by Naman Agarwal

Published On Aug. 6, 2025

The butterfly option strategy, also known as the butterfly spread strategy, is one of the most popular advanced techniques in options trading. Favored for its ability to deliver defined risk and targeted profits, this non-directional approach uses a combination of options with different strike prices to create a risk-adjusted position. The butterfly option strategy is designed for traders who anticipate minimal movement in the underlying asset, enabling them to profit from sideways or neutral market conditions. By combining both bull and bear spreads, the butterfly option strategy cleverly limits risk exposure, making it ideal for those looking for cost-effective ways to capture small, defined profits within a specific price range. In practice, a butterfly spread strategy involves constructing four options contracts usually either all call options or all put options all with the same expiration date but with three different strike prices. The primary benefit of the butterfly option strategy is that it allows traders to benefit from a stable or range-bound market with a lower premium outlay compared to other non-directional trades, such as straddles or strangles.

A butterfly option strategy, sometimes called a butterfly spread strategy, is a defined-risk, non-directional trade that profits most when the underlying asset remains close to a targeted price at option expiry. What is a butterfly option trade? This approach involves using three strike prices and four option contracts of the same expiration date. The unique structure of the butterfly strategy enables traders to take advantage of low volatility in the market, capturing profit within a narrow range while keeping risk strictly limited.

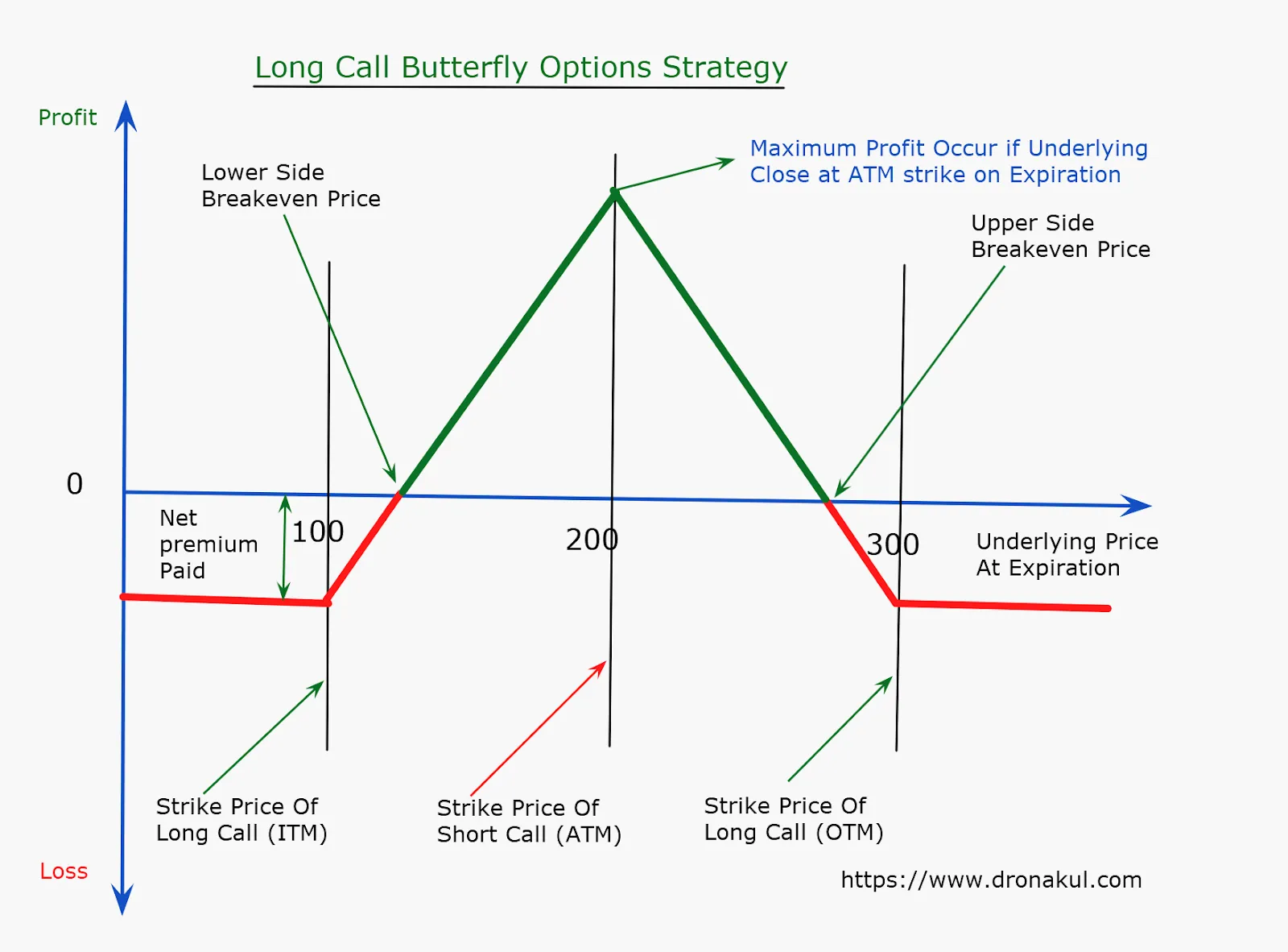

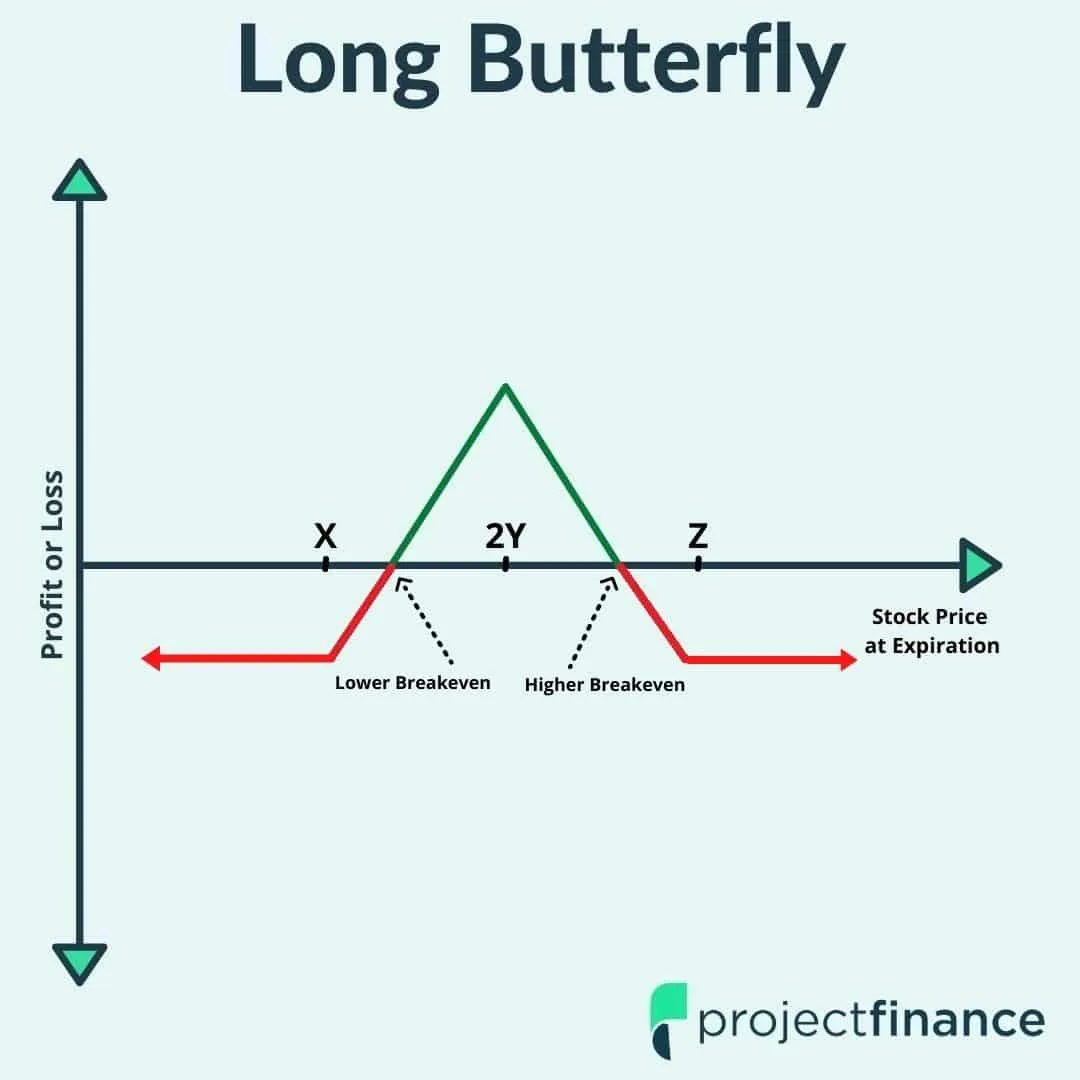

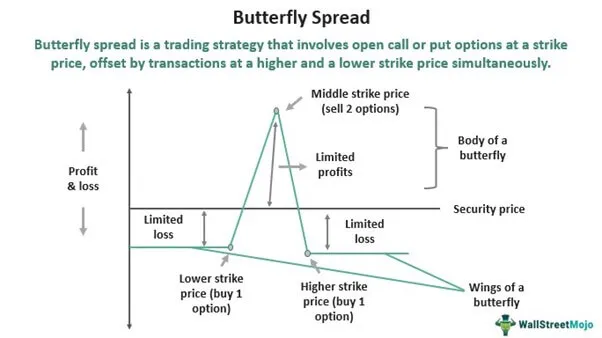

The core idea is to:

Buy one option at the lowest strike (the lower "wing").

Sell two options at the middle strike ("body").

Buy one option at the highest strike (the upper "wing").

This creates a position resembling a butterfly’s shape , hence its name. The maximum profit is achieved if the underlying asset closes at the middle strike price upon expiration. The maximum loss is limited to the net premium paid to establish the trade, providing a clear risk/reward scenario.

Butterfly spread strategies offer traders several advantages but also come with trade-offs. Understanding these can help determine when a butterfly strategy is the right fit for your portfolio.

Below are the main pros and cons of the butterfly option strategy:

Pros | Cons |

Defined risk : maximum loss is limited to the initial premium paid. | Maximum profit is capped, creating limited upside potential. |

Cost-effective compared to straddles and strangles; requires lower premium. | Profits only if the underlying closes within a narrow price range near the middle strike. |

Ideal for range-bound or low-volatility markets. | Susceptible to losses if there’s a large move in the underlying asset though loss remains capped. |

Easy to plan and manage : clearly defined breakeven points and profit potential. | Sensitive to strike price and expiration selection; incorrect setup can reduce probability of profit. |

Time decay (theta) usually works in favor of the position, especially as expiry nears and if the asset remains stable. | Low maximum reward often means traders must size positions larger for meaningful gains. |

There are several types of butterfly option strategies catering to differing market outlooks and volatility expectations. What is a butterfly spread strategy variant? The main forms include:

Before diving into each type, note that all these spreads share the same fundamental structure utilizing three strike prices and four options contracts.

Long Call Butterfly Spread

Buy 1 ITM (in the money) call

Sell 2 ATM (at the money) calls

Buy 1 OTM (out of the money) call

Long Put Butterfly Spread

Buy 1 ITM put

Sell 2 ATM puts

Buy 1 OTM put

Short Call Butterfly Spread

Short 1 ITM call

Long 2 ATM calls

Short 1 OTM call

Short Put Butterfly Spread

Short 1 ITM put

Long 2 ATM puts

Short 1 OTM put

Iron Butterfly Spread

Sell 1 ATM call and 1 ATM put (forming a short straddle)

Buy 1 OTM call and 1 OTM put (the wings) at equal distance from the ATM

Reverse Iron Butterfly Spread

Buy 1 ATM call and 1 ATM put

Sell 1 OTM call and 1 OTM put

Choosing the right butterfly strategy depends on whether you want to profit from stability (long butterflies) or strong moves in either direction (short/reverse butterflies), and whether you prefer using all calls, all puts, or a mix.

Setting up the butterfly spread involves four options contracts and three strikes. Structure and strike selection are crucial to the butterfly spread strategy’s success.

Structure:

Buy 1 lower-strike call or put (wing)

Sell 2 middle-strike call or puts (body)

Buy 1 higher-strike call or put (wing)

All options expire on the same date.

Choosing strike prices and expiry:The “body” or middle strike is set close to the price where the trader expects the underlying to settle on the options expiry day.The “wings” are typically equidistant from the body, optimizing the chance of maximum profit when the underlying stays near the body strike. The choice of expiry should align with the expected timeframe of low volatility in the underlying asset—close enough that premium decay benefits the spread.

Why exact strikes and expiry matter: Strikes too close yield tiny profit windows; too far apart, the premium rises and reduces net gain. The ideal butterfly capture zone comes from careful planning around likely price stability.

Table: Strike Structure of a Standard Butterfly Spread

Action | Option Type | Strike Price |

Buy | Call/Put | Lower (Wing) |

Sell 2 | Call/Put | Middle (Body) |

Buy | Call/Put | Upper (Wing) |

The best time to use a butterfly spread strategy is when low volatility is expected in the underlying asset, and you anticipate the price will stay near a specified target. This makes the butterfly option strategy ideal for stable, range-bound markets, earnings seasons devoid of surprises, or post-news-event periods with muted price movement.

The butterfly strategy is most effective when the trader expects little directional movement.

Suitable for targeting small, defined profits when a stock is likely to remain near a certain strike price.

Butterfly spreads help limit risk, as the wings of the trade cap losses even in the event of sharp market movements.

Additional Tips :

Use butterfly spreads when implied volatility is expected to drop.

Deploy near major expiration dates for greatest time value benefit.

Appropriate when you want market-neutral positions with well-defined risk-reward.

The butterfly option strategy and butterfly spread strategy provide traders with one of the most flexible and risk-controlled techniques in the options world. By using three strike prices and four options contracts, savvy traders can build positions that are cost-efficient, limit maximum risk, and deliver modest but reliable profits when assets remain range-bound. Remember to choose appropriate strike distances and expirations for your butterfly option strategy to suit your market outlook and trading goals. While no strategy is without its limitations, the butterfly option strategy remains an excellent tool for defined-risk profit targeting in quiet, low-volatility conditions.

The butterfly strategy is considered a defined-risk and limited-reward options strategy. It is less risky than naked options strategies because your maximum loss is capped at the premium paid. However, it can be complex for absolute beginners, as it involves simultaneously entering multiple option contracts and requires an understanding of strike selection and market conditions. It's best for those who have some familiarity with options trading basics, but cautious beginners can use it to learn about risk management in a controlled way.

The main risks of a butterfly spread include:

Limited profit range: You can only profit if the underlying price ends very close to the middle strike price. Large moves either way can result in a loss.

Complex execution: Managing three or four-legged trades can lead to execution challenges and higher commissions.

Low probability of max profit: Maximal gains occur rarely, only if the price lands exactly at the target strike at expiry.

Potential slippage or liquidity issues: If the chosen options are not liquid, you may face poor fills on entry or exit, impacting returns.

Your maximum profit is achieved if the underlying asset closes exactly at the middle strike price at expiry; this profit is limited and known in advance. For example, a typical payout setup might let you risk 100 to make 300, but hitting that exact payout is uncommon. More realistically, butterfly spreads offer a good risk-to-reward ratio, often letting you risk 1 to potentially earn 2 or 3, but the chance of making some profit (not max profit) is substantially higher (e.g., 80%+ chance in some scenarios).

Yes, you can use butterfly spreads for intraday trading, especially when you're expecting minimal movement or a range-bound market during the trading session. Intraday butterfly traders seek quick profits from time decay (theta) or sharp changes in implied volatility. However, intraday butterflies might require even more precise execution and monitoring, as profits can erode quickly with underlying price movement or changes in option prices.

No, while both are neutral strategies with limited risk and reward, iron butterflies and regular (long call or put) butterflies differ:

Feature | Regular Butterfly (Call/Put) | Iron Butterfly |

Options used | All calls or all puts | Combination of calls and puts |

Market outlook | Neutral (low volatility expected) | Neutral (low volatility expected) |

Construction | Buy 1 ITM, Sell 2 ATM, Buy 1 OTM | Sell 1 ATM put & call, Buy 1 OTM put & call |

Max profit location | At the middle strike at expiry | At the short (ATM) strike price at expiry |

Max loss | Net debit paid | Spread width minus premium received |

Margin requirement | Usually net debit (paid upfront) | Net credit (received upfront) |

The iron butterfly typically creates a position with a net credit and uses both puts and calls, while a traditional butterfly uses only calls or only puts.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart