Impact:

Expected MI308 sales to China (2025): $800 million

Government share: $120 million

Margin impact: Reduction from 30% to 15%

Competitive positioning: Potentially compromised

The global semiconductor market's trajectory adds urgency to these concerns. With the market projected to reach $1.2 trillion by 2034, access to major markets like China becomes increasingly critical for companies seeking to maintain their competitive positions.

Key Market Data:

2024 global semiconductor sales: $627.6 billion

Projected 2025 growth: 11% year-over-year

China's market share: 35% of global demand

U.S. companies' dependence on China sales: Critical for major players

U.S. allies are watching this development with considerable concern, as it could set precedents for their own trade relationships:

European Union: Officials have expressed worry that similar arrangements could be imposed on European companies' access to American markets.

Japan and South Korea: Key semiconductor allies are reassessing their technology-sharing agreements with the United States.

Taiwan: As a critical semiconductor manufacturing hub, Taiwan is particularly concerned about potential disruptions to established trade relationships.

China's response to this arrangement has been multifaceted and strategically calculated:

Domestic Industry Support: Increased government funding for domestic semiconductor development to reduce dependence on American technology.

Supply Chain Reorientation: Active efforts to help Chinese companies transition away from American suppliers.

Retaliatory Measures: Potential development of similar arrangements for Chinese market access by foreign companies.

Year | Chip Demand (China, $B) | Domestic Production ($B) | Import Dependency (%) |

2022 | $186 | $33 | 82% |

2025 | $219 (est.) | $56 (est.) | 74% (est.) |

China’s Semiconductor Demand vs. Domestic Production

The Nvidia-AMD revenue-sharing deal represents more than just another trade agreement – it signals the emergence of a fundamentally new approach to balancing commercial interests with national security concerns. By monetizing security restrictions, the U.S. government has crossed a Rubicon that cannot be uncrossed.

For corporate America, this deal represents a wake-up call about the evolving relationship between business and government in an increasingly complex geopolitical environment. The traditional separation between commercial transactions and government policy has been fundamentally altered, creating new risks and uncertainties that will require entirely new approaches to international business strategy.

The $3.48 billion in annual revenue that Nvidia and AMD will generate for the U.S. government is significant, but the precedent this sets is far more valuable and dangerous than any single payment. As Treasury Secretary Bessent suggested, this could indeed be a "beta test" for a new model of international commerce where market access is explicitly priced and sold by governments.

The corporate panic is justified. This deal doesn't just affect two semiconductor companies it potentially reshapes the fundamental rules of global business. Companies across all industries must now plan for a world where market access could suddenly become subject to government taxation, where commercial success could be held hostage to political negotiations, and where the line between private enterprise and state control continues to blur.

As we move forward, the business community must grapple with a central question: In an era where national security and commercial interests are increasingly intertwined, what price are we willing to pay for the privilege of doing business globally? The answer to that question will shape the future of international commerce for decades to come.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart