by Naman Agarwal

Published On Aug. 24, 2025

India’s equity market entered the new fiscal year facing a finely balanced combination of tail-winds and head-winds. Disinflation, a tentative recovery in rural demand, a once-in-a-decade proposal to rationalise the Goods and Services Tax structure and the largest public-sector capex push in modern Indian history are creating an environment in which corporate earnings could finally re-accelerate after 4 quarters. If enacted before Diwali, this could reduce prices in several mass categories and pull forward demand into the festive quarter.

Yet those positives are offset by the most expensive large-cap valuations in six years, continued uncertainty around United States trade tariffs, a still-elusive broad-based private investment cycle and early evidence that credit costs are starting to normalise upwards in retail banking. The next two or three quarters will therefore function as a “moment of truth”, in which the competing narratives of optimism and over valuation will be debatable.

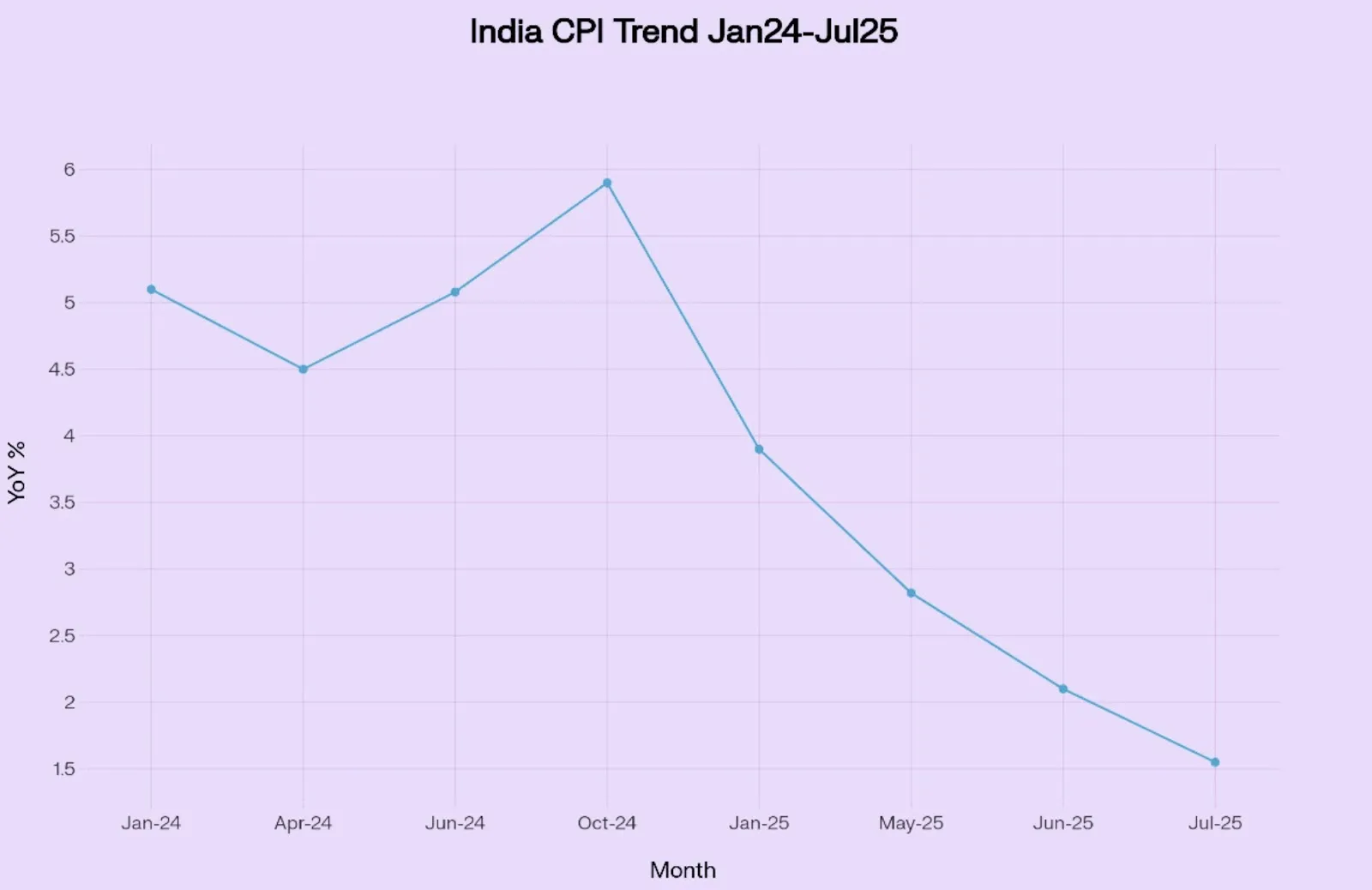

The macro narrative starts with the speed and breadth of India’s disinflation. Consumer-price inflation has dropped from well above RBI’s 4% target in early 2024 to just 1.55% by mid-2025 as food prices stabilised and global commodity prices corrected, aided by a near-record kharif harvest and a strengthening rupee. That trajectory is captured visually in the panel below, where the steep decline in headline CPI creates space for an easing cycle in the second half of the year.

Source: MoSPI

Retail inflation has fallen sharply below the RBI’s 4% target, giving policymakers room to cut rates. A steady policy rate into the festive quarter helps EMIs and keeps financing cost headwinds contained for durables, two-wheelers, entry cars, and housing-adjacent spends.

Disinflation is intersecting with an aggressively front-loaded fiscal stance. The Centre’s capital outlay jumped 36% year-on-year in the June quarter and state-government capex rose 29%, ensuring that the public sector remains the principal engine of fixed-investment growth while the corporate sector waits for capacity utilisation to rise above 76%. Crucially, the willingness to spend has not compromised fiscal discipline: the fiscal deficit remains anchored at 5.1 % of GDP and the Centre has stuck to a glide path that brings the gap below 4% by FY28.

The IMD expects normal to above normal rainfall for Aug to Sep at the all India level. This is useful for rural incomes via agri output, even if regional variability persists. Better kharif outcomes typically spill over into a healthy Oct to Dec (festive) consumption cadence.

Finally, the external backdrop is less threatening than in 2022-23. Brent crude is trading near US $72 per barrel, well below the range that triggers automatic margin pressure for downstream energy companies. At the same time the Reserve Bank’s foreign-exchange reserves have climbed past US $660 billion, giving the rupee an extra buffer against exogenous shocks. Together these factors underpin a macro narrative that is as constructive as at any point in the past four years, notwithstanding the perennial risk from geopolitics.

Among the milestones that could transform domestic demand in FY26, none is more immediate than the pending decision to collapse India’s four-rate GST structure into a cleaner and potentially more pro-consumption matrix of two principal rates.

The proposed reform pushes toward two core rates (5% and 18%), with a higher rate for sin/luxury items. The stated intention: simplify slabs, cut prices meaningfully in mass categories, and boost demand ahead of Diwali. Government messaging plus media reporting suggests multiple GST Council touchpoints before the festive season, aiming to lock reforms by October 2025.

What could shift where (illustrative):

12% to 5% moves in processed foods, footwear (sub ₹1,000), certain wellness/Ayurveda items would directly reduce shelf prices and encourage trade up from unbranded to branded.

28% to 18% in select durables (e.g. ACs/ large TVs) would drop sticker prices ~8% and spur penetration in Tier-2/3 India.

Cement at 28% today, any cut would ease project/B2C costs and indirectly support home improvement cycles.

Cigarettes/ aerated beverages likely see higher explicit rates or continued cess, limiting any benefit there and possibly offsetting some revenue loss from general cuts.

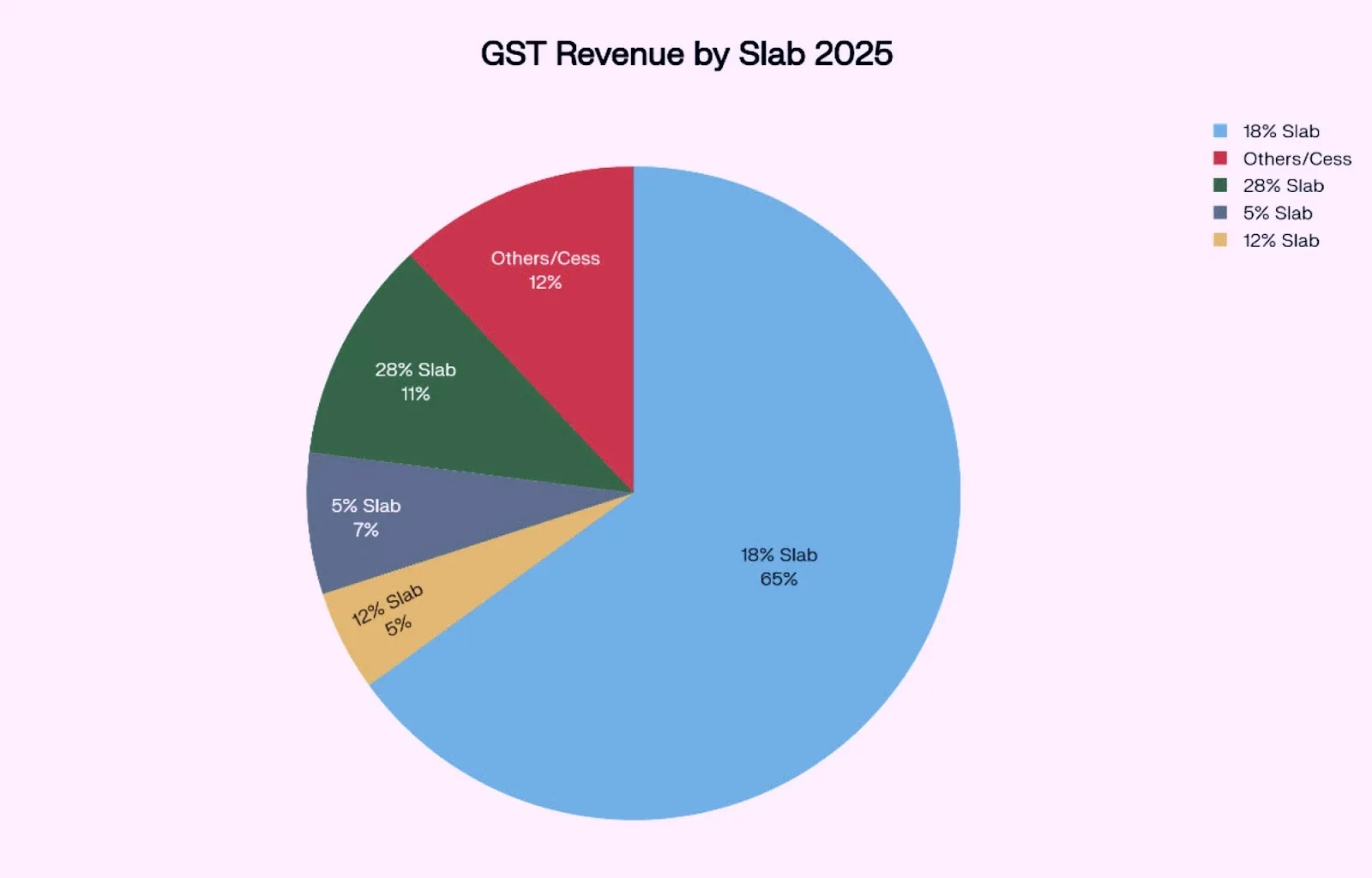

To appreciate the stakes one must recognise how concentrated GST revenues already are. Three-quarters of all GST collections originate in the 18% slab, while essentials taxed at 5% and intermediates at 12% contribute barely twelve % of the pool. Rationalisation therefore forces the Council to weigh consumption elasticity against near-term revenue loss.

Source: Deccan Herald

GST revenue is overwhelmingly concentrated in the 18% slab, highlighting the stakes of rationalisation. A straightforward elimination of the 12 % slab by reallocating ninety % of those items to the 5 % category would reduce annual GST collections by only 1.3 %, an easily manageable hit that is likely to be recouped within twelve months through buoyant spending. By contrast, merging the 12 % and 18 % slabs into a new 15 % rate would risk a 7.3 % revenue shortfall, a materially tougher ask for the fiscal math.

A little noticed ancillary of GST 2.0 is its potential to solve long-running inverted-duty anomalies. Processed foods that currently pay 18 % tax on inputs such as palm oil but only 12 % on outputs could shift exclusively to 5 %, restoring neutrality, widening branded penetration and reducing working-capital locks. The same mechanics apply to footwear, small appliances, agri-machinery and Ayurvedic formulations.

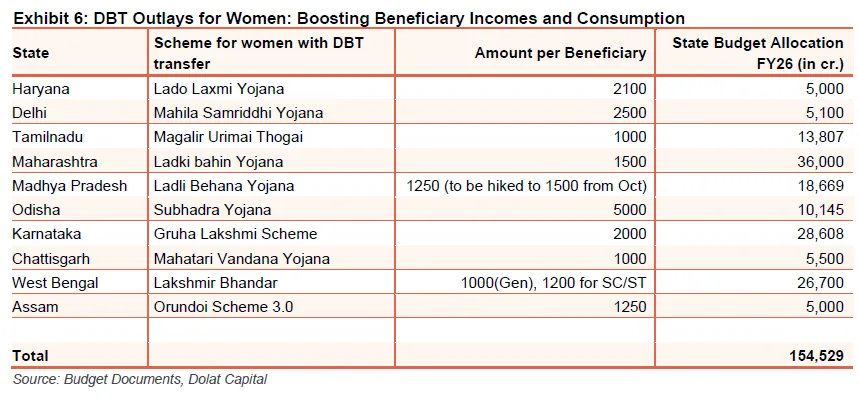

Multiple States are deploying women-centric DBT transfers that put ₹1,000–₹2,000 per month directly into women heads of households, money that tends to skew toward staples, kids’ needs, and small aspirational buys.

Karnataka – Gruha Lakshmi: ₹2,000 per month to eligible women; budget data and state releases highlight scale and ongoing payouts.

West Bengal – Lakshmir Bhandar: ₹1,200 (SC/ST) and ₹1,000 (other categories) per month to eligible women; budget documents indicate sizable allocations.

Madhya Pradesh – Ladli Behna: payout raised to ₹1,500 starting October 2025. That makes Q3/Q4 a key window for a consumption uplift in MP’s semi-urban and rural markets.

Aggregate FY26 DBT outlays to women well north of ₹1.5 lakh crore, creating a durable floor under staples and supporting affordable discretionary demand. This is a structural underpinning of the consumption thesis.

GST rationalisation is only one of three levers that could revive household demand. The second is the combination of better farm incomes and women-centric transfers. Crop procurement prices have moved modestly higher, and with kharif output poised for a second year of above-trend yields, rural wage growth finally outpaced CPI for three consecutive months to July something that last happened in early 2021. The third lever is disinflation itself: the 420-basis-point fall in headline CPI translates mechanically into real disposable-income gains for both urban fixed-income households and rural wage earners.

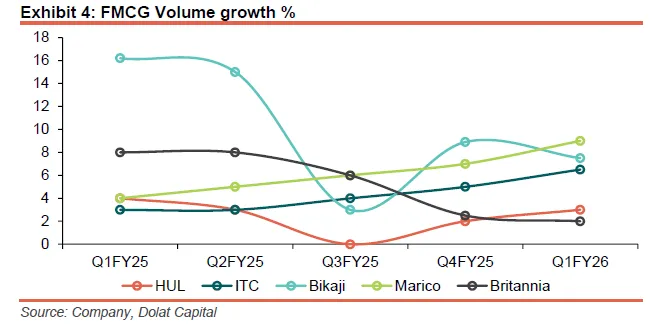

Channel commentary collated from June-quarter earnings calls confirms the turn. The qualitative story is echoed quantitatively in the volume charts for quick-service restaurants, FMCG staples and paint companies, all of which inflected northward during Q1FY26 after a bruising FY24-25 patch.

Yet the improvement is neither uniform nor secure. Inventories remain elevated in cooling appliances after an early monsoon cut into April demand, and retailers confirm that discretionary apparel sales are recovering faster in tier-two catchments than in metros. Consumer-sentiment surveys show cautious optimism rather than exuberance. Put differently, the consumption cycle has bottomed and is turning, but the amplitude of the up-cycle depends on policy follow-through and, crucially, on the pace at which corporate India passes declining input costs to end-customers.

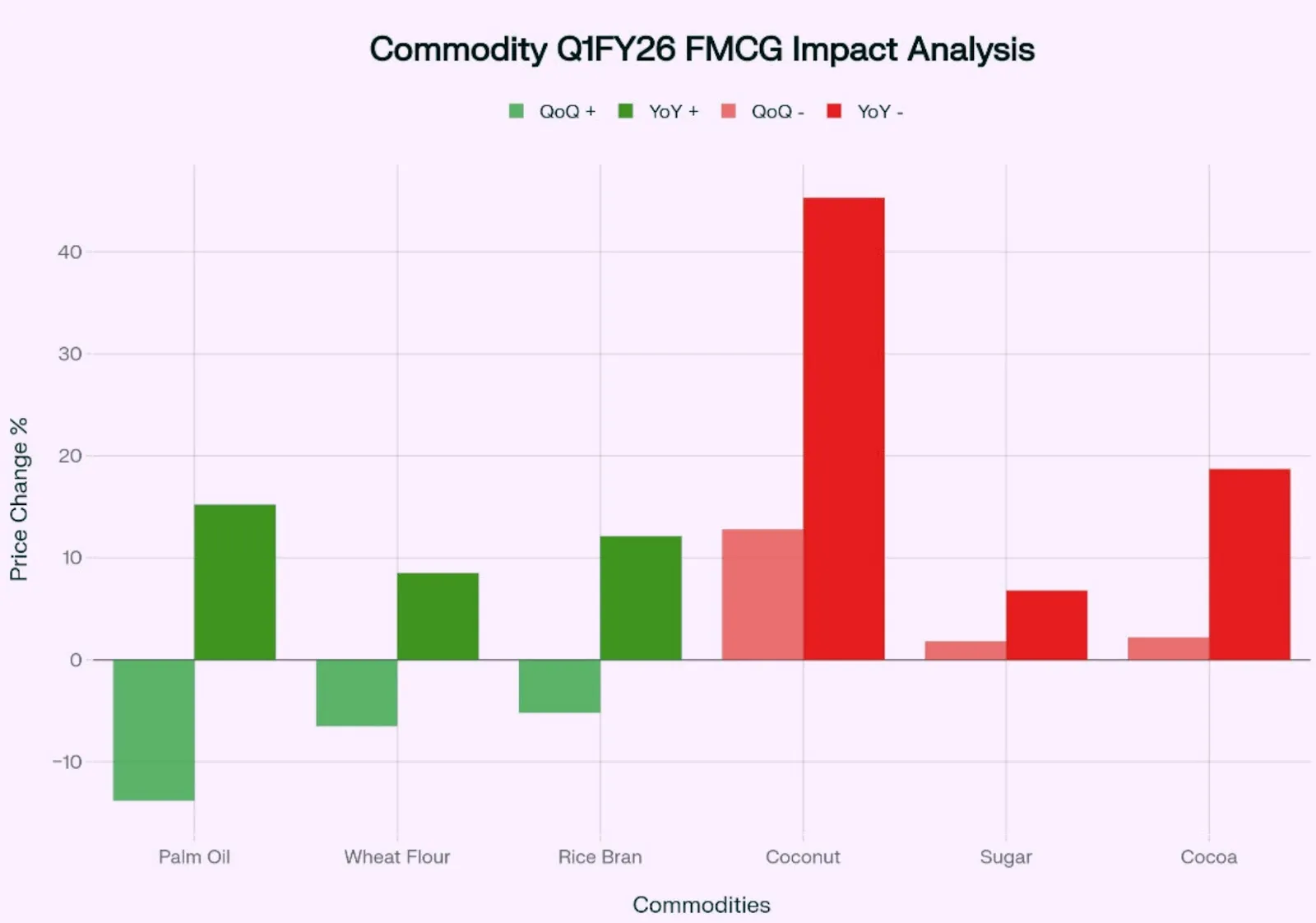

The commodity complex is co-operating. Palm-oil prices fell fourteen % quarter-on-quarter, international wheat landed six-and-a-half % cheaper and sugar wholesale prices eased two %, letting FMCG gross margins breathe. Metals tell a similar story. Copper spot prices are down six % since March and aluminium has slipped eight %, taking input pressure off cable and wire manufacturers. An overlay of those cost curves against the Revenue-EBITDA-PAT trajectories for the coverage universe shows that after a five-quarter margin squeeze, operating leverage is back on the table.

Source: Moneycontrol , ET

The recent ban on online real-money gaming platforms in India, introduced to address public welfare and security concerns, could also lead to increased consumption by redirecting consumer spending. India's gaming market, with 590 million users, generated $3.8 billion annually, including ₹20,000 crore in tax revenue from real-money games. About 147 million gamers spent money on gaming, many from non-metro areas, making this a significant sector before the ban.

While the ban disrupts an industry supporting around 200,000 jobs and results in lost tax revenue, it may free up substantial disposable income previously spent on gaming. This redirected spending could boost other sectors of the economy, potentially increasing overall consumption despite the regulatory trade-offs. The actual impact will depend on how consumers shift their spending after the ban.

Earnings, paradoxically, are the weakest link in an otherwise constructive narrative. The Earnings Index, which measures upgrades to downgrades, registered 0.69 for Q1FY26, the fourth quarter below the breakeven threshold. Revenue, EBITDA and PAT estimates for the non-financial, non-energy universe were cut by 102, 97 and 164 basis points respectively for FY26 even as FY27 numbers were left largely intact, reflecting the consensus hope that growth rebounds in the second half.

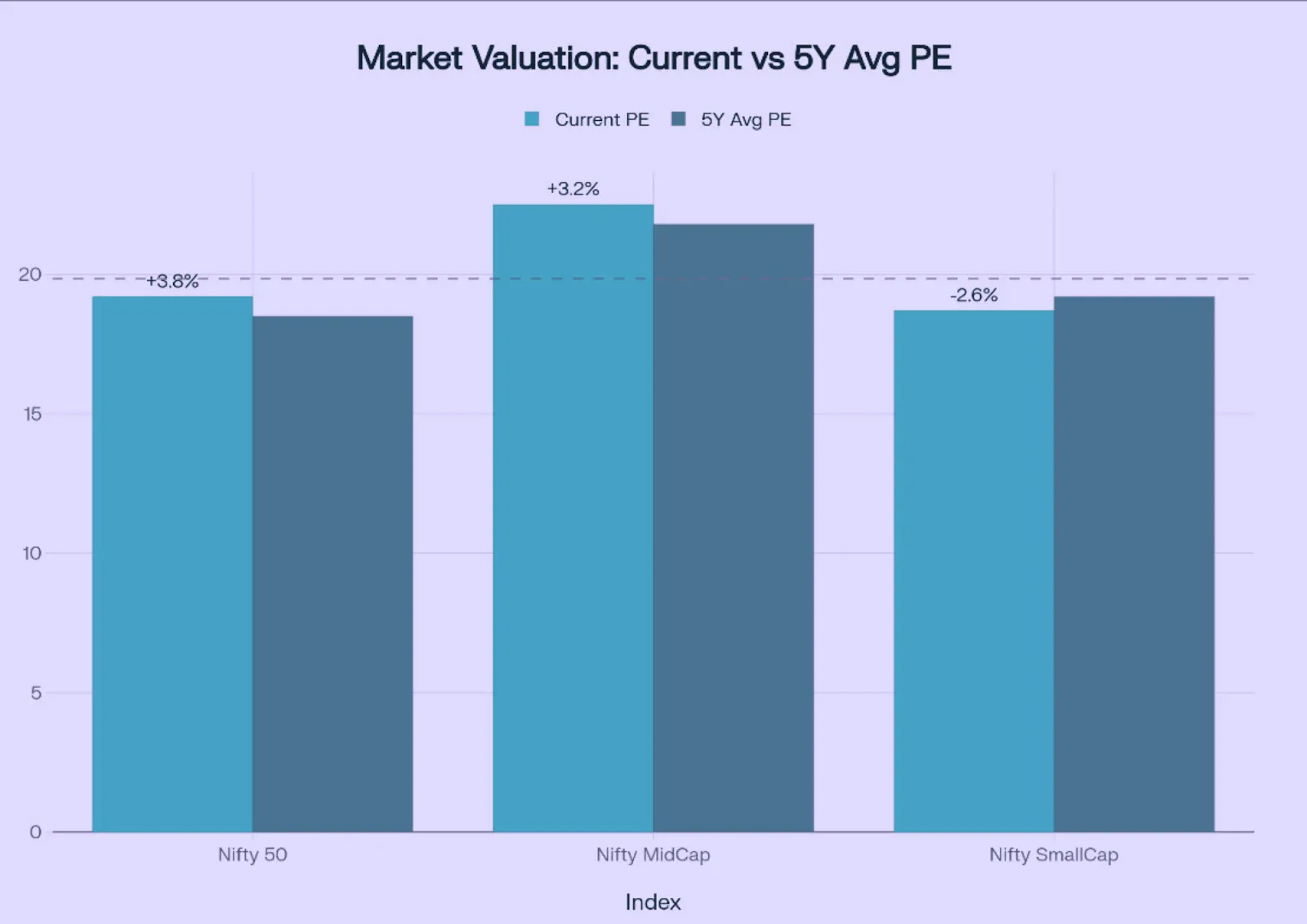

Equally revealing is the granular distribution of revisions. Hotels, retail and FMCG staples enjoyed upward surprises, while infra, chemicals and durables recorded disappointments. IT services produced modest beats on cost control rather than topline traction. The net effect is that valuations look stretched versus near-term earnings reality: the Nifty 50’s one-year forward price-earnings multiple trades one standard deviation above its five-year average, while the mid-cap index is only marginally below its mean and the small-cap gauge sits two standard deviations cheap.

Source: Nifty PE

Nifty 50 index turns slightly positive in 2025 with recovery seen by March, while Small-cap and Mid-cap stocks lag behind. The relative-value calculus therefore tilts toward selective mid-caps, particularly where earnings momentum aligns with valuation de-rating. On that metric paints, cables and digital services stand out on the long side, whereas exporters exposed to US tariff uncertainty on textiles and gem-and-jewellery foremost warrant caution despite appealing multiples.

Sector | FY26E Revenue Growth (%) | FY26E EBITDA Growth (%) | FY26E PAT Growth (%) | 1-Yr Fwd P/E (×) | Stance |

Consumption Staples | 9.9 | 9.0 | 9.7 | 41 | Positive |

Consumer Durables | 21.3 | 19.5 | 25.1 | 36 | Neutral |

Banking & Financials | 7.5 | 10.1 | 4.8 | 20 | Neutral |

Cement | 13.7 | 42.9 | 79.0 | 21 | Neutral |

OMCs | –2.2 | 13.3 | 23.0 | 5–7 | Positive |

IT Services | 5.1 | 5.6 | 6.1 | 24 | Neutral |

Internet Platforms | 35–40 | nm | nm | 30–45 | Positive |

Source: Dolat Capital estimates, Bloomberg consensus

Within staples the debate boils down to margin resilience. Past rounds of price hikes now cycle through the base, creating head-room to reinvest in brand spending once input disinflation shows up at the gross-margin line. Among discretionary names paints deserve special attention. The arrival of a deep-pocketed challenger has depressed multiples, yet the leader’s distribution moat and the industry’s benign demand elasticity suggest the market may be under-pricing a likely re-acceleration of earnings.

Retail, particularly apparel, emerges as a leveraged play on the rural recovery and GST simplification. Companies that undertook painful store rationalisation in FY24 now face a cleaner cost base. Brent and cotton prices are favourable, while women-centric cash transfers shift incremental rupees toward household consumption. These dynamics make Trent and V-Mart, for example, logical beneficiaries, although the former’s valuation premium embeds high expectations.

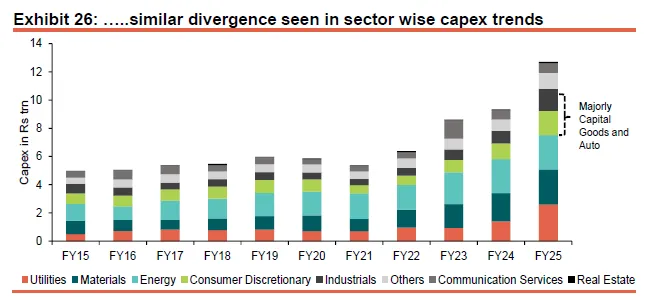

The divergence between public and private investment remains stark. Charts covering machinery-and-equipment spends as a share of gross fixed capital formation show the ratio still below pre-COVID levels, even as government outlays on roads, rail and defence reach record highs.

That divergence disproportionately benefits capital-goods vendors with public-sector order books of cable producers, power T&D contractors and certain EPC players while leaving private-sector oriented industries in a holding pattern.

Banking sector revenue growth slowed to 7.7 % in FY25 and is pencilled in at 7.5 % for FY26, with credit-cost guidance uniformly nudged up as delinquencies surface in micro-loans and small-ticket secured products. The good news is that large universal banks see limited impact because their exposures reside in higher-ticket, floating-rate segments. Net interest margins for private banks should prove more resilient than for PSUs, which face larger re-pricing lags on MCLR-linked loans. In housing finance the risk-reward tilts towards under-levered niche lenders with superior underwriting.

Oil-marketing companies have traded at deep discounts to book for years, but the confluence of falling crude prices, LPG under-recovery compensation and refinery upgrades positions them for step-function improvements in free-cash-flow. HPCL is the standout, with its Vizag bottom-upgradation facility adding an estimated US $3 per barrel to gross refining margins from the December quarter. Together with operating-leverage tail-winds, the stock’s 5× FY27 earnings multiple is difficult to ignore. Among city-gas distributors, Mahanagar Gas offers the best volume trajectory and the lowest policy risk, whereas Gujarat Gas faces intensifying propane competition in its industrial heartland.

IT services enter a third consecutive year of single-digit growth, yet the sector’s dividend and free-cash yields now approximate six %, anchoring valuation. Investor expectations are sufficiently muted that even modest second-half acceleration, catalysed by rate cuts in the United States and early Gen-AI monetisation, could spark a rerating. LTI Mindtree, with its balanced vertical mix and expanding margin profile, screens attractively among large-caps, while Oracle Financial Services enjoys niche pricing power in core-banking software. On the internet side, the pivot from growth to profitability is well advanced, and business models exposed to MSME digitisation like Newgen, IndiaMART are poised for non-linear operating leverage.

The Indian auto and two-wheeler sector is demonstrating strong growth and promising prospects for the coming years. In FY25, the automotive industry recorded steady expansion with passenger vehicle sales rising by 4.9% year-on-year and total vehicle production reaching over 25 million units. Two-wheelers, in particular, showed robust demand driven by rising rural incomes and growing consumer sentiment. The two-wheeler industry is expected to accelerate further with an 8-9% volume growth forecast for FY26, supported by easing inflation, increased disposable incomes due to tax rebates, and favourable monsoon conditions. These factors are boosting domestic demand as well as exports, which surged by 19% to over 5.3 million units in FY25.

Looking ahead, India is well-positioned to be a global automotive leader, driven by rising middle-class income, youth population, and policy support for electric vehicles (EVs). The government’s PM E-DRIVE scheme with a US$1.3 billion budget encourages EV adoption and infrastructure development. The sector is expected to grow at a CAGR of around 8.8% from 2025 to 2034, with the market projected to more than double by 2034. Technological advances such as AI, 5G connectivity, and EV innovation will further strengthen India’s competitiveness. With increasing investments, rising exports, and a shift towards electric mobility, the auto and two-wheeler sector in India is set for a positive, transformative growth trajectory.

Our Innovation Tracker Portfolio includes a strong allocation to the consumption theme with a focus on the auto and two-wheeler sector, reflecting its robust growth potential and pivotal role in India’s economic transformation.

The year ahead is indeed a “moment of truth”. The macro environment is the friendliest since 2017: inflation is below target, the rupee is stable, public capex is roaring and a landmark GST reform is within reach. Against that, corporate earnings still need to prove themselves and valuations at least for mega-caps leave slim margin for error. The optimal positioning therefore emphasises three attributes: valuation support, operating-leverage visibility and policy-tail-wind alignment. India’s consumption flywheel is getting synchronized nudges: simpler GST + benign inflation + positive rate environment + women led DBT flows, right before the festive quarter.

Policy timing will ultimately arbitrate the debate between optimism and valuation fatigue. If the GST Council delivers rate cuts by October, the festival season could unleash a consumption wave strong enough to pull earnings forward, validate valuations and extend the bull market. Should implementation slip into 2026, investors may have to contend with earnings downgrades and multiple compression before the next up-cycle starts. The stakes are clear, the path is promising, and the coming quarters will reveal whether India’s equities can transform potential into performance.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart