India's financial services landscape is undergoing a transformation driven by two parallel forces: aggressive credit expansion and tightened regulatory oversight. Banks and non-banking financial companies (NBFCs) are reshaping the credit delivery architecture, with each playing distinct roles in extending financial services to diverse borrower segments. As of January 2026, India's banking sector has crossed a historic milestone: total bank credit has surpassed ₹200 lakh crore for the first time, while NBFCs are projected to cross ₹50 lakh crore in assets under management by March 2027. Understanding the growth dynamics and regulatory frameworks governing these sectors is essential for entrepreneurs, investors, and financial stakeholders navigating India's evolving fintech ecosystem.

India's banking sector has demonstrated resilience and steady expansion. Scheduled Commercial Banks (SCBs) held total credit outstanding of ₹203.2 lakh crore as of December 31, 2025, registering growth of approximately 11.7-12% year-on-year when adjusted for reporting changes. Over the past decade, bank credit has expanded at a compound annual growth rate (CAGR) of 10.8%, establishing the sector as a backbone of India's economic infrastructure.

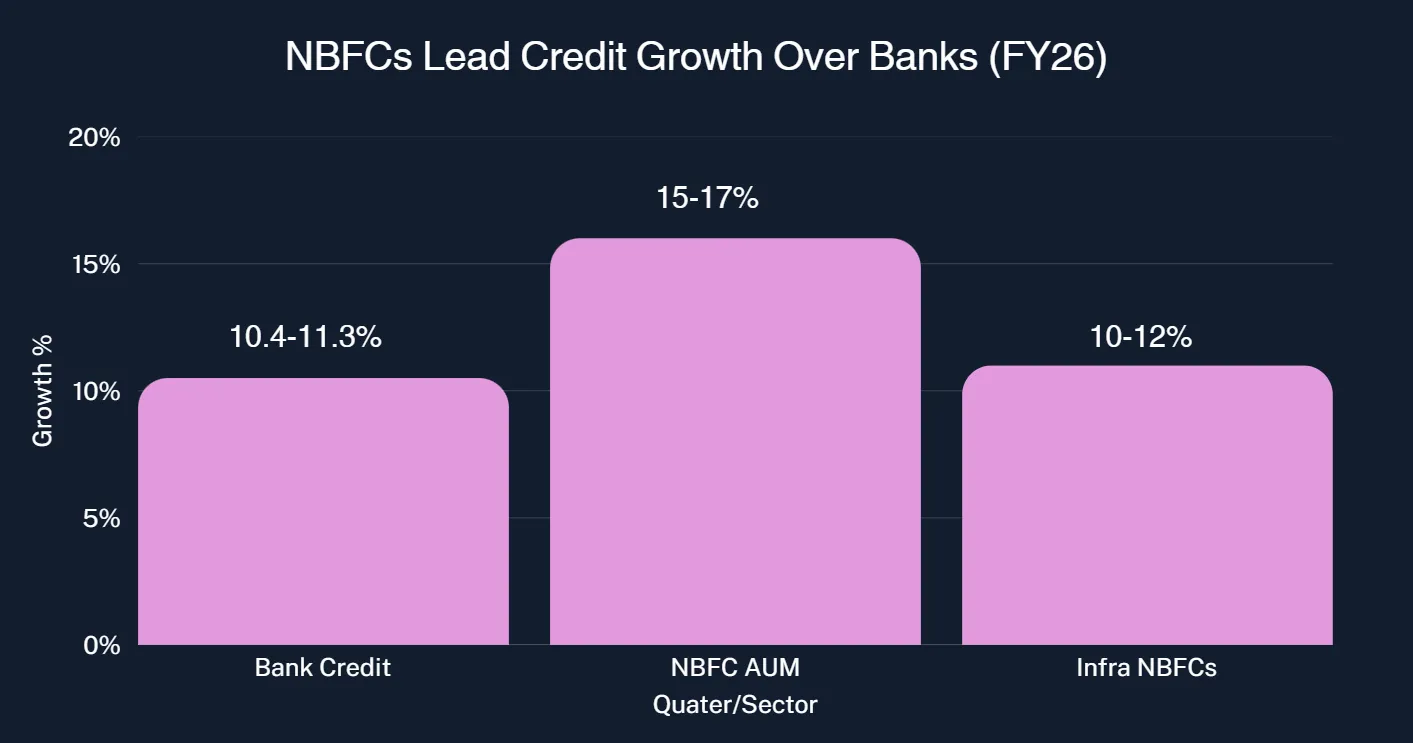

The credit growth trajectory tells a compelling story. From ₹164.3 lakh crore in March 2024, total bank credit has grown to over ₹200 lakh crore within a single fiscal year. For FY26, ICRA projects incremental bank credit of ₹19-20.5 trillion, translating to growth between 10.4-11.3%. While this represents moderation from the 20.2% growth recorded in FY24, the slowdown reflects a deliberate recalibration rather than systemic weakness credit growth is now calibrated for quality and asset quality preservation rather than sheer volume expansion.

Asset Quality and Financial Health

One of the most striking improvements in Indian banking has been the dramatic decline in non-performing assets. Gross NPAs (Non-Performing Assets) of SCBs fell to a 12-year low of 2.31% by March 2025, down from 11.2% in FY18. This represents a remarkable journey from peak stress levels witnessed during the NBFC crisis of 2018-19 and the pandemic period. Net NPAs declined to 0.52% by March 2025, the lowest in 20 years, driven by stronger provision buffers and improved borrower selection mechanisms.

This asset quality improvement has enabled banks to expand profitability. SCBs recorded a historic aggregate net profit of ₹3.50 lakh crore in FY24, up from ₹2.63 lakh crore in FY23. Return on Assets (ROA) has also reached decade-high levels, signaling that growth is genuinely profitable rather than driven by margin compression.

Deposit and Credit Distribution

Bank deposits have nearly tripled over the past decade, growing from ₹88.35 lakh crore in 2015 to ₹231.90 lakh crore as of January 2026. Deposits and credit are now broadly balanced, with a Credit-to-GDP ratio of 93%, indicating substantial headroom for further credit expansion compared to global peers. Current Account Savings Accounts (CASA) continue to grow, though at a slower pace of 7.6% year-on-year in Q1 FY26, while term deposits are capturing higher proportions due to rising interest rates.

Credit composition by sector:

Sector | FY26 Growth Rate | Share in Bank Credit | Key Drivers |

MSME & Unsecured Loans | Moderate | 17% | Post-stress recalibration; RBI guidelines on unsecured exposure |

Agricultural Credit | Steady | 8.5% | Government support; seasonal demand |

Retail (Housing, Auto, etc.) | 13-16% | 30% | Rising disposable incomes; affordability schemes |

Corporate & Industrial | Mixed 5-8% | 40% | Capex cycles; export demand |

Public sector banks (PSBs) have gained traction, overtaking private banks in credit growth for the first time in 14 years, driven by competitive pricing strategies and expanded retail lending. This reversal is significant; it indicates a strategic shift by PSBs toward market share capture in profitable retail segments while maintaining their fortress balance sheets.

While banks remain the larger player in absolute terms, NBFCs have emerged as the faster-growing segment. NBFC assets under management are projected to grow at 15-17% in FY26, significantly outpacing bank credit growth. More substantially, NBFC credit is expected to expand by ₹1.7-2.4 trillion in FY26 alone, with cumulative AUM reaching approximately ₹48-50 lakh crore by March 2026 and crossing ₹50 lakh crore by March 2027.

The market share of NBFCs in overall credit has stabilized at approximately 18-19%, reflecting their entrenchment as critical players in credit delivery. For NBFCs excluding infrastructure entities, growth is estimated at 15-17%, while infrastructure-focused NBFCs (NBFC-IFCs) are expected to grow at a healthier 10-12%, supported by government infrastructure spending priorities under the Viksit Bharat Vision 2047.

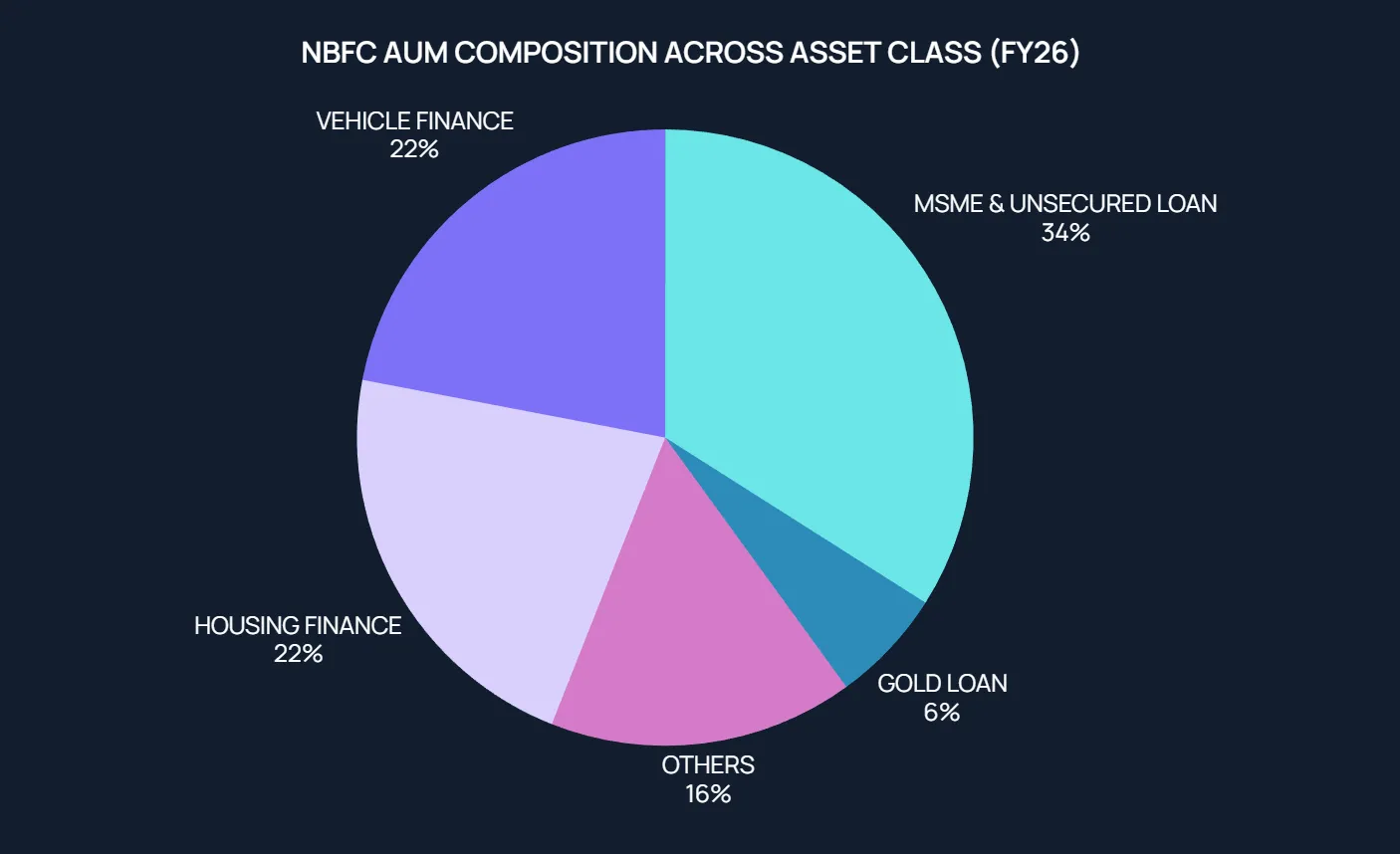

The diversity of NBFC portfolios offers insights into which borrower segments they serve. Unlike banks, which maintain sizable corporate and agricultural lending, NBFCs are heavily concentrated in retail and MSME segments.

Breakdown of key NBFC segments:

Segment | AUM Share | FY26 Growth Rate | Strategic Position |

Vehicle Finance | 22% | 13-20% (16-17% avg) | Strongest NBFC domain; used vehicles dominant |

Housing Finance | 22% | 12-13% | Under pressure from PSB competition; slowing |

MSME & Unsecured Loans | 34% | Varied (18-22% personal; higher for business) | Highest-margin segment; asset quality risks |

Gold Loans | 6% | 30-35% | Fastest-growing; formal market capturing unorganized share |

Others | 16% | Mixed | Microfinance, education, LAP, etc. |

This composition reflects NBFCs' strategic positioning as specialists in underserved and operationally complex segments where traditional banking reach is limited.

Gold Loans: The gold loan market has emerged as the standout performer. Outstanding gold loans surged to ₹3.5 lakh crore by November 2025, up from ₹89,898 crore in November 2023 representing an extraordinary 30+ times expansion in 24 months. While this explosive growth is partly attributable to reclassification of agricultural gold loans by banks, genuine growth is robust at 25% CAGR from FY20 to FY24.

Notably, the market share dynamics have shifted. Banks now hold 50.3% of aggregate gold loans as of March 2025, up from 30.6% in 2020, while NBFC share declined to 49.7% from 69.4%. NBFCs are responding by planning to add nearly 3,000 dedicated branches over the next year to recapture market share, particularly in underserved geographies where their distribution networks remain superior.

Vehicle Finance: Comprising 22% of NBFC AUM, vehicle finance remains a structural strength. NBFCs dominate used-vehicle lending, where their underwriting models and collections capabilities deliver superior risk-adjusted returns compared to banks. Growth of 16-17% is expected to persist through FY27, driven by GST-related demand uplift, premiumization trends in the new car segment, and continued shift toward used vehicles among price-sensitive borrowers.

Affordable Housing Finance: While housing loans overall face competitive pressures from PSBs, affordable housing (loans below ₹25 lakh) remains an NBFC stronghold, growing at 22-23%. This segment benefits from government interest subsidy schemes, making affordable housing finance both socially impactful and profitable.

MSME Lending: NBFCs are the dominant player in micro-LAP (loans below ₹10 lakh ticket size), holding 45% market share compared to 26% for private banks and 11% for PSUs. NBFC MSME AUM is projected to cross ₹5.3 lakh crore by FY26, supported by 32% CAGR from FY21 to FY24 significantly outpacing bank growth rates of 20.9% (private banks) and 10.4% (PSBs). However, asset quality concerns in the MSME segment are rising, with higher PAR90+ levels in micro-LAP compared to larger ticket sizes.

The Reserve Bank of India introduced the Scale-Based Regulation framework in October 2023, fundamentally restructuring how NBFCs are supervised. Rather than applying uniform standards across the sector, the RBI now categorizes NBFCs into four layers based on size, complexity, and systemic importance a more sophisticated approach that mirrors international best practices.

NBFC Classification and Requirements:

Layer | AUM Threshold | Key Regulatory Requirements | NPA Classification | Capital Adequacy |

Base Layer (BL) | < ₹1,000 cr | Minimal standards; lighter touch | 180 days (transitioning to 90) | No mandatory CRAR |

Middle Layer (ML) | ₹1,000 cr - Higher | Board-approved policies; governance standards | 90 days | Minimum 15% CRAR |

Upper Layer (UL) | Top 10 NBFCs + systemic risk entities | Stringent governance; public disclosure; CET1 capital | 90 days | 15% CRAR + 9% CET1 |

Top Layer (TL) | Designated systemic entities | Intensive RBI monitoring; stress testing | 90 days | Higher than UL |

Net Owned Funds (NOF) Requirements

All NBFCs seeking registration must maintain minimum Net Owned Funds, a prudential requirement that ensures capital adequacy. For NBFC-Investment and Credit Companies (the dominant category), the NOF requirement was increased to ₹10 crore effective October 1, 2022. Existing NBFCs have been granted a phased transition path, with ₹5 crore required by March 31, 2025, and ₹10 crore by March 31, 2027. This requirement effectively filters out undercapitalized operators, raising minimum standards across the sector.

Risk Weight and Capital Adequacy Norms

A critical regulatory development occurred in response to rapid unsecured lending growth. From 2023 onwards, the RBI imposed additional risk weights on unsecured retail lending by both banks and NBFCs. This measure a 75-100 bps add-on to standard risk weights significantly increased capital requirements for lenders pursuing aggressive unsecured lending strategies.

Capital adequacy norms have also been tightened. Upper Layer NBFCs must now maintain Common Equity Tier 1 (CET1) capital of at least 9% of risk-weighted assets, in addition to overall CRAR of minimum 15%. This harmonization with international Basel III standards ensures that systemically important NBFCs maintain robust capital buffers.

Exposure Limits and Concentration Risk

The RBI has imposed strict exposure limits to prevent excessive concentration:

· Single Borrower Exposure: Maximum 25% of Tier I capital

· Group Borrower Exposure: Maximum 40% of Tier I capital

· Gold Loan Exposure: For gold-lending NBFCs, maximum 7.5% of capital funds, with potential upside to 12.5%

· IPO Financing Cap: Limited to ₹1 crore per borrower to prevent speculative bubbles

Deposit Regulations and Governance

For NBFCs undertaking deposit-taking activities, stringent norms apply regarding reserve requirements, liquidity ratios, and depositor protection. All NBFCs with 10 or more branches must implement a Core Banking Solution (CBS) within three years from October 2022, enhancing operational transparency and real-time monitoring capabilities.

Corporate governance norms now mandate appointment of independent directors, risk committees, and audit oversight functions comparable to banking standards. This evolution reflects the RBI's recognition that NBFCs have become systemically important and must therefore operate under equivalent governance rigor.

Policy Support and Monetary Easing

The RBI's recent monetary easing cycle has been a tailwind for both sectors. The repo rate was cut to 6.25% in February 2025, and further reductions are expected in FY26 to support demand. Lower borrowing costs directly improve the economics of lending, expanding margins for both banks and NBFCs while reducing customer acquisition costs through lower interest rate pass-through.

Government stimulus measures particularly the GST rate rationalization in late 2025 and expected Cash Reserve Ratio (CRR) reductions are expected to stimulate consumption and MSME credit demand. These measures are forecast to support credit growth acceleration in H2 FY26, after a sluggish H1 characterized by asset quality stress in retail and MSME segments.

Financial Inclusion and Underserved Markets

India's Credit-to-GDP ratio of 93% remains significantly below global peers, indicating substantial untapped potential. With only 77% of adults holding formal financial institution accounts as of the latest survey, rural and semi-urban markets present enormous growth opportunities. NBFCs, with their specialized distribution networks and customized underwriting, are better positioned than banks to serve these segments profitably.

Co-Lending Partnerships

An emerging structural trend is the rise of co-lending partnerships between banks and NBFCs. This model allows NBFCs to leverage their distribution and underwriting capabilities while reducing balance-sheet risk through shared lending. Banks benefit from access to specialized borrower segments and improved yield on loans without proportional credit risk concentration. Co-lending arrangements are increasingly critical for smaller and mid-sized NBFCs facing funding constraints due to tightened regulatory norms.

Digital Transformation

Both sectors are undergoing rapid digital transformation, with UPI payments, mobile banking, and fintech integrations reducing operational costs and accelerating loan approvals. NBFC partnerships with fintech platforms and payment aggregators are enabling real-time lending decisions, particularly in MSME and retail segments, creating competitive advantages.

Asset Quality Stress in MSME and Microfinance Segments

While headline NPA ratios for banks remain at historic lows, stress is visible in specific segments. MSME lending, particularly in micro-LAP, shows higher PAR90+ levels compared to larger ticket sizes. Microfinance as a sector faces significant headwinds, with CRISIL maintaining a negative outlook on the segment due to elevated customer borrowing levels and competitive pricing dynamics that have compressed margins while deteriorating asset quality.

Export-dependent industries particularly textile, apparel, and contract manufacturing are under pressure from global demand uncertainties. Employees in these sectors face income shock risk, affecting their capacity to service MSME loans, personal loans, and microfinance obligations.

Liquidity Constraints for Smaller NBFCs

Smaller and mid-sized NBFCs face meaningful funding challenges. Despite the RBI's April 2025 rollback of increased risk weights on NBFC lending, bank credit to NBFCs (₹13.8 lakh crore as of September 2025) remains stagnant. This forces smaller players to rely on costlier alternatives like securitization, bond issuances, and external commercial borrowings, all of which carry higher costs and refinancing risks.

Larger NBFCs, by contrast, have diversified funding access and can tap debt capital markets. This bifurcation is likely to favor consolidation, with well-capitalized, larger entities capturing incremental market share from undercapitalized competitors.

Regulatory Compliance Burden

The evolving regulatory framework while necessary for financial stability imposes non-trivial compliance costs. New reporting requirements, enhanced governance standards, and capital adequacy ratios require investments in systems, personnel, and advisory services. Smaller NBFCs, lacking economies of scale, face disproportionate compliance burdens, creating barriers to entry and consolidation incentives.

Housing Segment Slowdown

Housing finance, historically a growth engine for NBFCs, is facing headwinds. Growth is expected to moderate from 14% to 12-13%, driven by fierce competition from PSBs offering aggressively priced home loans. Additionally, residential real estate sales growth in the top seven metros is projected to slow, reducing new loan origination opportunities.

Banking Sector Expectations

Bank credit growth of 10.4-11.3% for FY26 represents a sustainable pace after earlier high-growth years. The composition is shifting toward higher-quality retail and MSME lending as corporate capex cycles remain muted. Profitability should remain robust, supported by easing funding costs and improving asset quality. Capital adequacy ratios remain strong, with PSB CRAR improving to 14.83% by September 2024, providing ample flexibility for credit expansion.

NBFC Sector Momentum

NBFCs are expected to grow at 15-17% in FY26, driven by consumption demand, gold loan formalization, and MSME lending expansion. The sector's AUM will reach approximately ₹48-50 lakh crore by March 2026, crossing ₹50 lakh crore by March 2027. However, this growth will be uneven larger, well-capitalized entities will accelerate while smaller players face funding pressures and regulatory compliance challenges.

Gold loans and vehicle finance will remain the growth engines, while personal loans will recover from low-20s growth to 22-25% as credit risk recalibration stabilizes. Housing finance will continue, but at moderated rates as competitive pressures persist.

India's banking and NBFC sectors are at an inflection point. Banks are consolidating strength through improved asset quality and profitable growth, while NBFCs are establishing themselves as indispensable players in retail and MSME credit delivery. Regulatory frameworks, while tightening, are creating clearer playing fields that favor well-capitalized, professionally managed entities over undercapitalized operators.

For entrepreneurs building fintech platforms and wealth management businesses, this environment presents both opportunities and challenges. The regulatory push toward compliance, capital adequacy, and governance creates barriers to entry but also ensures that compliant platforms gain sustainable competitive advantages. Co-lending partnerships, API integrations with banks, and specialization in underserved segments represent viable strategies for scaling lending businesses in this evolving landscape.

The next 24 months will be pivotal as inflation stabilizes and monetary policy eases, credit demand should accelerate, unlocking substantial growth potential for both banks and NBFCs that have invested in asset quality, technology, and risk management capabilities.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart