by Sonam Srivastava, Siddharth Singh Bhaisora

Published On May 5, 2024

By now, most of you know that we have launched our large cap focused strategy - Wright Titan, but many investors continue to ask us about Titan - what is it? So today's newsletter is diving deep into Wright Titan. What is Wright Titan? What is the current sector & market cap allocation? Why large caps - and why now?

Wright Titan offers a sophisticated, low-risk equity strategy aimed at capitalizing on large cap stocks, characterized by low volatility and high stability, and also focusing on mid cap stocks for growth. This strategy employs a quantitative trend following approach, leveraging a combination of multiple indicators. These are integrated through advanced position sizing techniques and market regime modeling using machine learning, designed to predict and adapt to market fluctuations effectively.

The primary goal of Wright Titan is to provide investors with consistent returns over time by participating in the growth of large cap stocks while maintaining a check on volatility. This strategy is meticulously crafted to remain stable across various market conditions, making it an ideal choice for investors seeking steady growth without excessive risk.

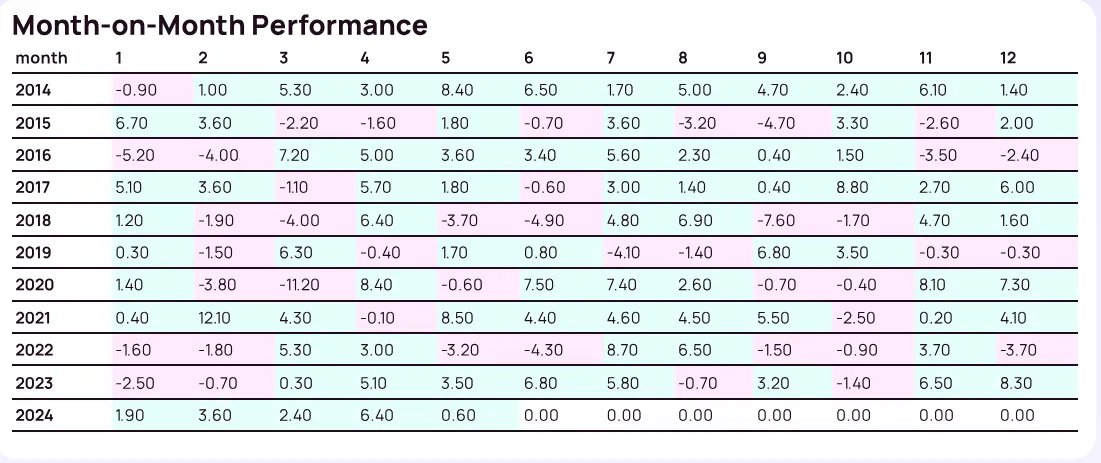

The Wright Titan portfolio exhibits a varied month-on-month performance from 2014 to 2024, showing the ability to perform impressively and manage downturns effectively. The data showcases significant resilience, with the strategy successfully navigating through market downturns and recovering swiftly, as highlighted in the positive upticks during recovery phases post-2018 and the COVID-19 market disruptions.

Here are some key observations from the backtested results:

Performance fluctuates throughout the ten years. We see positive trends during volatile periods & overall see a positive trend for its backtested performance.

The strategy demonstrated robust recovery in Covid 2020 - we see a sharp rebound from -11.20% in March 2020 to +8.40% the following month. This pattern underscores the strategy’s resilience and adeptness at navigating market volatilities.

There seems to be some seasonality to the performance, with peaks and troughs occuring around the same time each year. For example, performance tends to be higher in April - June and lower in January - February for most years.

Large cap stocks, such as those from well-established companies like ITC and Hindustan Unilever, are known for their resilience and capacity to endure economic downturns. These companies have solid financial foundations and have withstood numerous economic cycles. The advantages of investing in large caps include:

Consistent Dividends: Many large cap companies have a long history of regularly paying dividends, providing investors with a steady income stream alongside the potential for stock price appreciation.

Market Stability: Large caps contribute significantly to the stability of an investment portfolio. They act as a buffer during market volatility, which allows investors to include higher-risk investments with less concern, enhancing the potential for diversified returns.

Simplified Asset Allocation: Investing in large caps helps simplify the asset allocation and diversification process. These companies often operate across multiple industries, like Reliance with its footprints in oil & gas, consumer goods, and financials, naturally ensuring a balanced investment spread.

Strong Historical Performance: The S&P BSE Large Cap index, a barometer for large-cap stocks in India, has posted impressive average annual returns of over 13% in the past decade. This track record underscores the potential of large-cap investments to yield favorable returns.

Economic Expansion and Government Initiatives: With India's economy on a rapid growth trajectory, sectors like infrastructure, banking, and technology are poised for substantial expansion. Programs such as the 'Make in India' initiative and significant projected investments in infrastructure (projected at $1.4 trillion by 2025) highlight the strategic opportunities for large caps in these areas.

Liquidity and Accessibility: The liquidity of large-cap stocks ensures that investors can enter and exit positions with minimal impact on the market price, a critical advantage over less liquid small-cap stocks.

Reputation and Familiarity: The well-established nature of large-cap companies offers investors familiarity and confidence, making these stocks a preferable option for those looking to diversify their portfolios without stepping too far outside their comfort zone.

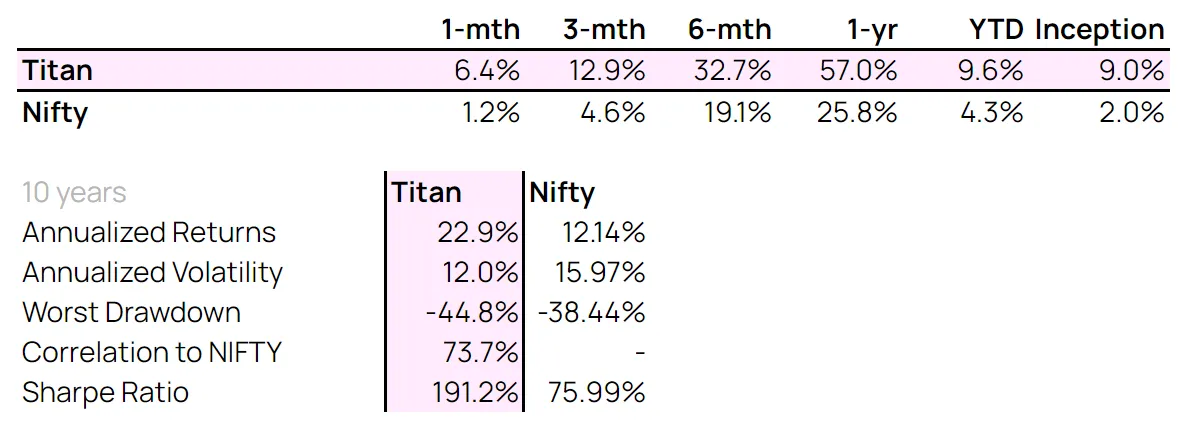

Titan shows returns of 9% at inception v/s Nifty’s 2%, and maintains stable performance across different time frames from 1 month, 3 months, 6 months, 1 year, 2 years, and 3 years.

This refers to the standard deviation of the annualized returns, measuring the volatility or risk of the investment. Titan's risk is 12%, lower than Nifty's 15.97%, indicating that Titan offers less fluctuation and more stable returns compared to the benchmark index.

Titan's Sharpe ratio is 191.2, compared to Nifty's 75.99. The Sharpe ratio measures the performance of an investment compared to a risk-free asset, after adjusting for its risk. A higher Sharpe ratio means better return for the same risk, suggesting Titan offers stable risk-adjusted returns.

This metric shows the maximum observed loss from a peak to a trough of a portfolio, before a new peak is achieved. Titan has a maximum drawdown of -19.2%, significantly better than Nifty’s -38.4%, highlighting its stronger resilience during market downturns.

Titan has a correlation of 73.7 with Nifty, indicating a strong positive relationship. This means while Titan generally follows the broader market trends represented by Nifty, it also manages to outperform significantly thanks to its strategic investments.

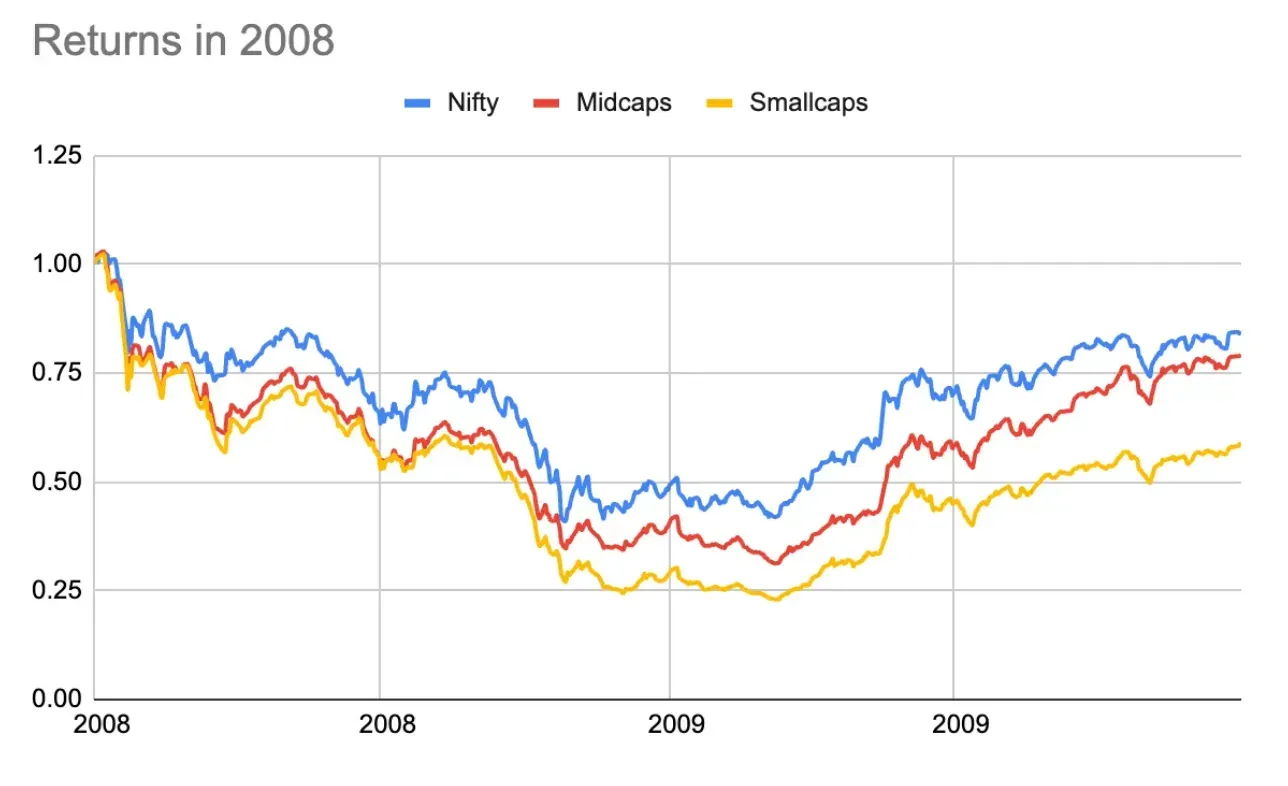

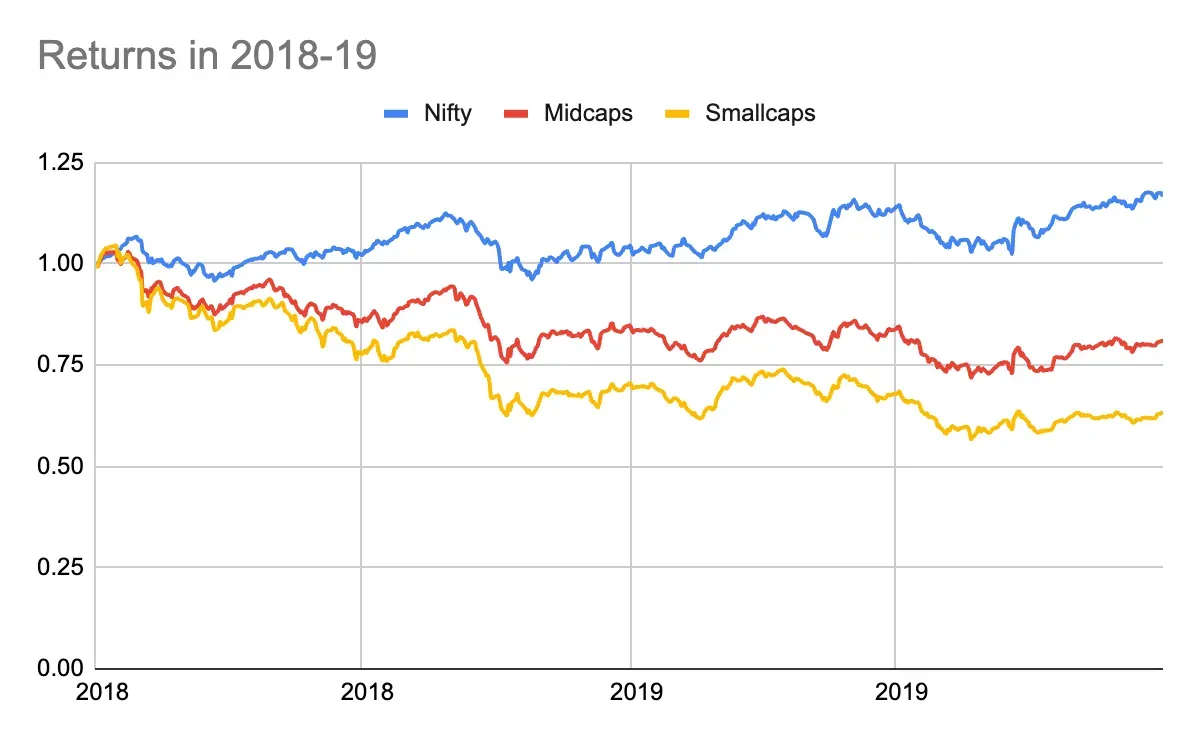

What becomes evident as we look at smallcap, midcap & largecap segments is that they do not deviate significantly from their inherent return potentials over extended periods. Let’s look at their performance across different cycles:

During the 2008 crash, the entire market completely fell and there was widespread panic. But what is interesting is how the different market caps performed throughout the crisis & beyond. We saw mid caps & small caps fell with greater intensity than large caps. By late 2009, all sectors began to recover, with large caps leading the rebound.

During 2018-19, we saw a lot of volatility in the market. Large caps showed their strength by giving a steady & stable performance throughout the period. However, mid caps and smallcaps have shown more volatility in their returns - exhibiting a more pronounced decline to nearly 75% of the value, suggesting a heightened sensitivity to markets.

Large cap performance during Covid crash:

The Covid 19 Pandemic. Despite the severe economic disruption, analysis of large-cap equity funds revealed that both direct and regular schemes provided average returns of over 60% during 2020-21.

Large cap performance during 2024 performance:

In 2024, a significant 67% of large-cap mutual funds managed to outperform their benchmarks, with specific examples like Quant Large Cap Fund, Baroda BNP Paribas Large Cap Fund, and Taurus Large Cap Fund delivering impressive returns in double digits. Far above their benchmark predictions.

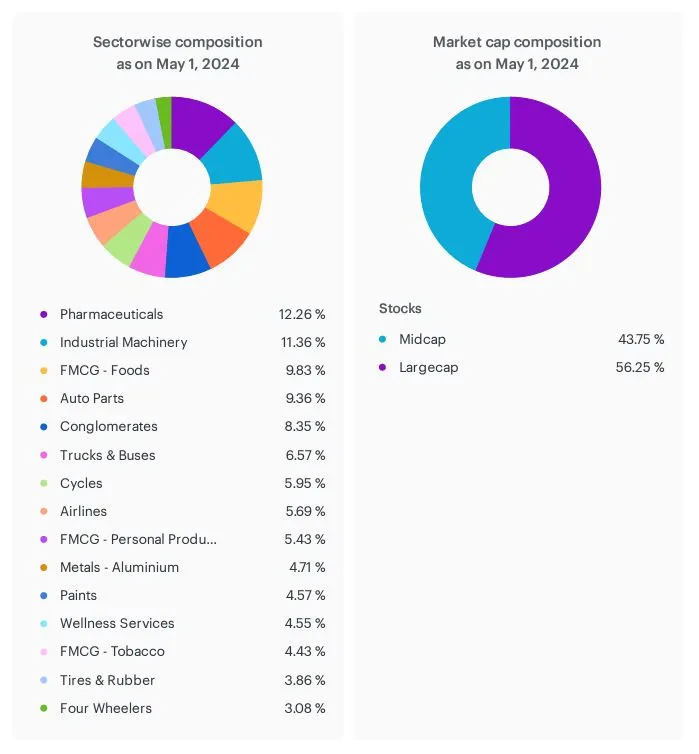

Pharmaceuticals (12.26%): This sector holds the largest share, which suggests a focus on healthcare, likely due to its defensive nature and consistent demand, irrespective of economic cycles.

Industrial Machinery (11.36%): Significant investment in this sector indicates a belief in industrial growth or a cyclical recovery, reflecting confidence in the industrial sector's expansion.

FMCG - Foods (9.83%): Consistent consumer demand makes this a stable investment, providing steady returns and less volatility.

Auto Parts (9.36%) and Conglomerates (8.35%): These investments show a diversified approach within industrials and multi-industry holdings, spreading risk and capturing growth across different market segments.

Trucks & Buses (6.57%), Cycles (5.95%), and Airlines (5.69%): Investment in these sectors might aim to capitalize on economic recoveries where transportation and consumer discretionary spending increase.

FMCG - Personal Products (5.43%), Metals - Aluminium (4.71%), and Paints (4.57%): These sectors are typically more resilient to economic downturns or represent specific growth opportunities within their industries.

Lower Weight Sectors: Wellness Services, FMCG - Tobacco, Tires & Rubber, and Four Wheelers, each below 5%, indicate selective, targeted investments potentially based on specific growth forecasts or valuations within these industries.

While Titan is primarily large cap focused, we keep significant allocation towards midcaps - this allocation allows the portfolio to focus on growth while ensuring stability.

Largecap (56.25%): The majority of the portfolio is invested in large-cap stocks, aligning with a strategy that prioritizes stability, reliable returns, and lower volatility. Large caps are typically market leaders and can provide steady dividends.

Midcap (43.75%): A substantial portion of the portfolio is also allocated to mid-cap stocks, which offer higher growth potential than large caps but come with increased volatility and risk. This allocation suggests a balanced approach, seeking growth while managing risk exposure.

This proactive investment strategy aims to leverage growth opportunities in the mid-cap space while anchoring the portfolio with the stability and lower volatility of large-cap stocks. The emphasis on pharmaceuticals and industrials may reflect a defensive posture combined with a bet on economic recovery, which could be particularly fitting given the unknowns of market conditions as of May 2024.

Risk Profile: Typically higher risk tolerance due to longer investment horizon.

Ideal Portfolio Mix:

Large Caps: 30-40% - Provides foundational stability and steady growth.

Mid Caps: 30-40% - Offers higher growth potential, suitable for long-term appreciation.

Small Caps: 20-30% - Maximizes potential returns with higher risk, benefiting from a longer time to ride out market volatility.

Risk Profile: Moderate risk tolerance; focused on both growth and preservation of capital as retirement approaches.

Ideal Portfolio Mix:

Large Caps: 50-60% - Ensures more stability and reliable dividends.

Mid Caps: 20-30% - Provides growth but with reduced risk compared to small caps.

Small Caps: 10-20% - Offers growth potential but kept lower to manage risk exposure.

Risk Profile: Lower risk tolerance as the focus shifts to preserving capital and preparing for retirement.

Ideal Portfolio Mix:

Large Caps: 60-70% - Dominates the portfolio to secure stable returns and capital preservation.

Mid Caps: 20-30% - Reduced proportion to lower risk while still capturing some growth.

Small Caps: 5-10% - Minimized exposure to reduce volatility and safeguard the investment portfolio.

Risk Profile: Very low risk tolerance; primary focus is on income and capital preservation.

Ideal Portfolio Mix:

Large Caps: 70-80% - Provides steady income through dividends and stability.

Mid Caps: 15-25% - Maintains a small growth component.

Small Caps: 0-5% - Very minimal or no exposure to protect against downturns and ensure liquidity.

Who should invest in Wright Titan?

Wright Titan is a data-driven investment strategy that focuses on minimizing risk and maximizing returns through a deep analysis of the Indian market's top 200 stocks. This strategy specifically harnesses the strengths of large-cap and mid-cap stocks, selecting 20-25 of them based on quality, low volatility, and momentum. The portfolio is built with a keen eye on sector and stock allocation constraints, ensuring a diversified and stable investment vehicle. Designed For:

Retirees: The strategy is ideal for those nearing retirement, offering stability and steadiness through large-cap stocks known for their resilience and consistent performance.

New Investors: Beginners find a safe entry point with Wright Titan, thanks to its focus on low-risk, large-cap investments that provide a solid foundation for future growth.

High-Risk Appetite Investors: Even for those with a penchant for risk, allocating a portion of their portfolio to Wright Titan balances overall risk and smoothens return profiles, providing essential stability.

While large-cap investing provides inherent stability, it's crucial to remember that all investments carry some degree of risk. That's why we take a proactive approach to risk management with the Wright Titan Portfolio. Our investment strategies aim to minimise potential downturns without sacrificing its stability & growth potential.

If this approach to large-cap investing aligns with your goals, and you want the benefits of large-cap investing combined with our expertise, the Wright Titan Portfolio might be a great solution for you. We've carefully designed it to be a core investment strategy that can strike a balance between risk and reward, focusing on long-term stability and growth potential for all investors.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

Get full access by signing up to explore all our tools, portfolios & even start investing right after sign-up.

Oops your are not registered ! let's get started.

Please read these important guidelines

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions

Sign-Up Using

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Skip & use OTP to login to your account.

Your account is ready. Discover the future of investing.

Login to start investing on your perfect portfolio

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Login to start investing with your perfect portfolio

Forgot Password ?

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Your account is ready. Discover the future of investing.

By logging in, you agree to our Terms & Conditions

SEBI Registered Portfolio Manager: INP000007979 , SEBI Registered Investment Advisor: INA100015717

Tell us your investment preferences to find your recommended portfolios.

Choose one option

Choose multiple option

Choose one option

Choose one option

Choose multiple option

/100

Investor Profile Score

Congratulations ! 🎉 on completing your investment preferences.

We have handpicked some portfolios just for you on the basis of investor profile score.

View Recommended Portfolios