by Abhishek Banerjee, Siddharth Singh Bhaisora

Published On June 23, 2024

In the world of investing, there are many ways for one to achieve greater than average returns. Contrarian investing is one of these strategies to profit from imperfect knowledge of other investors. This strategy is based on the idea that one should not follow what everyone else in the market is thinking but go against it. Contrarian investing involves buying securities that have been performing poorly and disposing of those that are doing well. Though this might seem bizarre to some people; it’s rooted in libertarianism and assumes that markets often overreact to news thereby leaving room for astute investors.

So is contrarian investing more than just a fool’s errand? We explore the ideas of the strategy and some of the best examples of Contrarian Investing in this article.

At its core, contrary investing thinks there is more profit to be made by not going with the flow. So this means that this method calls for exploitation of such emotional reactions caused inefficiencies as well as information asymmetry among investors. A situation in which the majority make choices based on partial or wrong knowledge presents an opportunity for contrarians to profit because they base their decisions on an elaborate analysis rather than emotions or gut feelings about the market.

One of the most famous aficionados of the contrarian strategy is none other than billionaire investor and Berkshire Hathaway chairman and CEO Warren Buffett.

Unfortunately, market movements of most people are significantly influenced by emotions and behaviours.These emotions can result in irrational decisions from investors. Sometimes, when markets are on a decline fear often leads to panic selling thus making stock prices fall below their intrinsic value. However, Contrarian investors would see this as an opportunity to purchase undervalued stocks.

During bull markets, over-exuberant buying can drive prices above their intrinsic value. In such scenarios, contrarian investors may opt to sell, anticipating a market correction. The psychology behind contrarian investing involves maintaining rationality amidst the emotional behaviour of other investors.

Contrarian investing is an age-old concept. It traces its roots back all the way to Benjamin Graham who is seen as the father of value investment. In his seminal book “The Intelligent Investor,” Graham showed how important it was to buy underpriced stocks and take a long term view of investing. His principles established the basis for contrarian investing.

Notable investors like Warren Buffett and John Templeton have also embraced contrarian strategies. Buffett's famous adage, "Be fearful when others are greedy and greedy when others are fearful," encapsulates the essence of contrarian investing and has been reiterated numerous times over the years. Templeton, on the other hand, built his fortune by buying stocks during times of market pessimism.

1. Market Inefficiencies: Contrarians believe that markets are not always efficient and that prices can deviate from their true value. This deviation creates opportunities for profit.

2. Long-Term Perspective: Contrarian investing requires patience. It may take time for the market to recognize and correct asset prices.

3. Research and Analysis: Thorough research and fundamental analysis are crucial. Contrarians need to distinguish between temporarily undervalued stocks and those with genuine long-term potential.

4. Emotional Discipline: Contrarian investors must remain disciplined and not be swayed by market sentiment. This requires a strong understanding of one's investment philosophy and the ability to stick to it.

1. Market Extremes: Look for extremes in market sentiment. During periods of extreme pessimism or optimism, opportunities often arise. Tools like the VIX (Volatility Index) can help gauge market sentiment.

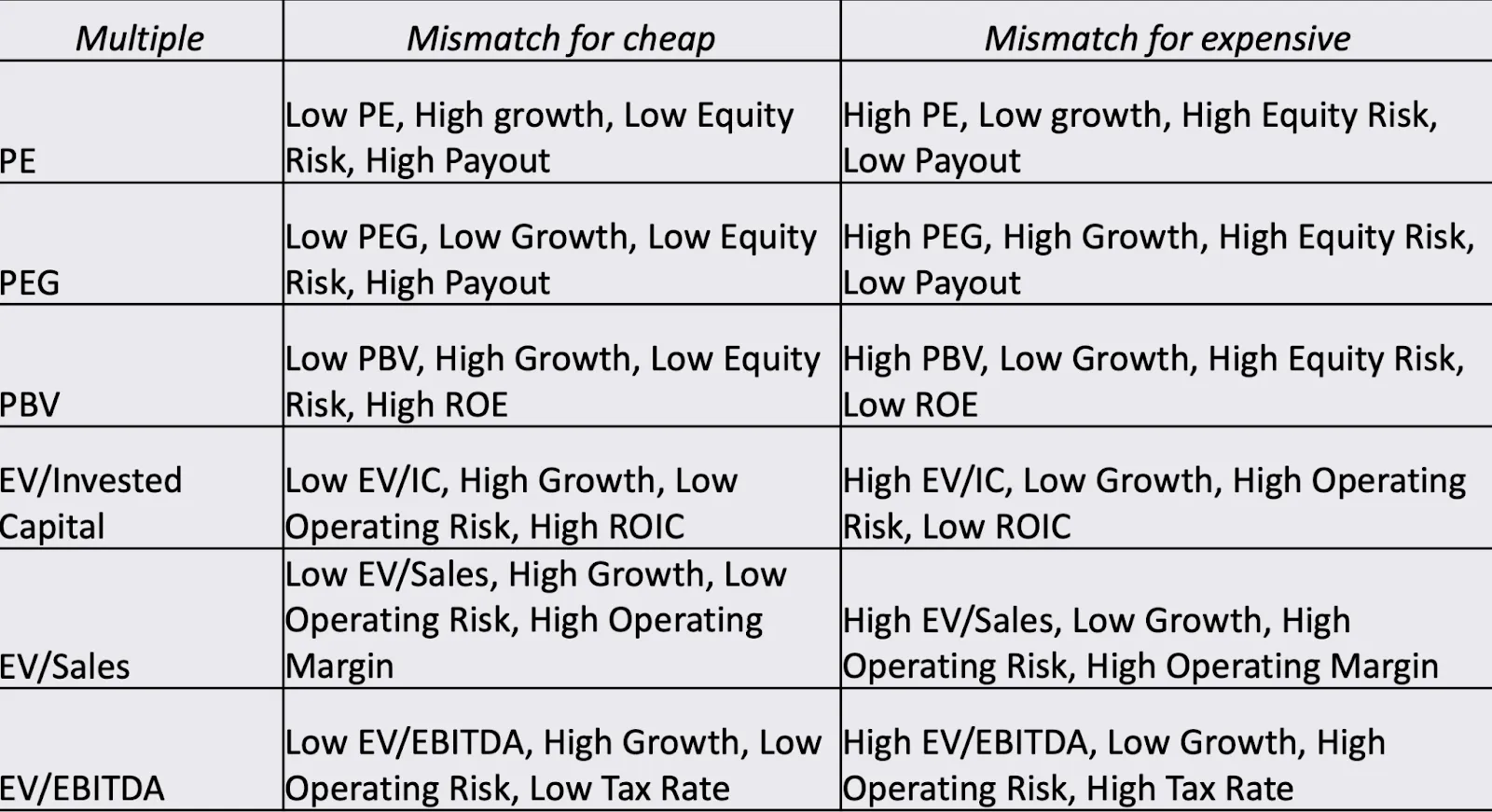

2. Undervalued Stocks: Use fundamental analysis to identify undervalued stocks. Metrics such as price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and dividend yield can provide insights into a stock's value.

3. Contrarian Indicators: Pay attention to contrarian indicators like high short interest or low analyst ratings. These can signal potential opportunities.

1. Diversification: Diversify your portfolio to manage risk. Contrarian investments can be volatile, and diversification helps mitigate potential losses.

2. Risk Management: Set clear risk management strategies. Determine your risk tolerance and consider setting stop-loss orders to protect against significant losses.

3. Patience and Timing: Timing is crucial in contrarian investing. Be patient and wait for the right opportunities. Avoid rushing into investments without thorough analysis.

1. John Templeton's Success: During the Great Depression, John Templeton bought shares in every company listed on the New York Stock Exchange that was trading below $1. This bold move paid off as many of these companies recovered, leading to substantial profits.

2. Warren Buffett's Investments: Warren Buffett's investment in American Express during the 1960s "salad oil scandal" is a classic example of contrarian investing. Despite the negative sentiment, Buffett recognized the company's strong fundamentals and invested heavily, resulting in significant gains.

3. The Financial Crisis of 2008: During the 2008 financial crisis, most investors panicked and sold their stocks. Contrarian investors who bought during this period reaped substantial rewards as the market eventually recovered.

Michael Burry, a hedge fund manager at Scion Capital, became famous for his contrarian trading strategy during the 2008 financial crisis. His approach was based on detailed analysis and a strong belief that the housing market was heading for a massive collapse. Here’s an in-depth look at his strategy:

Burry's background as a doctor gave him a unique, analytical perspective on financial markets. He meticulously examined the housing market data and mortgage-backed securities (MBS). His analysis revealed several key insights:

Home prices had been increasing at an unsustainable rate.

Banks were issuing subprime mortgages to borrowers with poor credit histories.

Many mortgages had adjustable rates, which would reset at higher rates, leading to increased defaults.

The loan-to-value ratios were deteriorating, and borrowers were not being adequately vetted.

Burry concluded that the housing market was a bubble set to burst. To profit from this insight, he turned to the credit default swap market. CDS are financial derivatives that function like insurance contracts against the default of a debt instrument. Here’s how Burry used them:

Burry purchased CDS on MBS. Essentially, he was buying insurance against the default of mortgage bonds, betting that these securities would lose value.

For these CDS, Burry had to pay premiums. His bet was that the eventual payout would far exceed these costs.

Burry faced significant resistance from his investors and other financial institutions. His approach was highly unconventional and went against the prevailing market sentiment. Key points include:

Investors were initially unhappy because they were paying premiums for these CDS, which reduced short-term returns.

Despite the pressure, Burry remained confident in his analysis and stuck to his strategy.

One of the critical aspects of Burry’s strategy was his patience. He knew that timing the market precisely was nearly impossible, but he had strong conviction in his analysis:

Initially, Burry’s fund suffered as the housing market continued to rise and the premiums on the CDS ate into returns.

Burry had to manage the fund carefully to ensure they could continue paying the premiums until the market turned.

When the housing market finally collapsed, defaults on subprime mortgages skyrocketed, leading to:

The value of the CDS soared as the securities they insured against defaulted. Burry’s fund made billions of dollars.

Burry’s contrarian bet paid off, proving his analysis correct.

Burry’s strategy during the financial crisis had several lasting impacts:

His actions helped highlight the significant flaws in the mortgage and financial markets.

Burry’s success has inspired other investors to conduct thorough, independent analyses and not be swayed by market sentiments.

His story was prominently featured in Michael Lewis’s book “The Big Short” and the subsequent film adaptation, bringing wider attention to his achievements.

Burry’s willingness to go against the crowd was crucial. He didn’t rely on prevailing market sentiments but trusted his detailed analysis.

His extensive research into mortgage-backed securities and the housing market provided the foundation for his strategy.

Despite taking a massive bet, Burry carefully managed the fund’s liquidity to ensure they could maintain their positions.

His ability to withstand short-term losses and investor pressure underscored the importance of patience and conviction in a well-researched investment thesis.

Michael Burry’s contrarian strategy during the 2008 financial crisis remains a profound example of the power of independent thinking and rigorous analysis in financial markets.

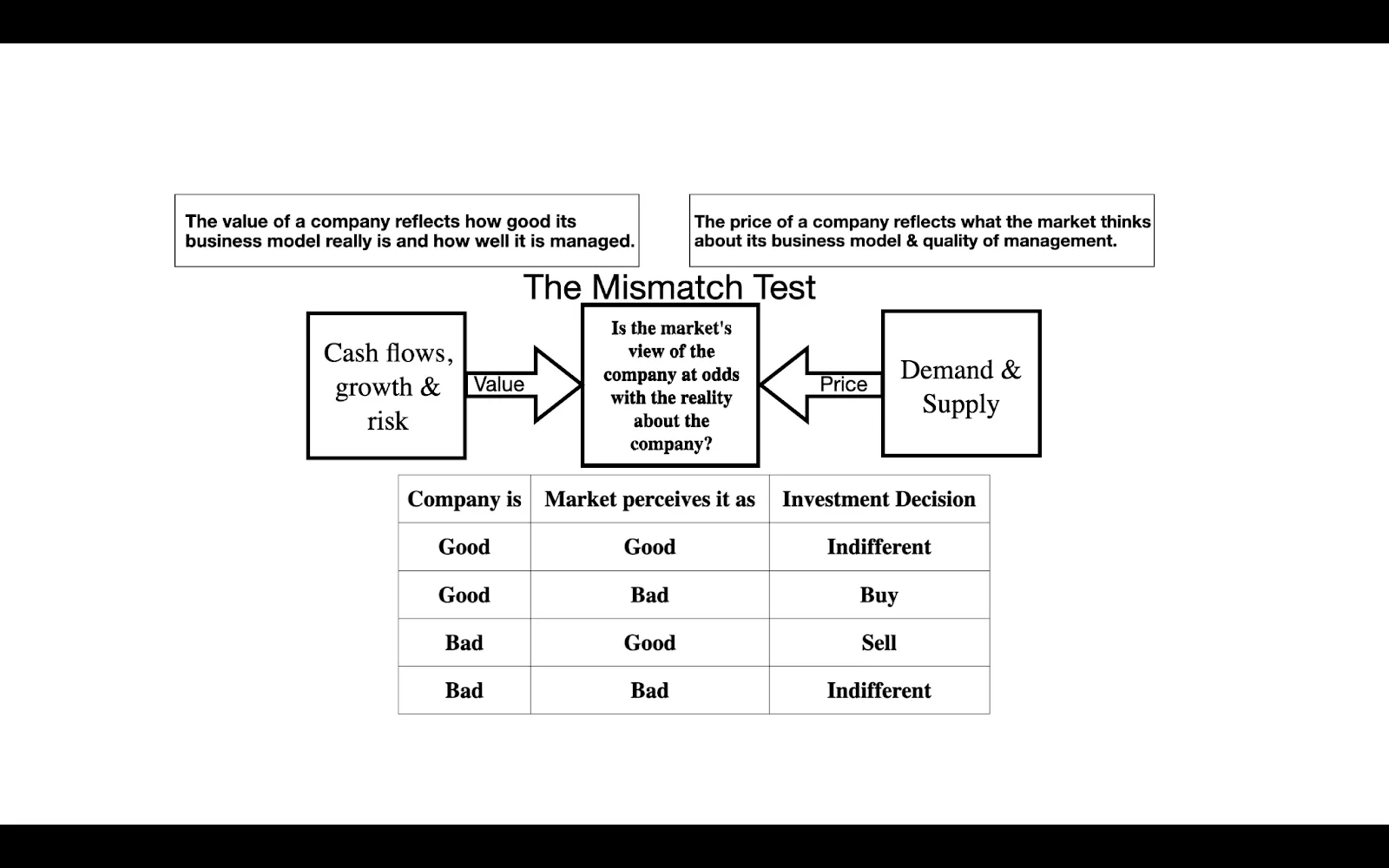

As per Aswath Damodaran, who is a professor at New York University and is affectionately known as the ‘Dean of Valuation’, a more refined version of contrarian investing is looking for companies whose stock prices have dropped more than their fundamentals suggest. This may happen due to reasons we mentioned above like emotionally charged investors, market crisis, sector wide reforms.

Source: Aswath Damodaran’s Notes on Value Investing: The Contrarians

We turn to companies in crisis, whose market prices have usually dropped in the time frame prior to our assessments. After this we update the fundamentals to reflect what we learned about the company. We then compare this to the pricing of the company to see if it is cheap with the updated valuation.

Source: Aswath Damodaran’s Notes on Value Investing: The Contrarians

Stocks that have taken a beating but hold potential for recovery include Ujjivan Small Finance Bank. This is due to its low P/E ratio, suggesting that the market might be undervaluing it, coupled with stable quarterly profits that show little variation. On the other hand, Eureka Forbes sports a high P/E ratio but significantly more variability in quarterly profits, which could indicate that it is currently overvalued by market standards.

Analysing stock fundamentals is a crucial aspect of contrarian investing, enabling investors to make informed and strategic decisions.

Aswath Damodaran’s views on contrarian investing highlight a balanced approach. He believes that while contrarian strategies can be highly profitable, they must be grounded in fundamental analysis, a keen understanding of market inefficiencies, and behavioral finance principles.

Efficient Market Hypothesis (EMH): Damodaran discusses the efficient market hypothesis, which suggests that asset prices reflect all available information. He notes that while markets are generally efficient, there are pockets of inefficiency where contrarian strategies can be profitable.

Exploiting Inefficiencies: He argues that contrarian investors seek to exploit these inefficiencies. This requires patience and thorough research, as market corrections can take time.

Investor Psychology: Damodaran incorporates concepts from behavioral finance, acknowledging that markets are influenced by investor psychology. Emotions like fear and greed can drive prices away from their intrinsic value.

Capitalizing on Behavioral Biases: Contrarian investors can benefit by recognizing and capitalizing on these biases. For instance, during market panics, contrarians might find undervalued stocks due to widespread fear.

Understanding Risk: Damodaran emphasizes the importance of understanding and managing risk in contrarian investing. Because contrarians often go against the grain, they must be prepared for potential short-term losses and volatility.

Diversification: He advocates for diversification to manage risk. While betting against the crowd can be profitable, spreading investments across various assets can mitigate the risk of being wrong.

Patience and Time Horizon: Damodaran highlights that successful contrarian investing often requires a long-term perspective. Markets can remain irrational longer than investors can stay solvent, so patience is crucial.

Consistent Strategy: He suggests that contrarian investors maintain a consistent strategy, backed by solid analysis, and not be swayed by short-term market movements.

Historical Context: Damodaran often refers to historical market anomalies and case studies where contrarian investing has paid off. He uses these examples to illustrate the practical application of contrarian principles.

Learning from Mistakes: He also stresses the importance of learning from past mistakes. Not all contrarian bets will succeed, so analyzing failures can provide valuable lessons for future investments.

Not for Everyone: Damodaran acknowledges that contrarian investing is not suitable for all investors. It requires a strong stomach for volatility and a willingness to stand alone against prevailing market trends.

In-depth Knowledge Required: He warns that contrarian investing demands a deep understanding of the markets and the specific assets being considered. Superficial analysis can lead to significant losses.

1. Timing Challenges: One of the most significant limitations of contrarian investing is the difficulty of timing the market correctly. Identifying undervalued assets and predicting when they will rebound is challenging. The market may remain irrational longer than expected, leading to prolonged periods of underperformance for contrarian positions.

2. Emotional Resilience: Contrarian investing requires a high level of emotional resilience. Going against the crowd and maintaining positions during market downturns can be psychologically taxing. Investors must withstand negative sentiment and remain confident in their analysis, which can be challenging during extended periods of market pessimism.

3. Potential for Misjudgment: There is always a risk of misjudging the intrinsic value of a stock or asset. What appears to be undervalued might be facing structural issues that the investor has overlooked. If the underlying fundamentals do not improve, the investment may not yield the expected returns, leading to potential losses.

4. Liquidity and Volatility Risks: Contrarian investments usually involve buying into less popular assets, which may be more volatile and less liquid than more widely held securities. This lack of liquidity can make it difficult to exit positions without significantly impacting the price. Volatility can also lead to large short-term losses, requiring a strong stomach and long-term perspective to weather the ups and downs.

By capitalising on market inefficiencies and the emotional reactions of other investors, contrarian investors can spot undervalued opportunities and avoid overhyped risks. Nevertheless, one should be patient, thoroughly research on any idea before putting money into it as well as have the ability to withstand psychological pressures. This approach has been demonstrated by the successes of legendary investors like Warren Buffet and John Templeton; thus, there exists potential for substantial returns.

Contrarian investing is far from a fool's errand; it is a robust and time-tested strategy that leverages the fundamental principles of market psychology and rational analysis.It is therefore important that every investor embrace a disciplined and independent mindset in order to successfully navigate through the intricacies of investing in financial markets. Contrarian investing calls for thinking differently, acting decisively, and having courage to go against market trends. By doing so, contrarian investors prove that sometimes what others see as risk is opportunity while what they view as opportunity is actually risk. Hence contrarian investing is not merely a gamble against the crowd but a calculated strategy founded upon the notion that markets often misprice assets thereby giving smart speculators an edge.

Read this article Smallcaps learnings from Great Investors: Warren Buffett, Peter Lynch & Michael Burry

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

Get full access by signing up to explore all our tools, portfolios & even start investing right after sign-up.

Oops your are not registered ! let's get started.

Please read these important guidelines

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions

Sign-Up Using

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Skip & use OTP to login to your account.

Your account is ready. Discover the future of investing.

Login to start investing on your perfect portfolio

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Login to start investing with your perfect portfolio

Forgot Password ?

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Your account is ready. Discover the future of investing.

By logging in, you agree to our Terms & Conditions

SEBI Registered Portfolio Manager: INP000007979 , SEBI Registered Investment Advisor: INA100015717

Tell us your investment preferences to find your recommended portfolios.

Choose one option

Choose multiple option

Choose one option

Choose one option

Choose multiple option

/100

Investor Profile Score

Congratulations ! 🎉 on completing your investment preferences.

We have handpicked some portfolios just for you on the basis of investor profile score.

View Recommended Portfolios