by Siddharth Singh Bhaisora

Published On Aug. 10, 2025

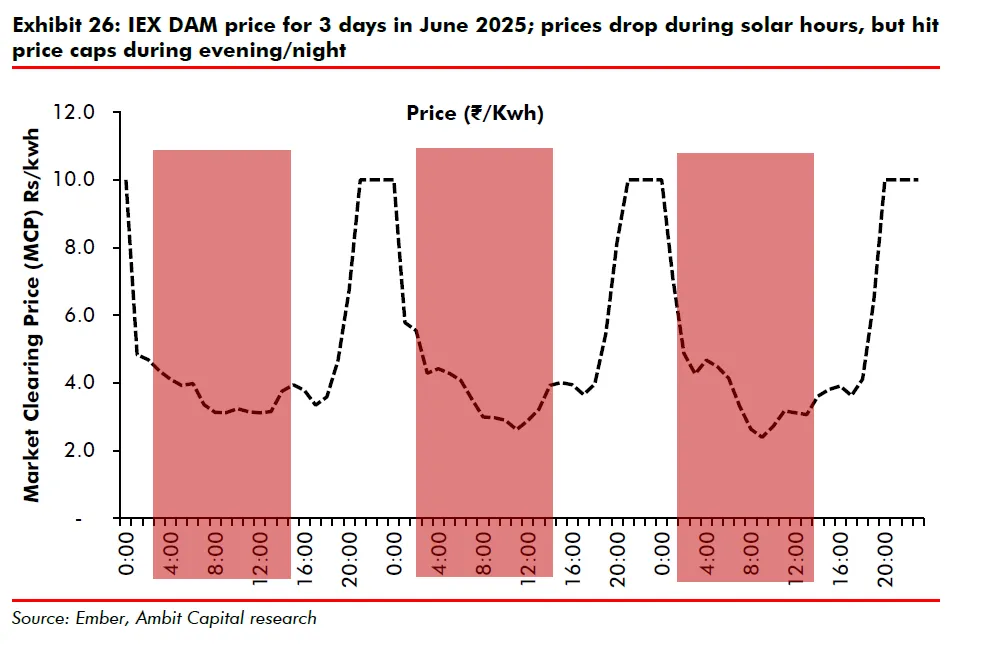

If you’ve been tracking India’s power markets lately, prices collapse around midday and then leap after sunset. Now this isn’t random. It’s the grid adjusting to a surge of daytime solar and renewable energy followed by evening demand. And it’s creating an investable opening that didn’t exist a couple of years ago: grid scale batteries earning money from both price arbitrage and grid support services.

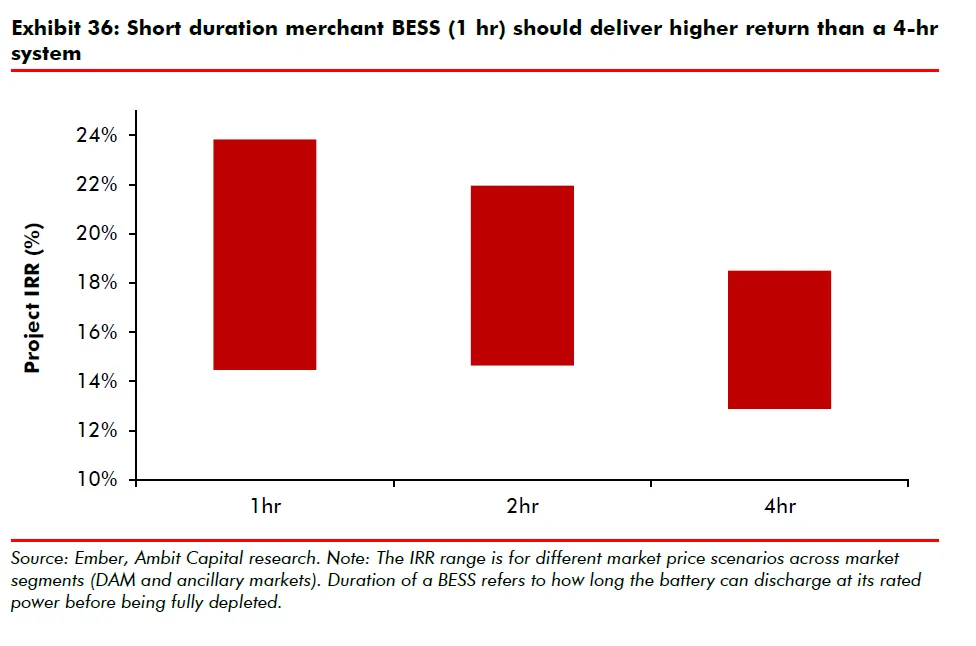

In fact, fresh research from Ambit Capital shows that “merchant” battery projects, ones that sell into markets rather than sit on long term contracts, can now clear equity like returns in India. Returns are now driven by a combination of day ahead market price arbitrage and ancillary services, with 1 to 2 hour batteries currently beating longer duration builds on IRR. As an Indian retail investor, this is no longer a “someday” theme; it’s investable, provided you know where the earnings come from, what could compress them, and which business models are aligned with India’s grid reality.

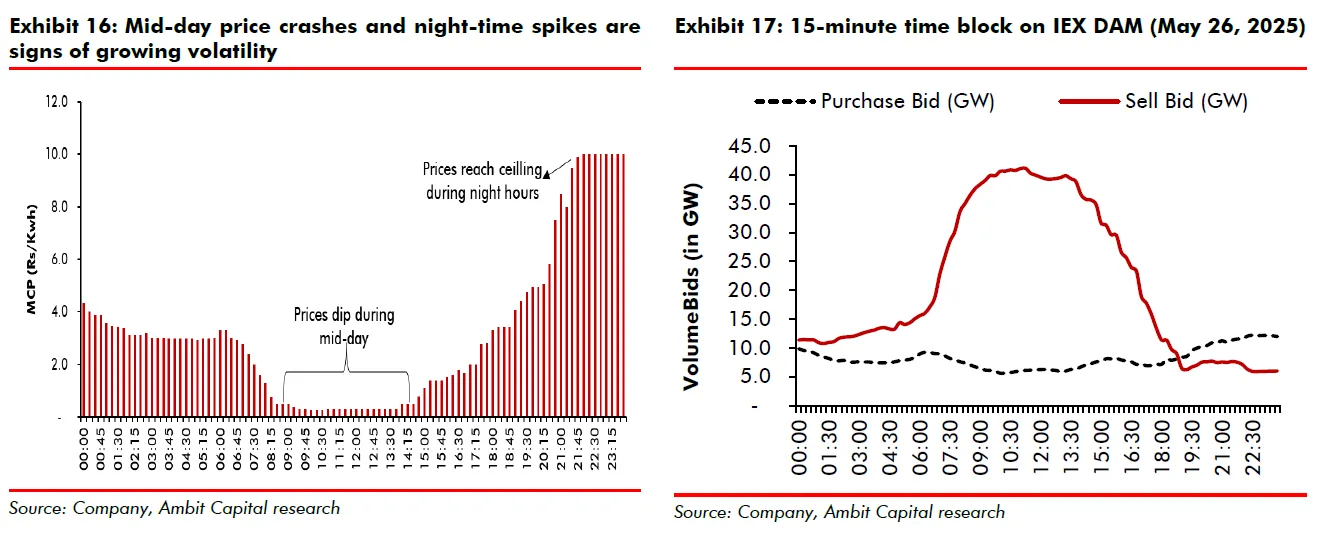

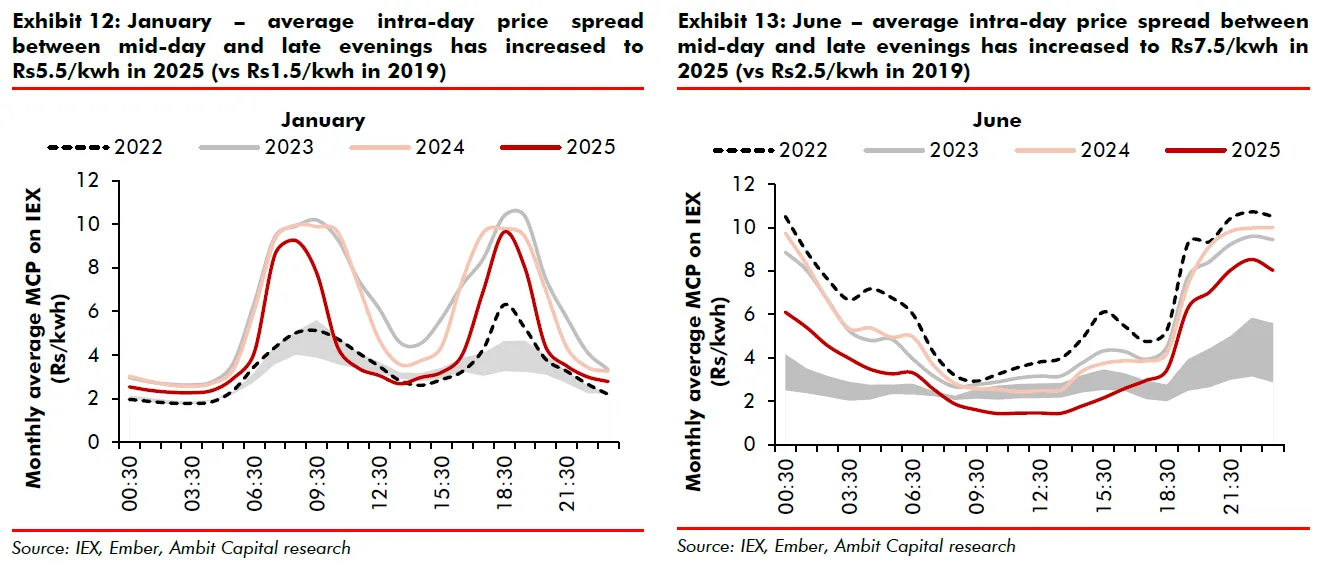

India’s short term power exchanges increasingly show rock bottom prices at midday and sharp spikes after sunset.

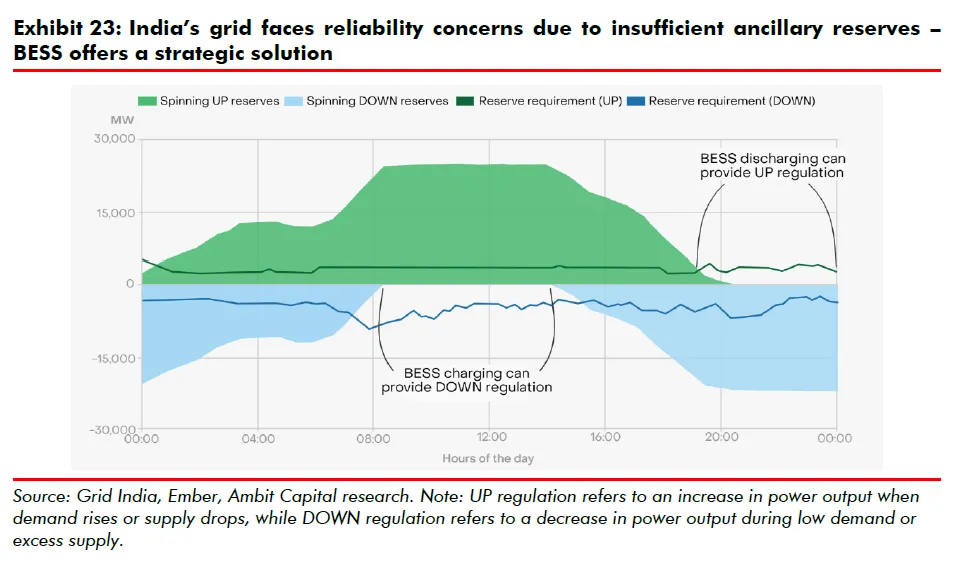

For generators that sell at market prices (like merchant solar), that’s a problem: the price they actually realise vs. the average market price fell to an average of ~65% during 2022 to 24 from ~80 to 85% in 2019 to 22. On 26 May 2025, grid stress was so acute that both upward and downward spinning reserves were inadequate for long stretches the same day.

Volatility is no longer an occasional event for the energy market. Assets and ways that are able to buy low at noon and sell high at night (and stabilise frequency in between) are positioned to monetise that volatility. Enter battery energy storage systems (BESS).

Batteries are now a recognised, bankable grid asset. Two quiet but decisive regulatory shifts unlocked the opportunity:

Standalone energy storage is now a de licensed activity under the Electricity Rules, 2022. Storage owners can buy, store, sell electricity or lease capacity, just like generators.

CERC Ancillary Services Regulations (2022) formally allow batteries to provide fast response Secondary Reserve and Tertiary Reserve services, with procurement, deployment and compensation mechanisms spelled out.

On top of that, national planning now assumes storage is critical to 2032’s power mix. India’s 14th National Electricity Plan cites 74 GW / 411 GWh of storage by 2032, including 47 GW / 236 GWh of BESS.

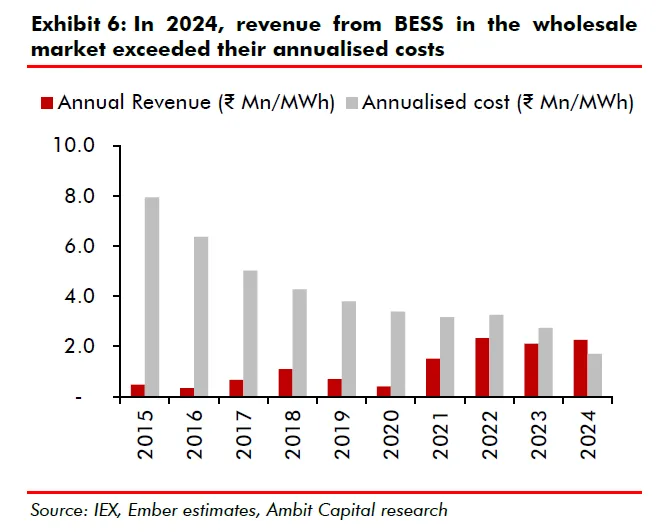

Two simple numbers explain why 2024 became the turning point. First, battery costs: estimates highlighted in the press peg a 2 hour BESS around ₹1.7 million per MWh in 2025 after roughly an 80% drop since 2015. Second, market revenues: potential earnings from participating in the DAM are cited around ₹2.4 million per MWh, enough to clear annualised costs for the first time last year and 5x higher than a decade ago.

And in 2024, the revenues a 2 hour BESS could earn in the day ahead market exceeded its annualised cost the first time that’s happened in India’s short term power markets.

On the price side, India’s exchanges are now showing deep midday troughs (solar) and sharp evening peaks, with day ahead market prices touching ₹9/kWh or more in roughly 1 out of every 6 hours in recent years, more than enough volatility to monetise with storage. Midday prices in the summer months fell by ~20% from 2022 to 2024, widening spreads further.

And this is exactly the kind of trough to peak volatility battery storage systems monetise by charging low and discharging high.

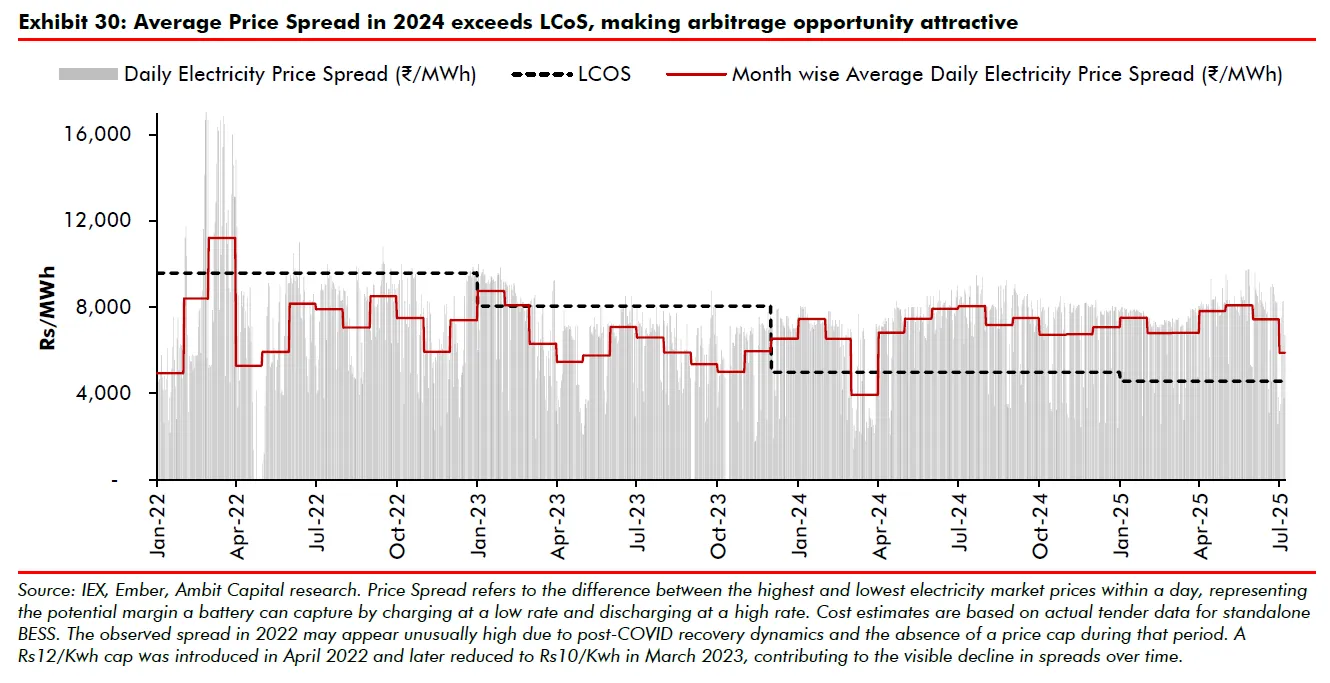

It’s straightforward in principle: charge when prices are low i.e. during heavy solar hours, discharge when they’re high i.e. during evening peak. A worked example using 2024 IEX Day Ahead Market prices: charging at ₹2.6/kWh and assuming 85% round trip efficiency raises your effective energy cost to ₹3.06/kWh. Add a levelised cost of storage (LCOS) of ~₹4.5/kWh, and your delivered cost is ₹7.56/kWh; sell into an evening block at ₹10/kWh and you net ~₹2.5/kWh for that cycle.

What changed vs. 2 to 3 years ago? Since early 2024, the average daily price spread on IEX has exceeded LCOS, flipping merchant batteries from “promising” to profitable without needing a long term purchase contracts (PPAs).

Also, India’s Day Ahead Market price cap was refixed to ₹10/kWh in March 2023 (down from ₹12). That reins in extremes, but spreads remain wide enough for storage to work.

But the real kicker, and the reason the best reported returns push into the low 20s, is value stacking. India’s ancillary services framework now lets batteries earn revenue by helping keep the grid stable. Under Secondary Reserve Ancillary Service (SRAS) and Tertiary Reserve (TRAS) programs, fast responding batteries can be dispatched to absorb excess energy (SRAS Down) or deliver power on command, with performance linked compensation.

The clever bit is that in SRAS Down, a battery can effectively get paid to charge, turning what is normally a cost into income, and accuracy bonuses can further sweeten results. Put DAM and ancillaries together and you have a two legged business model: trade the daily price shape most of the time, and support grid stability when called upon, getting compensated for precision. That is why analyses summarised in recent coverage show two flavours of return: up to around 17% IRR for 2025 vintage projects on DAM arbitrage alone, and up to roughly 24% where ancillary services are consistently layered in.

Indian power and energy curve spikes are sharp and short. That makes 1 to 2 hour battery storage systems at a sweet spot, since they capture the steepest hours without sitting idle through flatter shoulders. Analyses summarised in recent reporting still show mid teens IRR (~15.5 to 18%) across reasonable variations in round trip efficiency, depth of discharge and capex, with value stacked operations reaching higher.

4 hour battery storage builds aren’t “bad” but they generally fit contracted or capacity style products better than pure merchant plays in 2025.

India is still early in the rollout. By June 2025 the country had about 500 MWh operational but a 121 GWh development pipeline. Planning documents cited in coverage point to ~236 GWh of BESS required by 2032, underscoring a multi year runway. As utility scale renewables expand (168 GW operational, 145 GW in the pipeline noted in the same coverage), storage moves from “nice to have” to grid hygiene firming supply, reducing curtailment, and smoothing prices.

There’s no paradox here. In the near term, batteries profit because markets are volatile. Over time, as more BESS participates, the very same assets reduce volatility by soaking up midday surplus and shifting it into evening peaks. That softens extreme price hours and lowers system costs (e.g., less forced procurement at peaks, fewer curtailment payouts). Crucially, revenues then rely less on sheer spread and more on ancillary volumes and, potentially, capacity style products, keeping returns attractive for efficient operators even as arbitrage tightens.

You can’t directly invest in a merchant battery project from your demat account (yet). But you can build exposure through listed proxies. Think in four buckets:

Large listed producers and integrated utilities are best positioned to own or contract storage at scale, stack ancillary revenues, and arbitrage exchange spreads alongside their portfolios. Look for:

Announced BESS pipelines (1 to 2 hour systems for market operations, longer duration for contract/C&I plays).

Ancillary market readiness: telemetry, control systems, and SRAS performance track record.

Flexible portfolios: assets that can shift generation or integrate BESS behind the meter at plants.

As volatility grows, grid companies that invest in congestion relief and flexibility (including utility owned storage, dynamic lines, and system controls) should see rising regulated asset bases and capex visibility. India’s plan to deploy 47 GW / 236 GWh of BESS by 2032 underscores the grid wide adoption runway.

Wider spreads and higher volumes benefit market infrastructure providers. IEX remains the dominant platform (recent media place its market share around ~84%), though market design changes like market coupling are a moving piece to watch.

Cell/pack manufacturing and integration are scaling up domestically; cost curves (lithium ion LFP today, sodium ion and other chemistries tomorrow) drive long run margins. Focus on:

Cost per kWh trajectories and localisation benefits,

Order books tied to SECI/utility tenders,

Service revenue (O&M, augmentation, software).

Regulatory redesign: Market coupling, exchange rules, or changes to ancillary procedures could reshape spreads and access. Keep an eye on CERC consultations and Grid India notices.

Spread compression: A milder solar ramp or widespread storage build out could narrow arbitrage spreads. (Note: India’s cap already tempers extremes, but spreads still cleared LCOS through 2024 to 2025.)

Operational discipline: Missing SRAS accuracy or availability windows erodes economics quickly; the bonus up to ₹0.50/kWh is performance linked.

Technology & cost swings: Battery pack prices fell hard this decade; they can wiggle year to year with commodity cycles. Diversified chemistries and long term offtake for cells can hedge this.

Grid stress events: The very volatility that batteries monetise can also create non delivery penalties if assets or controls fail during excursions (remember 26 May 2025).

In the end, the takeaway is straightforward. India’s merchant batteries crossed the profit line in 2024 because revenues finally beat costs, and policy has matured enough to pay for the very stability that these assets provide. 3 forces are locking in the investment case:

Structural volatility from high daytime solar and evening demand is here to stay, this arbitrage exists, at least for now.

Policy scaffolding (de licensed storage + ancillary markets that reward speed) is already in place and hardening.

Economics have crossed the line: falling storage costs + spreads above LCOS since early 2024 = positive merchant economics, with credible IRRs in the low 20s for 1 to 2 hour systems that operate well.

If you’re looking to add an energy component to your portfolio, BESS makes a compelling case based on duration discipline, operator quality, and real operational performance front and center.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart