by Siddharth Singh Bhaisora

Published On Sept. 7, 2025

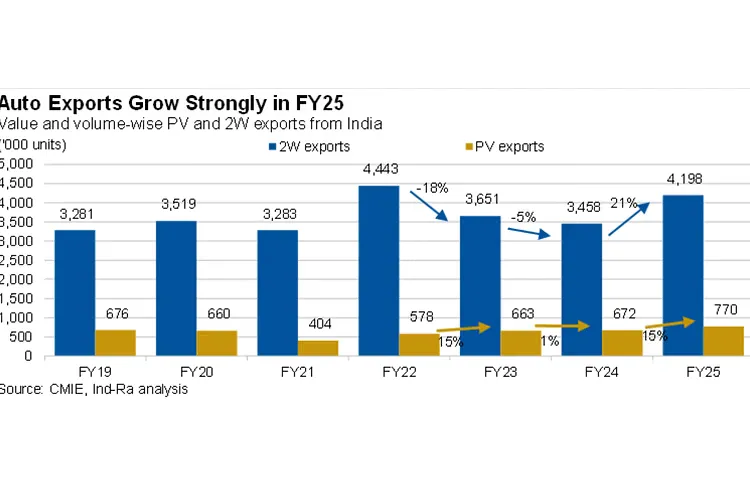

Auto components are firmly in an upcycle with record turnover, stronger exports, and a rare trade surplus. Passenger vehicle (PV) wholesales hit a fresh record of ~4.3 million units in FY25, with SUVs accounting for ~65% of sales, up from ~60% a year earlier. Two wheelers have staged a cyclical recovery, commercial vehicles are steady, and the auto components industry has nearly doubled in five years to ₹6.73 lakh crore (US$80.2 bn). Just as important, components trade has flipped to a surplus for a second year (US$453 mn in FY25), signaling rising global competitiveness and localization.

But momentum has cooled in passenger vehicles in recent months even as two wheelers, CNG and hybrids, three wheelers (especially electric), and exports pick up the slack. Policy supports remain powerful (PLI, new EV scheme, scrappage, Bharat NCAP), and the latest GST cuts on small cars and two wheelers add a near term tailwind, yet headwinds exist (export tariffs risk, entry level PV softness, EV infrastructure gaps). Net net: the auto value chain is structurally strong, but the boom is not uniform across segments. So what’s powering this boom? And what segments does it exist in?

Our Innovation Portfolio’s core thesis naturally leans into this: innovation led exposures to electrification, software defined vehicles, and localization where auto & ancillaries are clear beneficiaries. Watchlist it now to track this theme.

FY2024–25 closed strong for the industry as a whole. Domestic auto sales are up 7.3% YoY, with exports up 19.2%. Passenger vehicle (PV) wholesales hit a fresh high (4.30 million), two wheelers rebounded to 19.6 million, and three wheelers continued their post pandemic recovery.

But Q1 FY2025–26 cooled for PVs. June wholesales to dealers fell to an 18 month low; SIAM’s Q1 commentary also highlights the ongoing mix shift, utility vehicles (UVs) now form roughly two thirds of PVs, while small cars lag as affordability remains stretched. PV exports, however, were a record in Q1 FY2025–26.

Two wheelers are healing, not roaring. After several tepid years, the base is supportive; ICRA forecasts 6–9% growth in FY2025–26, hinging on rural recovery and the replacement cycle. The monsoon led rural uptick and improving FMCG orders are early corroborating signs.

Policy impulse just got stronger. The GST Council’s decision to cut GST on small cars and two wheelers from 28% to 18% (with larger cars at a simplified 40% rate) should lift entry level affordability ahead of the festive season.

The Indian consumer has upgraded decisively.SUVs/MPVs now dominate PV sales, ~65% share in FY25, as buyers pay for space, safety and features. This increases value per unit for OEMs and content per vehicle for suppliers (wiring, ICE/EV powertrain parts, electronics, trim).

Strong hybrids are trending. In FY2024, ~324k hybrids were sold; Toyota commanded >80% of the hybrid market in FY2025 YTD, with Maruti scaling. Hybrids lift thermal management, e drive, power electronics and battery content.

CNG share in PVs has climbed sharply (industry data points to mid teens to ~20% share by FY25), broadening the parts market (tanks, valves, fuel lines, calibration kits).

FY24 two wheeler wholesales rose to ~18.0 mn after years of softness; the cycle is improving with rural demand, scrappage incentives and infrastructure upgrades. Mix upgrades (SUVs), alt fuels (CNG, hybrids), and features (ADAS, connected infotainment) raise the bill of materials, a direct tailwind for component makers.

There are at least 5 Indian ancillaries clinching billion dollar EV export deals, an emblem of how EV sub systems (e axles, precision forgings, motor/gear assemblies, thermal and power electronics) are moving to India.

Sona Comstar: ~80% of its order book linked to EVs; expanding beyond the West to East Asia to diversify cyclical risk.

Samvardhana Motherson: aggressive global acquisitions across wiring, vision systems, modules; five acquisitions in FY25, continuing its multi vertical expansion.

Bharat Forge: completed acquisition of AAM India’s axle unit in Jul '25, adding technology and OEM relationships in a critical drivetrain niche.

This export muscle shows up in the macro. FY25 component exports rose 8% to US$22.9 bn, and India posted a trade surplus again, an inflection versus the historical deficit.

Bottom line on the auto parts and automobiles cycle: the aggregate is healthy, but momentum is rotating.

Up: two wheelers (especially entry/commuter), CNG, strong hybrids, three wheelers (electrification), and exports.

Sideways: commercial vehicles (near peak of cycle, flattish volumes).

Mixed: passenger vehicles, UVs stable at high share; entry level hatchbacks softer; 4W EVs growing off a small base; hybrids/CNG taking share.

The auto component industry posted another record year.

FY2024 25 | |

Turnover (₹ lakh crore) | 6.73 |

YoY Growth (%) | 9.6 |

Exports (US$ bn) | 22.9 |

Imports (US$ bn) | 22.4 |

Trade Surplus (US$ bn) | 0.453 |

Aftermarket (₹ crore) | 99,948 (+6% YoY) |

The industry noted a 5 year CAGR near 14% (FY2020–FY2025), implying the industry has nearly doubled in size since FY2020. The momentum is being fed by localisation, higher value added content, and a global appetite for China+1 sourcing from India.

The auto components industry has also clocked a trade surplus of US$300 mn in FY24, expanding to US$453 mn in FY25, with exports rising 8% to US$22.9 bn (North America ~27–32%, Europe ~29–30%). This is a profound structural signal: value add and competitiveness have improved enough to offset import intensity, even with electronics still largely imported.

But watch the U.S. tariff narrative as it could complicate export flows. Industry bodies have flagged it, while also pointing to diversification, Asia and other markets are taking a larger share of India’s exports. Near term models suggest 15–20% export risk to the US in a downside scenario. Firms with diversified footprints (EU/LatAm/Africa) and product mixes less exposed to US lines should fare better.

Components appear to be in a structural upcycle underpinned by export growth, rising domestic content (safety, electronics, emission control), and policy visibility. The trade surplus tipping point adds confidence, albeit with tariff risk to be monitored.

PVs are not uniformly booming, they’re rotating. UVs and exports look fine; entry level affordability is the pressure point. The GST cut for small cars materially helps that sub segment ahead of the festive cycle.

FY2025 wholesales was a record year. But June 2025 dealer dispatches were the weakest in 18 months, and the entry hatchback segment remains affordability constrained. SUVs now make up ~66% of PVs; PV exports hit a record in Q1 FY2025–26, cushioning domestic softness.

Hybrids & CNG: the two biggest share winners. Toyota led FY2025 hybrid sales (over 82,000 units) and commanded ~80%+ of the strong hybrid market, while CNG overtook diesel for the first time in FY2025 (~788k CNG vs ~736k diesel), with CNG’s share of new cars near 19–21% by mid 2025.

4W EVs: growing but still small. 4W EV penetration in FY2025 was ~2.7%, with the market leader’s share declining as new entrants scaled up. Charging infra and total cost of ownership perception remain hurdles; hence, hybrids and CNG are absorbing demand in the near term.

Capacity & capex: Maruti Suzuki’s Kharkhoda plant is live (adding 0.25 mn capacity initially, taking group capacity to 2.6 mn) with more phases planned. Tata Motors laid out ₹33k–35k crore PV/EV investments over 5 years; Mahindra is accelerating its born EV portfolio (₹16,000 crore EV capex plan).

FY2025 units: ~19.6 mn, still below pre pandemic peaks but the recovery is entrenched. ICRA sees 6–9% FY2026 growth, riding rural recovery, a replacement cycle, and fresh model launches. Fuel prices have been managed, and financing conditions are stable with the RBI repo rate at ~5.5% post earlier cuts.

Electrification: e 2W remains the biggest EV category (near 60% of all EVs) though growth is rationalising as subsidies taper; multiple ICE leaders are scaling EV portfolios.

Electric 3Ws posted ~90% YoY growth in FY2025. e 3W’s share in the 3W market is around 62% in mid 2025. The total EV pie still includes e rickshaws/e carts, which are meaningful at ~26–27% combined of EV sales.

This is India’s most advanced EV use case for mass mobility and last mile logistics.

FY2025 volumes were broadly flat YoY (~0.96 mn), which is typical late cycle behavior after a multi year up move tied to roads, mining, and infra. Electrification is tiny but buses are seeing early EV adoption; Tata Motors led e bus sales in FY2025, albeit with market share volatility as rivals scale.

These policy frameworks help de risk capex, improve returns on new technologies, and align corporate strategy with India’s push for domestic manufacturing and exports.

PLI focus on Advanced Automotive Technology (AAT) products, with material investment commitments (₹25,938 crore) already made by OEMs and suppliers; disbursements stretch through FY2028–29, giving multiyear visibility. It rewards AAT vehicles & components such as BEV/fuel cell tech, lightweighting, electronics, sensors, and other sunrise components. The Incentive rates are: 13–18% for OEMs; 7.2–13% for components, with an extra +5% for BEV components.

The goal is clear deep localization and global supply chain integration.

Aims to seed multi GWh domestic cell capacity; recent analyses note Exide Energy and Amara Raja among awarded capacities in the re bid tranche, with the scheme in gestation until late 2024. This underpins EV and hybrid supply chains for 2W, 3W and PV.

India’s new EV manufacturing scheme allows limited imports at 15% duty for firms committing to local investment and localization, aimed at catalyzing premium EVs and tech transfer from global EV makers to manufacture in India. The application portal is live, though not every global OEM may build locally.

Recent proposals to raise the GST on luxury EVs are also in play.

mandatory fitness tests for older vehicles and incentives against scrappage certificates are designed to stimulate replacement demand, particularly for commercial fleets and older passenger vehicles. Several states (e.g., Delhi) have strengthened enforcement.

India specific crash ratings are pushing safety parts and components, lifting per vehicle component value and nudging OEM product strategies; we’ve already seen mainstream models secure five star ratings.

Additionally, OEM competition on safety has catalyzed platform upgrades for parts such as airbags, ABS/ESC, ADAS fitment increase parts intensity for electronics, sensors, wiring harnesses, braking, steering, vision systems.

So, are auto parts & automobiles booming? Mostly yes - if you pick the right pockets.

Auto components: Yes, with strong fundamentals, policy scaffolding (PLI), and export traction.

Automobiles: Selective strength—2Ws, CNG & hybrids, e-3Ws, and exports look most attractive; PVs are resilient but entry-level still delicate.

Macro/policy: GST cuts are an immediate demand lever; EV policy provides an options framework; Bharat-NCAP and scrappage add structural replacement/feature content drivers.

Risks: export tariffs, EV infra/affordability, and policy flip-flops on taxation.

Our Innovation Portfolio is designed to front run structural change - it emphasizes disruptive, technology led trends and supply chain shifts. Auto parts, components & ancillaries sits at the crossroads of electrification, software/connected mobility, materials, and Make-in-India.

If you are interested in this theme watchlist the Innovation Portfolio to track it. You should also keep an eye on the following over the next 12 months

Monthly data for UV mix, hybrids/CNG penetration, retail inventory health. (Q1 FY26 retail was up ~4.85% YoY; July saw a base effect dip.)

PLI Auto & PLI ACC milestones: beneficiary disclosures, localization thresholds, and disbursement progress.

Export mix by geography (Asia share rising), and any new tariff actions in key markets.

Capex ramps at leading ancillaries (new plants, greenfield projects in wiring/electronics/structures).

EV policy (SPMEPCI) outcomes, fresh OEM manufacturing commitments and vendor localization

For an Indian investor, the prudent strategy is to lean into the value chain - quality tier-1s and sub-systems with export/geographical diversification—while tilting OEM exposure toward the segments and fuels that are actually winning share today. The sector’s long runway remains intact; the “boom” is in the composition more than the headline.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart