by Naman Agarwal

Published On Jan. 9, 2026

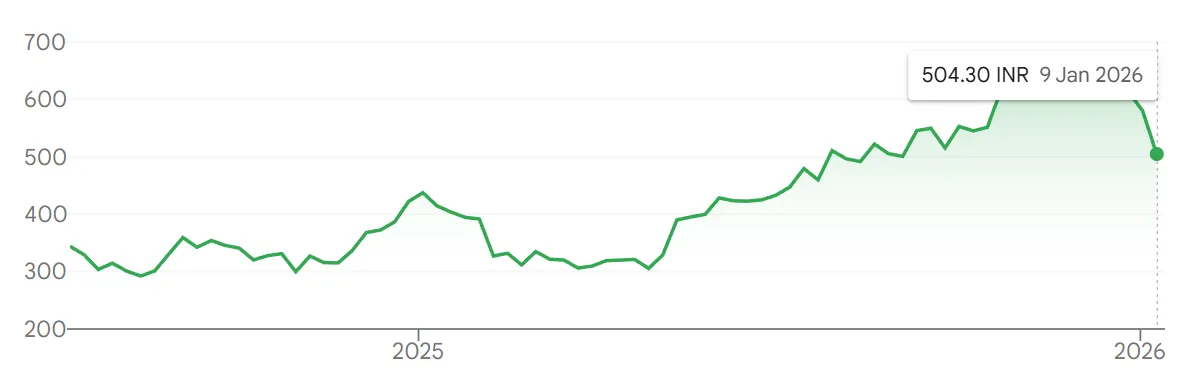

Allied Blenders & Distillers Limited (ABDL) stands at an inflection point, transitioning from a traditional spirits company into a diversified, premium-focused global brand powerhouse. With a current share price hovering around ₹510 and a market capitalization of ₹14,268 crores, the company has demonstrated remarkable resilience and growth momentum through strategic portfolio premiumization, international expansion, and aggressive backward integration. Recent quarterly results, landmark product launches, and management guidance paint a picture of a company firing on all cylinders, making it a compelling investment thesis for growth-oriented investors seeking exposure to India's consumption boom and the global premium spirits market.

The most recent quarter ending September 2025 (Q2 FY26) delivered impressive financial metrics that validate the company's strategic direction. ABDL reported consolidated total income of ₹994.81 crores, representing 14.4% year-on-year growth, with profit after tax reaching ₹62.92 crores, marking a commanding 32.3% year-on-year increase. The quarter-on-quarter metrics were equally robust, with net profit jumping 12.7% from the preceding quarter, showcasing sustained operational momentum even as the company navigates complex regulatory environments across Indian states.

The earnings per share (EPS) stood at ₹2.23 during Q2 FY26, reflecting 31.2% year-on-year growth. More significantly, EBITDA expanded by 23.6% year-over-year to ₹130 crores, with EBITDA margins expanding by 100 basis points to 13.1%, demonstrating that profit growth is not merely driven by volume increases but by genuine operational leverage and margin expansion. Operating expenses grew at 13.1% year-over-year, significantly slower than the 14.4% revenue growth rate, indicating improving operational efficiency and cost discipline.

Looking at trailing twelve-month metrics, the company's earnings have surged 395% year-over-year, with TTM EPS standing at ₹9.19. This extraordinary earnings growth significantly outpaces industry peers and validates the management's premiumization strategy. The profit before tax grew 30.8% year-over-year to ₹83.87 crores, translating to a profit before tax margin of 8.43%, up from 7.38% in the prior year quarter.

The most compelling aspect of ABDL's investment narrative centers on the spectacular execution of its premiumization strategy. The Prestige & Above (P&A) segment the company's high-margin cash cow continued its exceptional performance trajectory. In Q2 FY26, the P&A segment delivered 31% revenue growth to ₹533 crores, driven by remarkable 28.8% volume growth to 4.3 million cases. Volume salience in the P&A segment expanded to 47.1% in Q2 FY26 from 46.2% in Q1 FY26 and just 39.7% in the comparable quarter previous year.

What makes this performance particularly noteworthy is that value salience the contribution by revenue reached 56.9% in Q2 FY26, compared to 55.8% in the preceding quarter and 49.0% a year earlier. This indicates that the P&A segment is not only growing faster in volume terms but is also becoming an increasingly dominant profit contributor. The company has set an ambitious target of achieving 50% volume salience in the P&A segment by FY28, up from the current 47.1%, suggesting that the growth story is only at a mid-stage in its trajectory.

The flagship premium brand, ICONiQ, delivered approximately 2.7 million cases in Q2 FY26, representing 63% of total P&A volumes and solidifying its position as the leading contributor to the premiumization strategy. The brand continues to gain market share from competitors and demonstrate strong repeat consumption patterns, validating the quality and positioning of the product offering.

Perhaps the most strategically important development for ABDL investors is the dramatic acceleration of the ABD Maestro luxury subsidiary, co-founded by Bollywood superstar Ranveer Singh. Launched in March 2025, ABD Maestro represents ABDL's comprehensive entry into the high-margin luxury and super-premium spirits market. The company invested ₹70 crores for an 80% stake, with Ranveer Singh owning the balance and serving as creative partner.

As of the latest reporting, ABD Maestro achieved a run rate of approximately ₹40 crores in annual recurring revenue, with management targeting ₹100 crores by the end of FY26 a remarkable 2.5x growth in a single year. For context, every 1% volume contribution from the luxury portfolio translates to approximately 8x the impact on net sales value compared to mass-market volumes, making ABD Maestro a potent profit multiplier.

The luxury portfolio now includes eight distinct brands: Arthaus Blended Malt Scotch Whisky, Zoya Special Batch Gin, Rangeela Contemporary Indian Vodka, Yello Designer Whisky, Woodburns Contemporary Indian Malt Whisky, Pumori Small Batch Gin, Segredo Aldeia Café and White Rums, and Russian Standard Vodka through a partnership with Roust Corporation. Most recently, in December 2025, ABD Maestro launched AODH Irish Whiskey at ₹3,950 per 750ml bottle, marking entry into one of India's fastest-growing premium segments, with Irish whiskey exports to India growing 57% and India now ranking as the fifth-largest global market for Irish whiskey.

Management guidance indicates three additional luxury brand launches are planned for H2 FY26, comprising one white spirit and two whiskies, signaling an intention to complete the premium portfolio offering. The luxury brands have achieved listing in over 2,000 premium outlets, with ABD Maestro establishing presence at premium travel retail locations including Bengaluru and Delhi International Airports, reinforcing the luxury positioning and accessing high-spending consumer segments.

Beyond premiumization, ABDL is executing an aggressive backward integration strategy that should drive substantial margin expansion over the next two years. The company sources approximately 50% of its Ethyl Neutral Alcohol (ENA) externally, with the remainder from captive production. Through recent acquisitions and capacity additions, the company has increased captive ENA capacity significantly. Additionally, ABDL commissioned a PET bottle manufacturing facility in Telangana in FY25 with a capacity of 600 million bottles annually, serving approximately 65% of PET needs in Telangana and Andhra Pradesh.

The financial impact is substantial: management guidance suggests backward integration could contribute approximately ₹30 crores to gross profits, translating to approximately 75 basis points of margin accretion on sales volumes. The company is investing ₹525 crores in total capacity expansion between FY25 and FY27, which includes acquiring an additional ENA plant and establishing a new single malt whiskey distillery in Telangana, with production expected to commence in 2029.

Gross margins expanded to 44.4% in Q2 FY26 from 43.2% in Q1 FY26, with management guidance suggesting margins could exceed 45% by FY27 and operating profit margins potentially reaching 17% by FY28, compared to 12% in FY25 representing approximately 300 basis points of operating margin expansion opportunity.

While domestic markets currently contribute approximately 90% of ABDL's revenues, international expansion represents a critical medium-term growth lever. The company has achieved remarkable international expansion, growing its presence from just 14 countries in FY24 to 30 countries by Q2 FY26, with a target of 35 countries by the end of FY26. More impressively, the company has specifically identified Africa as a key growth region, with management targeting 1 million cases in Africa by FY28 currently representing approximately 13 million total addressable cases.

International export revenue grew 16% year-over-year to approximately ₹206 crores in FY25, with exports now contributing approximately 8% of total company revenues. Management has guided for a target of 12-15% international revenue contribution post the rollout of brands across new international destinations. The Officer's Choice umbrella brand continues to serve the Indian diaspora in Gulf Cooperation Council countries, while premium brands like Zoya gin and Arthaus whisky are gaining traction in North America and Europe.

Export business carries structural advantages compared to domestic operations: margins are approximately 1.3x higher than domestic operations, while working capital requirements are 50% lower than domestic operations, creating a high-margin, asset-light business model that should drive disproportionate profit growth as international sales scale.

ABDL trades at approximately 55.51x trailing twelve-month earnings, which presents a premium valuation on face value. However, when contextualized against the company's exceptional earnings growth rate of 31.2% on a TTM basis and forward earnings growth guidance of approximately 24-25% annually, the valuation becomes more defensible. The price-to-earnings growth (PEG) ratio appears reasonable given the magnitude of growth being delivered.

The company's financial health has strengthened materially, with debt-to-equity improving significantly from 260.9% five years ago to 66.4% currently. Return on equity has improved to approximately 20%, while return on capital employed stands at 23.22%, both indicating efficient capital deployment and value creation for shareholders. The company recently initiated dividend payments with a dividend yield of 0.71%, providing income alongside capital appreciation potential.

The stock reached an all-time high of ₹696.80 in November 2025, having appreciated 97.69% over the past year and demonstrating strong investor confidence in the transformation narrative. The 52-week low of ₹279 highlights the company's leverage to consumer sentiment and market cyclicality, with the stock presently trading 26.9% below its all-time highs following a recent consolidation period.

The key catalysts driving value creation include:

Continued premiumization momentum with P&A salience targeting 50% by FY28,

ABD Maestro scaling toward ₹200+ crores revenue run rate by FY27,

International expansion reaching 12-15% of total revenues,

Margin expansion from backward integration contributing 75+ basis points, and

Three additional luxury brand launches in H2 FY26 driving portfolio completeness.

Key risks include state-level excise duty changes impacting profitability, as evidenced by recent Telangana and Maharashtra policy challenges. The company's dependence on the Officer's Choice brand, though diminishing in percentage terms, still represents significant volume exposure. Regulatory uncertainties and the ongoing special investigation regarding Andhra Pradesh's liquor policy require monitoring.

Allied Blenders & Distillers has successfully transformed itself from a single-brand, mass-market dependent company into a diversified, multi-brand powerhouse executing flawlessly on premiumization, backward integration, and international expansion. The latest quarterly results, recent luxury product launches, and management guidance all validate this investment thesis. For growth-oriented investors with a medium-term investment horizon, ABDL presents a compelling opportunity to gain exposure to India's consumption growth story and the global premium spirits market at what appears to be a reasonable valuation given the magnitude of growth being delivered.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart